Tax Cuts and Jobs Act of 2017

As they prepare to leave office, Biden administration officials remain confident that IRA funds already committed by DOE will be impossible to claw back by the incoming Trump administration.

To move forward in the second Trump administration, both Democrats and Republicans will need to depoliticize the debate around climate and energy issues as they face the impacts of increasingly frequent and severe extreme weather, while meeting growing power demand from artificial intelligence, data centers and new manufacturing.

With the presidential election five weeks away, the fate of permitting reform and the Inflation Reduction Act were top of mind for attendees and speakers at the National Clean Energy Week Policymakers Symposium.

FERC Order 1920 could help move the bar significantly on more efficiently expanding the transmission grid, but its ultimate success depends on how it and other policies are implemented, stakeholders say.

FERC approved Duke Energy’s rate settlement with two co-ops to reflect lower corporate taxes enacted during the Trump administration.

FERC partly rejected Order 864 compliance filings by NorthWestern, Duke Energy and PacifiCorp regarding changes caused by the Tax Cuts and Jobs Act of 2017.

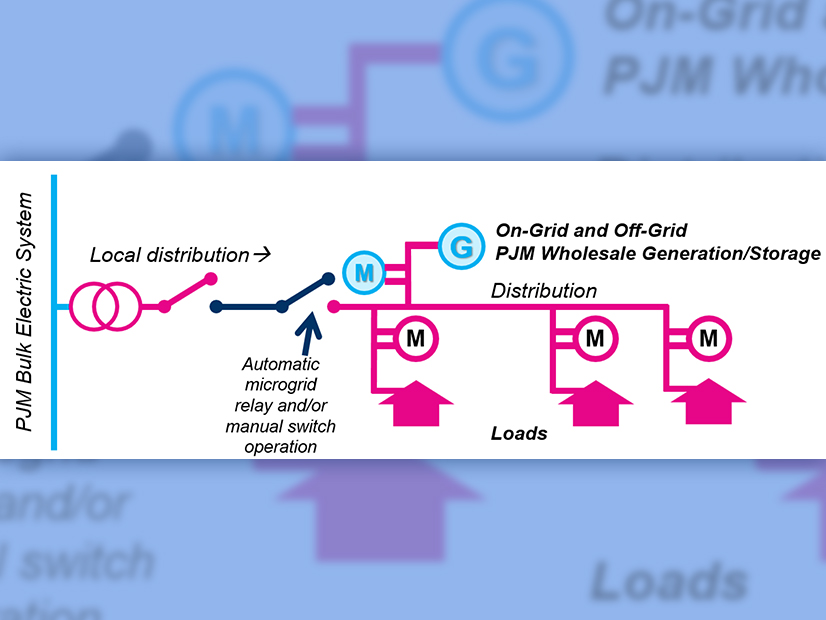

Stakeholders endorsed PJM’s proposed solution to update the value of capital recovery factors at last week’s MRC meeting.

PJM stakeholders at the MRC rejected two proposals aimed at addressing a dispute over black start units' capital recovery factor.

Stakeholders challenged PJM and its Monitor over updates to the RTO’s black start capital recovery factor table.

FERC denied KEPCo’s complaint that Westar Energy had twice violated its generation formula rate in assessing its own rates and federal income tax reduction.

Want more? Advanced Search