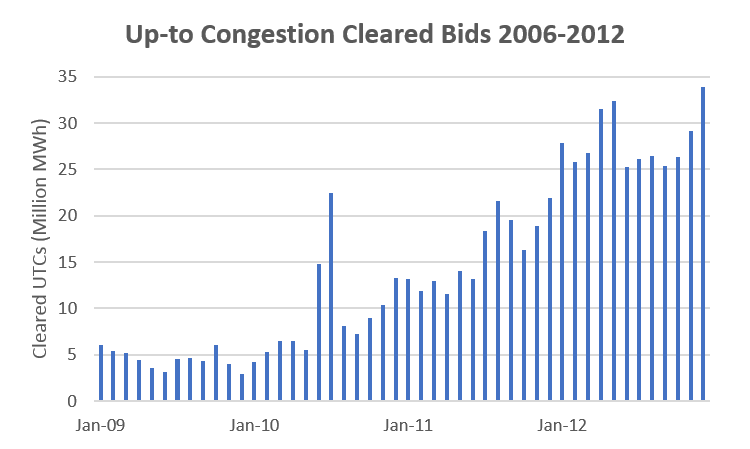

up-to-congestion transactions (UTCs)

FERC ordered a review of PJM’s rules regarding up-to-congestion transactions (UTCs), saying the RTO may be discriminating in how it treats these trades.

At FERC's uplift hearing, PJM was a target for criticism from market participants smarting over the $600 million uplift bill from January’s polar vortex.

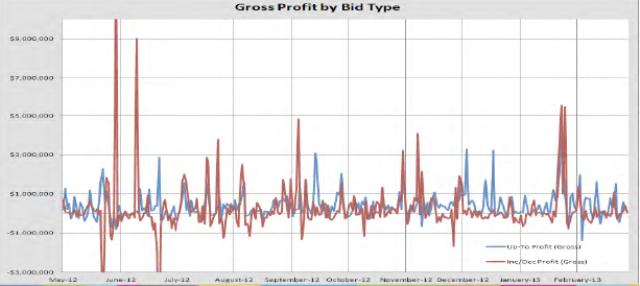

FERC staff issued a Notice of Alleged Violation last week against traders who exploited a loophole in PJM UTC trades in a case that will likely go to court.

After nearly four years of investigation, FERC publicly accused an energy trading firm of market manipulation in a case that dogged enforcement chief Norman Bay through his confirmation as commissioner.

The Powhatan Energy Fund, the subject of a FERC investigation for more than three years without being charged, has decided to go on offense by releasing documents it says proves it has been unfairly hounded.

A brief primer on virtual trading: INCs, DECs and UTCs.

Financial marketers are pleased with PJM’s proposal to change the way uplift charges are assessed on virtual trades but aren’t convinced by a PJM analysis that the RTO says justifies extending the charges to up-to congestion trades (UTCs).

PJM wants to change the way virtual trades pay for uplift, replacing the current unpredictable charges with a flat per megawatt fee and assessing them for the first time on up-to congestion trades (UTCs).

Members agreed last week to move forward with an initiative that could result in reduced restrictions on Up-to Congestion transactions.

PJM will consider relaxing rules for up-to congestion transactions under a problem statement approved last week.

Want more? Advanced Search