Western Energy Imbalance Market (WEIM)

When Arizona utilities file their next integrated resource plans, they’ll be required to include an analysis of cost savings and other benefits they could realize from Western regional market participation.

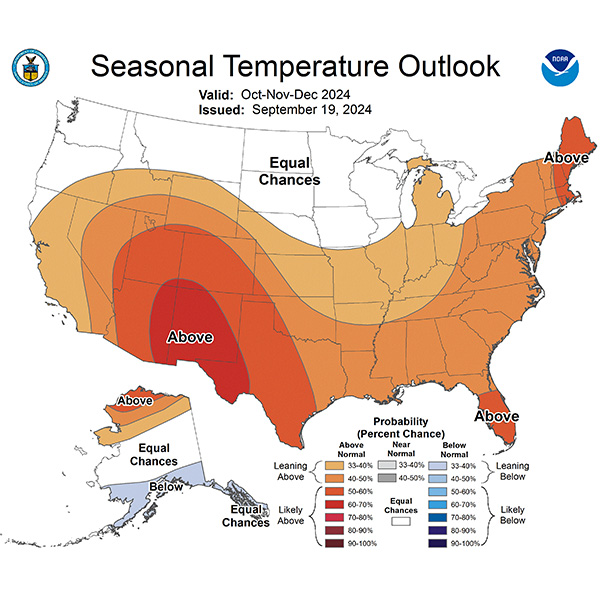

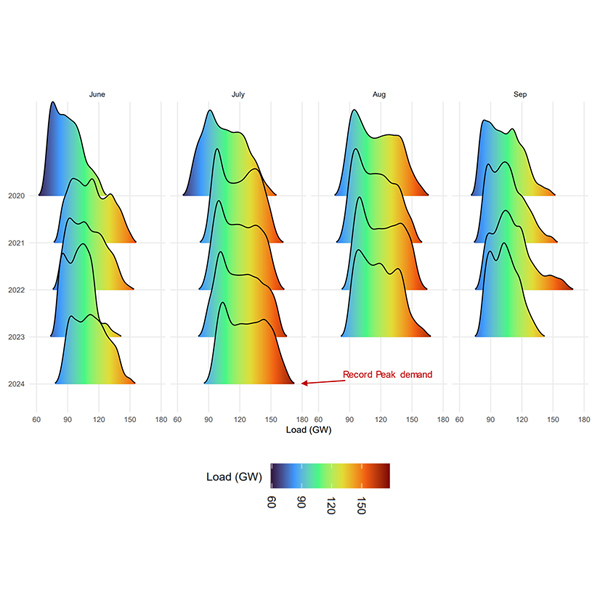

The growth of battery storage resources in the West largely contributed to an "uneventful" summer on the grid, despite record-breaking peak loads and temperatures.

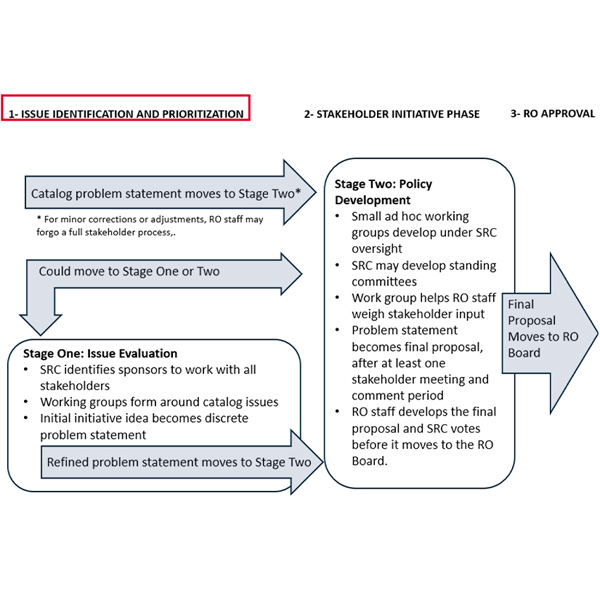

The next phase of the Price Formation Enhancements Initiative will look to address issues around market power mitigation, scarcity pricing and fast-start pricing.

