transmission congestion

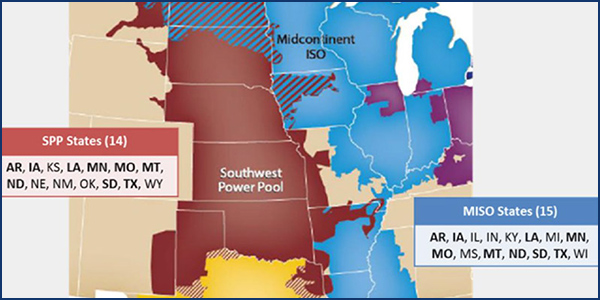

FERC ordered a technical conference to investigate overlapping congestion charges imposed on pseudo-tie transactions between MISO and SPP.

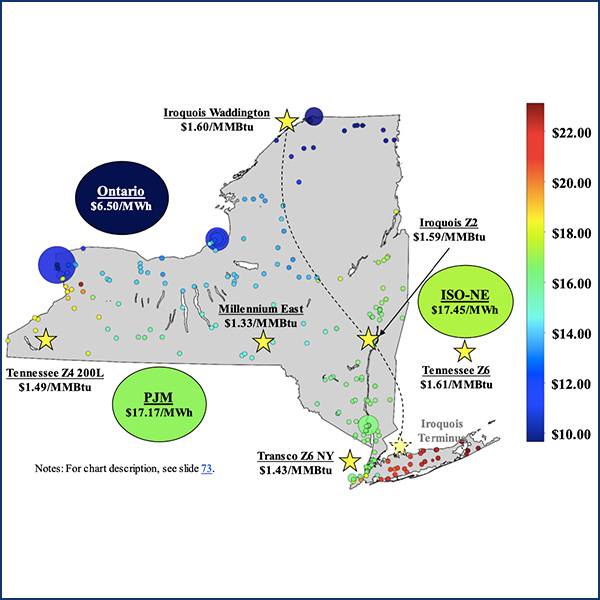

NYISO energy markets performed competitively in the second quarter, with the pandemic leading to the lowest load and average fuel prices in more than a decade.

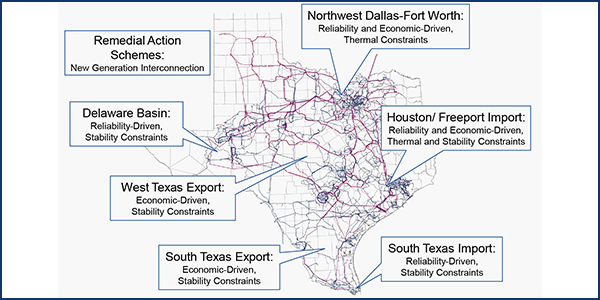

Renewable energy’s proliferation has played a key role in helping ERCOT meet demand, but is also beginning to cause transmission constraints.

PJM stakeholders continued debating changes to processes used to plan market efficiency transmission projects, including a new regional targeted process.

NYISO energy prices sank to 11-year lows during the first quarter, ranging from $15 to $35/MWh, according to the MMU’s State of the Market report.

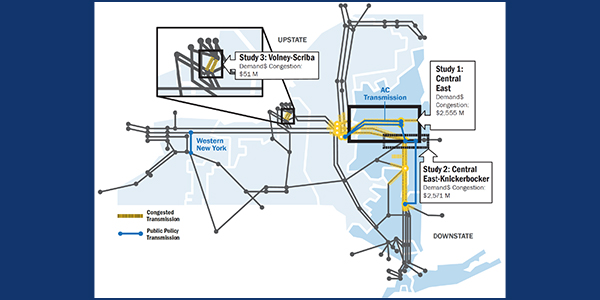

NYISO will need to expand its bulk transmission and some low-voltage lines to meet New York’s 2030 climate goals, according to the ISO's latest CARIS.

Renewable energy experts and grid planners joined government officials to discuss how to address New York’s outdated transmission system.

SPP stakeholders delayed a decision over the weighting of futures and the use of economic must-run modeling in the 2021 transmission planning assessment.

After a one-month delay, the PJM Market Implementation Committee endorsed two packages to update the RTO’s opportunity cost calculator.

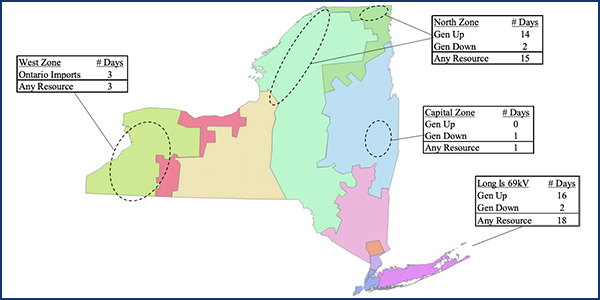

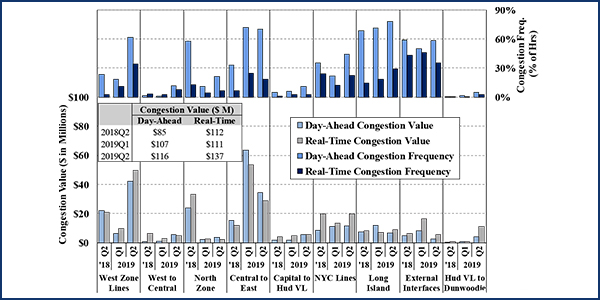

NYISO congestion costs surged in the second quarter despite lower electricity prices, gas price spreads and load levels, the Market Monitoring Unit said.

Want more? Advanced Search