tax credits

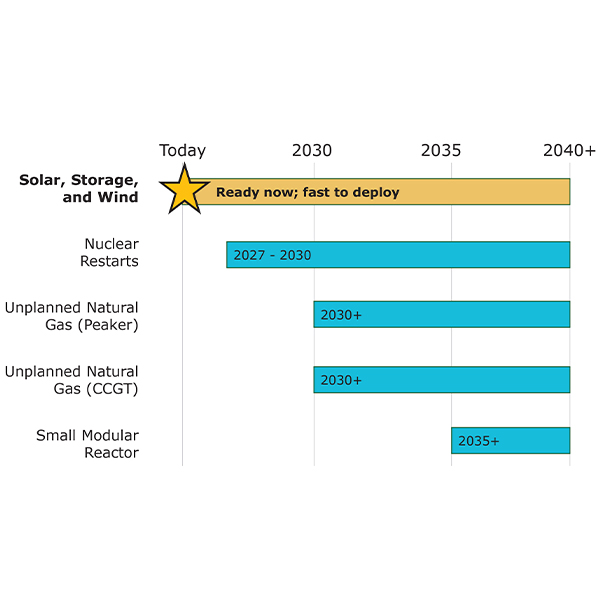

An ACORE report says solar and wind can be deployed cheaply and quickly to meet the country’s rapidly escalating demand growth, while providing support for natural gas and nuclear plants.

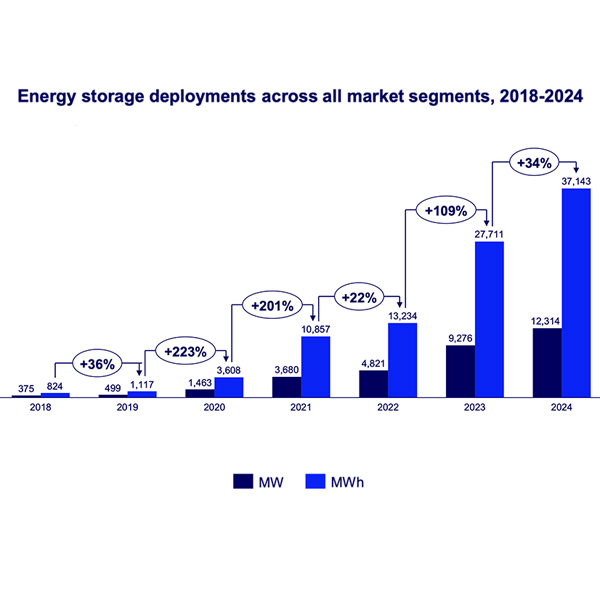

Storage set a new record of installations in 2024, but the forecasts for the rest of the decade are cloudy because of uncertainty around the future of tax credits and additional tariffs from President Trump.

With the presidential election five weeks away, the fate of permitting reform and the Inflation Reduction Act were top of mind for attendees and speakers at the National Clean Energy Week Policymakers Symposium.

The Treasury Department has released guidance on its 45X tax credit for clean energy manufacturing, which is meant to help spur domestic production of batteries, solar, wind, and minerals.

Treasury Department issues final guidance for lower-income community bonus on IRA tax credits for clean energy projects.

Gov. Michelle Lujan Grisham vetoed large portions of a tax package, cutting out tax credits for EVs, energy storage systems and geothermal electricity production.

The transparency and traceability of critical minerals and battery components will be essential for automakers as they work to meet domestic content provisions.

While EVs are on the floor they are by no means the main attraction, and much uncertainty remains about how fast automakers can build out their supply chains.

Consumers looking to cash in on the Inflation Reduction Act’s tax credits for electric vehicles may have to wait on the Treasury Department.

Two Western governors speaking at COP27 said they see states leading the federal government in tackling climate change measures on the ground in the U.S.

Want more? Advanced Search