The Western Interconnection reached a record-breaking peak load July 10 despite relatively moderate demand in CAISO, the ISO said during a meeting of its Market Performance and Planning Forum.

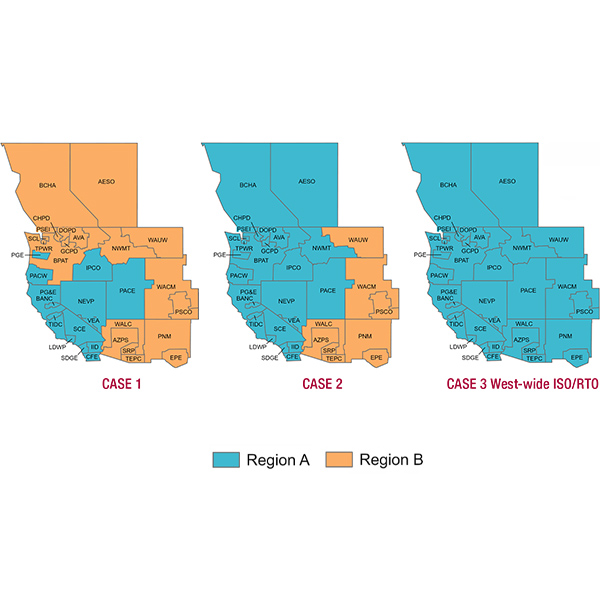

Stakeholder comments filed with the West-Wide Governance Pathways Initiative illustrate the complexity of building the new kind of Western regional organization envisioned by backers of the effort.

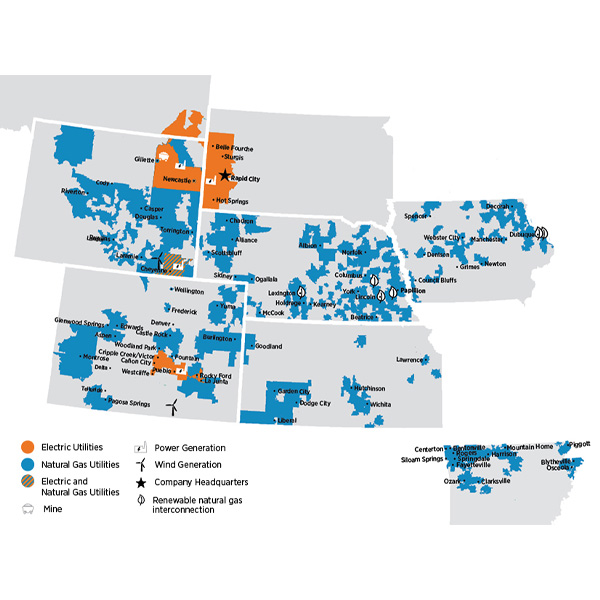

CAISO scored a geographically small but symbolically significant victory with the announcement that two Black Hills Energy subsidiaries will move to the ISO’s Western Energy Imbalance Market.

A single Western market is one of the safest bets to address the region’s reliability and cost issues in the face of extreme weather events, proponents of the West-Wide Governance Pathways Initiative said during a panel discussion.

A new initiative to streamline and expand bilateral trading in the Western Energy Imbalance Market and Extended Day-Ahead Market has been launched, marking another step toward EDAM implementation.

The integration of Markets+ with the Western Resource Adequacy Program would be among a handful of key reliability benefits of SPP’s Western day-ahead offering, according to an “issue alert” published by 10 entities that backed development of the market.

California energy agency heads appeared before state lawmakers to pitch the proposed CAISO governance changes being developed by the West-Wide Governance Pathways Initiative.

Want more? Advanced Search