Texas Energy Fund (TEF)

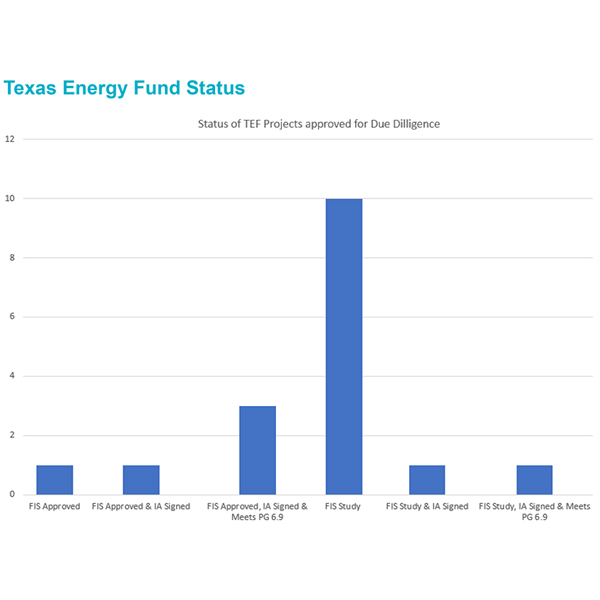

Texas’ loan program for gas generation has lost two more projects, marking the third and fourth companies to withdraw projects from the due diligence review process.

The Texas Public Utility Commission advanced two generation projects for due diligence review as part of the Texas Energy Fund’s In-ERCOT loan program, filling a hole left by two proposals that dropped out.

Two energy companies have withdrawn projects from the Texas Energy Fund, citing equipment procurement constraints that will keep them from meeting a December 2025 deadline.

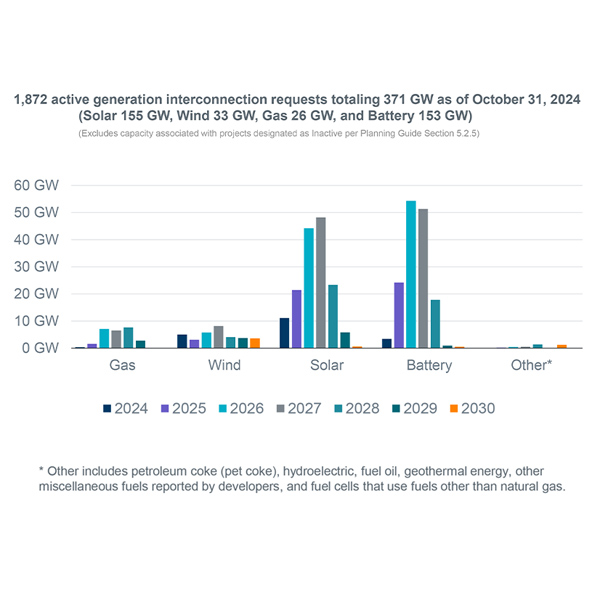

ERCOT released its semiannual but delayed Capacity, Demand and Reserves report that provides potential future planning reserve margins five years into the future that some say are "scary."

The Texas grid operator raised eyebrows in April when it said its load-growth forecasts had ballooned by 40 GW over the previous year. It said it anticipates about 152 GW of new load by 2030.

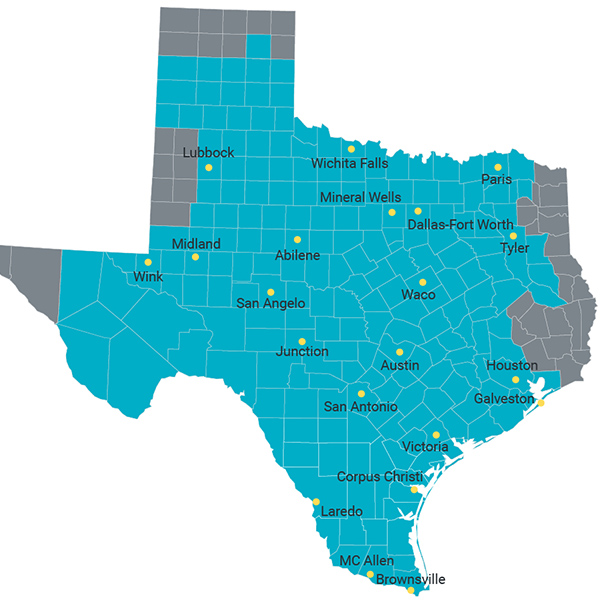

ERCOT’s request for must-run alternatives for cost-effective solutions to the congestion problems in San Antonio did not receive any responses by a Dec. 30 deadline, putting the solicitation in serious doubt.

The Texas Public Utility Commission's staff has recommended not moving forward with the proposed performance credit mechanism market design for ERCOT as it is currently designed.

Texas lawmakers charged with overseeing the state’s $5 billion fund for new gas-fired generation have taken aim at the consulting firm managing the Texas Energy Fund.

Texas regulators have approved ERCOT’s reliability plan for the petroleum-rich Permian Basin that could rely on the state’s first use of 765-kV transmission facilities.

Texas regulators have rejected the second-largest project from its portfolio of potential generation resources that would be built with state funds.

Want more? Advanced Search