UIL Holdings

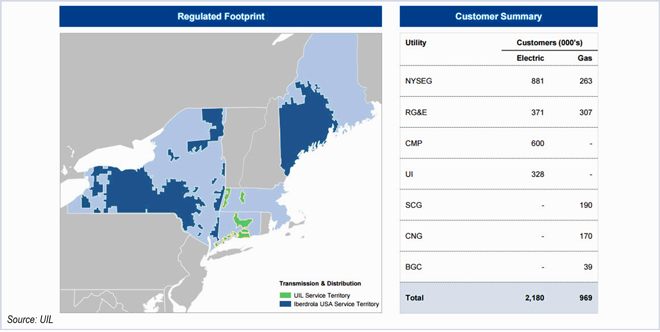

A divided panel of Connecticut regulators on Wednesday gave final approval to Iberdrola USA’s $3 billion takeover of UIL Holdings.

The state’s Public Utilit...

Connecticut regulators released a draft decision approving Iberdrola USA’s $3 billion acquisition of UIL Holdings.

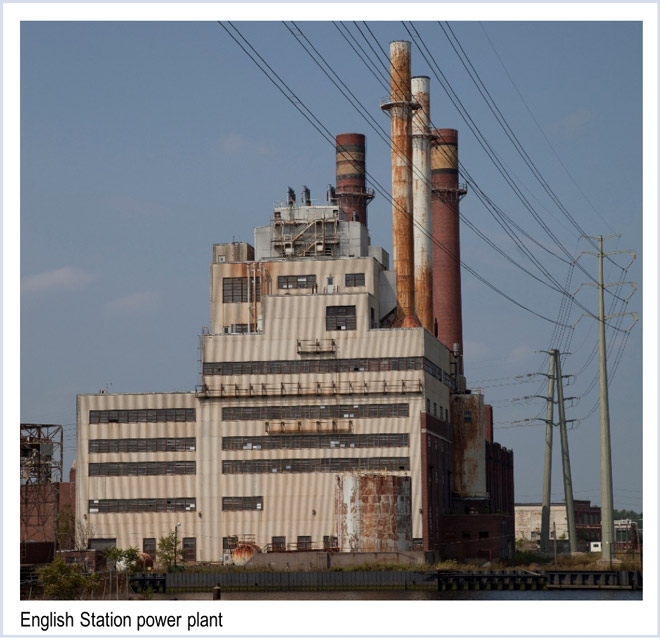

Iberdrola USA and UIL Holdings have agreed to clean up an abandoned power plant site in New Haven if Connecticut regulators approve their proposed $3 billion merger.

Iberdrola USA refiled its acquisition plan for UIL Holdings with Connecticut regulators, attempting to address objections that scuttled the previous plan.

Iberdrola reported increased revenue in its U.S. and other overseas operations that offset declines in Spain.

Iberdrola dropped its bid to acquire UIL Holdings but promised to file a new application that would address Connecticut regulators' objections.

Connecticut regulators said they will reject Iberdrola SA’s acquisition of UIL Holdings without much stronger ratepayer protections and assurances over local control.

Connecticut environmental officials are at odds with utility regulators over whether the state should seek cleanup of an abandoned power plant as a condition for Iberdrola’s acquisition of UIL Holdings.

At the New England Energy Conference and Exposition, experts said distributed generation isn't leading to a “death spiral” for traditional utilities.

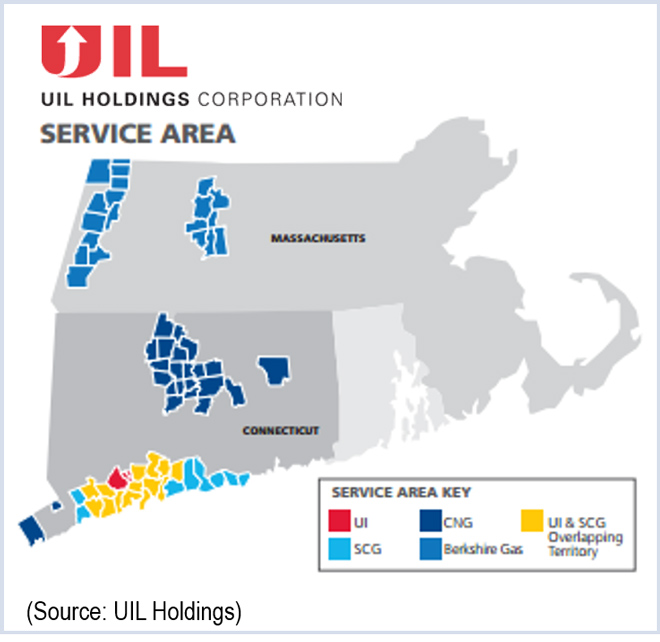

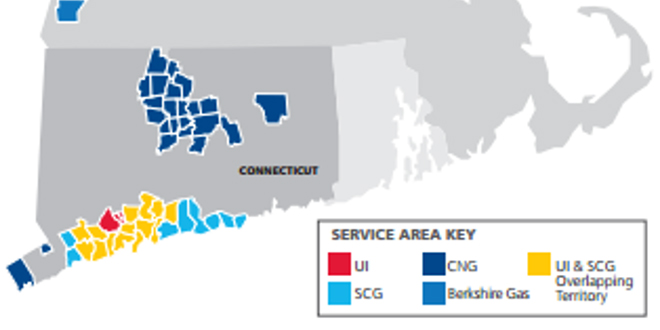

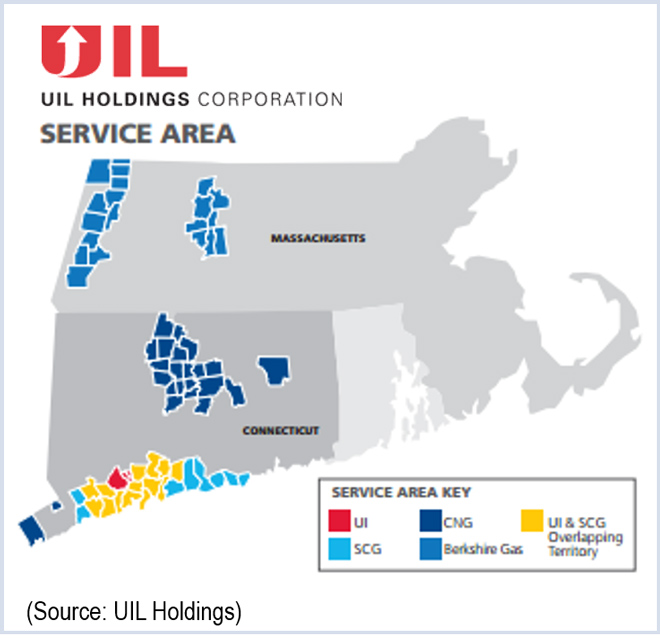

Iberdrola SA announced it is acquiring UIL Holdings, which has electric and gas distribution companies in Connecticut and Massachusetts, in a cash and stock deal valued at $3 billion.

Want more? Advanced Search