up-to-congestion transactions (UTCs)

No one spoke up when Market Monitor Joe Bowring opened the floor to stakeholders in the Monitor's annual Advisory Committee meeting Friday. But Bowring and his staff took the opportunity to renew their case for eliminating “sham” scheduling and changing PJM rules on opportunity costs.

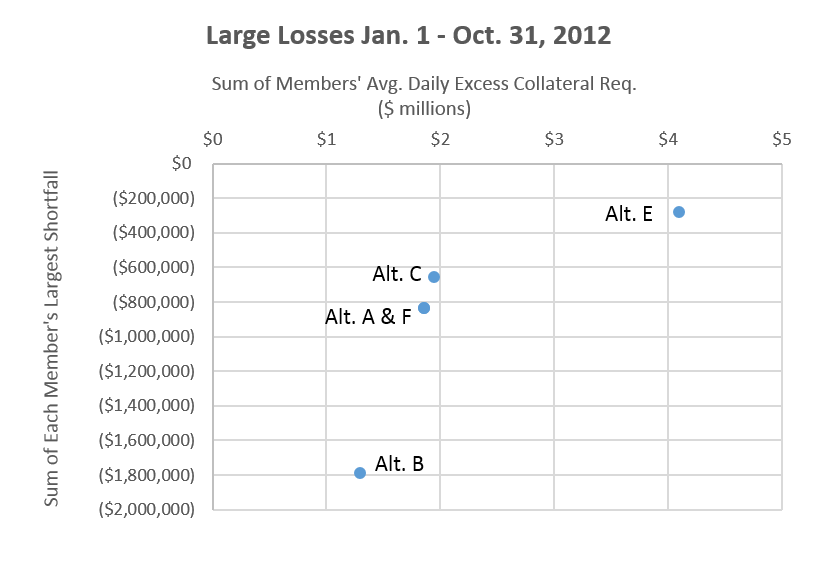

PJM's market monitor released data showing that up-to congestion (UTC) transactions are increasing shortfalls in Financial Transmission Rights (ftr) funding.

In a split decision for financial traders, an appellate court Monday sent a dispute regarding PJM’s line-loss collections back to FERC.

Below is a summary of problem statements and manual, Operating Agreement and Tariff changes approved by the PJM Markets and Reliability Committee (MRC).

The PJM Members Committee approved the following changes by acclimation at its annual meeting on May 16, 2013.

The Market Implementation Committee endorsed a first-ever credit requirement for up-to-congestion transactions. The new rule, a consensus resulting from 12 C...

Up-to congestion transactions were in the spotlight Thursday as the Markets and Reliability Committee:

Approved a definition of UTCs and a limit on trading...

By Rich Heidorn Jr.

Washington, DC (March 14, 2013) - Market Monitor Joseph Bowring released the 2012 State of the Markets report with a call for changes to...

The Market Implementation Committee voted overwhelmingly March 6 to endorse PJM’s proposals for applying forfeiture rules to virtual transactions, rejecting ...

By Rich Heidorn Jr.

PJM Insider

Wilmington – PJM’s proposal to limit Up to Congestion (UTC) bids stalled at the Markets and Reliability Committee Thursday, ...

Want more? Advanced Search