Western Power Trading Forum

The West faces a “pivotal” opportunity to develop a fresh approach to managing its electricity markets, one that could update RTO governance to better accommodate the public policy.

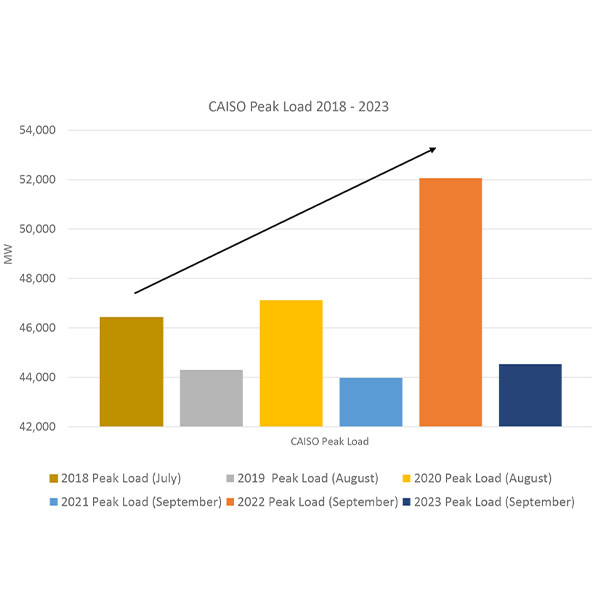

CAISO’s Board of Governors and WEIM Governing Body unanimously voted to approve an expedited proposal to increase the ISO’s soft offer cap from $1,000/MWh to $2,000.

BPA’s choice of a day-ahead market will not be driven by concerns about the impact of the seams that would divide the two markets proposed for the West, an agency official made clear.

Utility staff charged with managing real-time operations will be equipped to deal with the seams between two Western day-ahead markets, but the situation will be far from ideal, Western state energy officials heard at the CREPC-WIRAB spring conference.

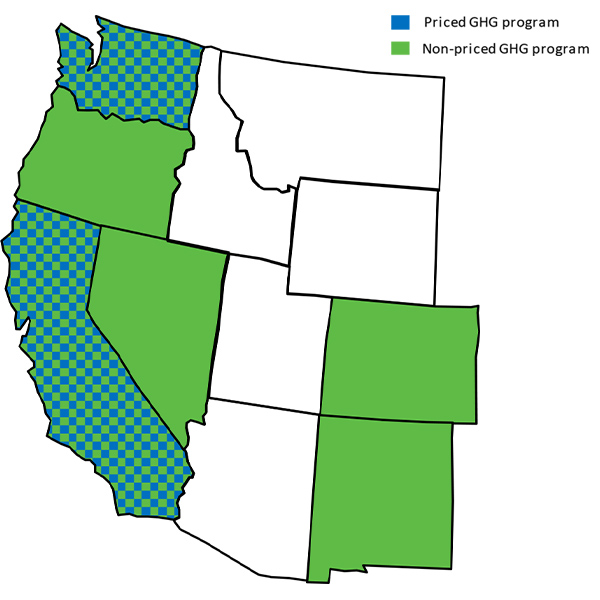

CAISO stakeholders and staff could soon be weighing two options for enabling the EDAM to track GHGs in a way that accommodates the patchwork of different carbon reduction programs across Western states.

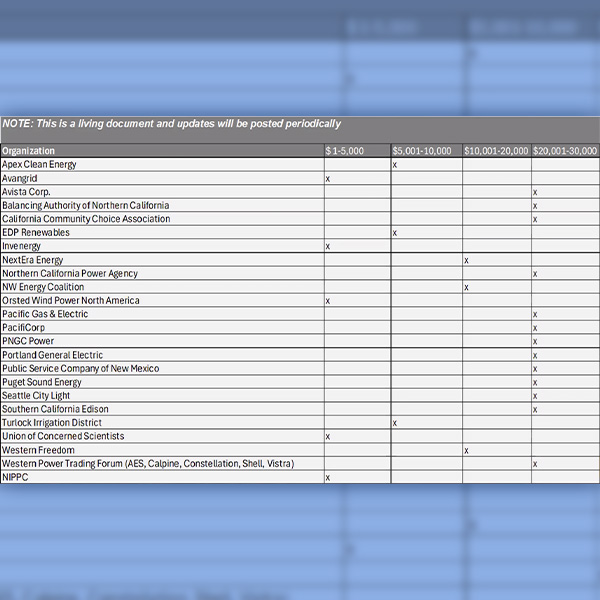

The West-Wide Governance Pathways Initiative has secured commitments of financial support from 24 utilities and other electricity-sector organizations and expects that list to grow.

The Public Power Council has asked the Bonneville Power Administration to choose SPP’s Markets+ when the agency issues its day-ahead market “leaning” in April.

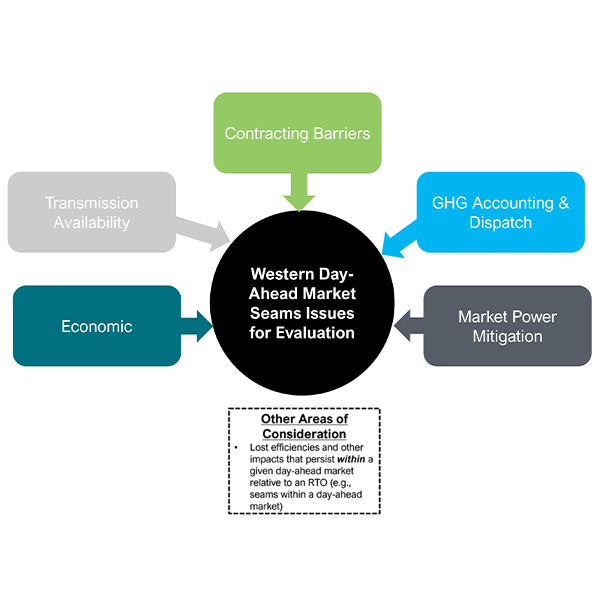

The study finds dividing CAISO’s EDAM from SPP’s Markets+ would create seams that pose a different set of problems than challenges seen at the boundaries of full RTOs in other parts of the U.S.

Future historians of the U.S. electricity sector one day might conclude the development of an RTO in the West hinged on two separate but interrelated events occurring on one day in July 2023.

Want more? Advanced Search