U.S. Department of the Treasury

The Treasury Department has released guidance on its 45X tax credit for clean energy manufacturing, which is meant to help spur domestic production of batteries, solar, wind, and minerals.

As U.S. automakers pull back on plans to invest heavily in electric vehicles, claiming sales are not growing as fast as expected, the Treasury Department and Internal Revenue Service issued new guidelines on the federal tax credits for EVs that could further slow sales.

The Treasury Department released guidelines for the Inflation Reduction Act’s investment tax credits for clean energy projects.

The Treasury Department published guidance for private-sector financial support of net-zero initiatives, a set of voluntary best practices to promote consistency and credibility.

Starting in 2024, consumers buying an electric vehicle that qualifies for a $7,500 tax credit under the Inflation Reduction Act.

Treasury Department issues final guidance for lower-income community bonus on IRA tax credits for clean energy projects.

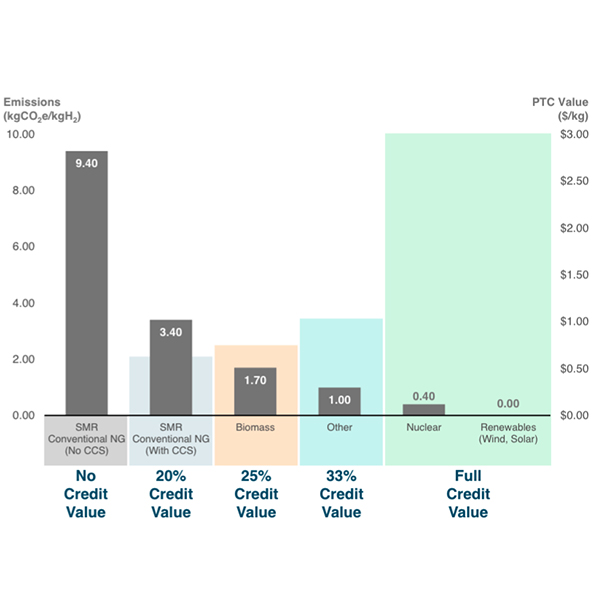

The Treasury Department is working to implement the 45v tax credit, which is the largest incentive passed under the Inflation Reduction Act and is meant to incentivize clean hydrogen production.

Power demands from the upstart clean hydrogen industry could lead to a dirtier electric grid.

Federal production tax credits for green hydrogen will depend on the "cleanliness" of the power used to produce it.

The Treasury Department's revised list of EVs qualifying for federal tax credits provided mixed news for U.S. and foreign automakers and prospective buyers.

Want more? Advanced Search