Tacoma Power

The Bonneville Power Administration should remain in CAISO’s WEIM and hold off on joining a day-ahead market, Seattle City Light and other Northwest parties urged in a letter sent to BPA CEO John Hairston.

BPA will be on the hook for nearly $27 million in funding for the next phase of SPP’s Markets+ — and potentially more depending on the market’s final footprint, according to a document SPP filed with FERC.

The RTO said it has received signed Phase 2 funding agreements from eight interested participants in its proposed day-ahead service offering — including the Bonneville Power Administration.

Tacoma Power has signed an agreement to join SPP’s Markets+, making the Washington utility the second Pacific Northwest entity to commit to participating in the market in the past month.

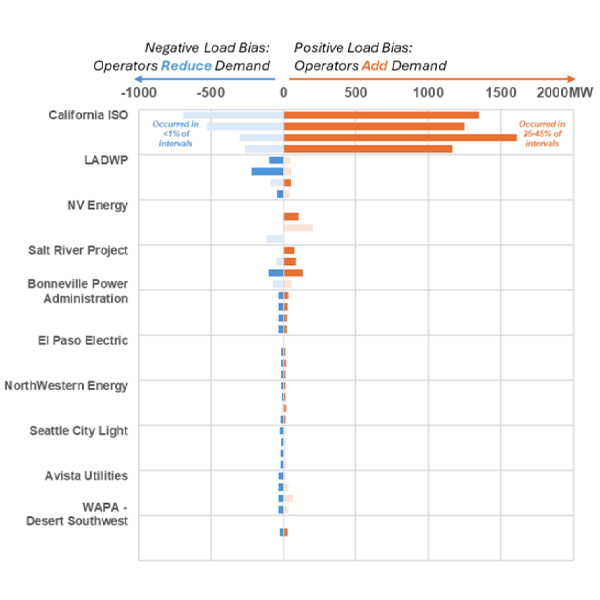

CAISO will be inherently compromised in its role as an operator of a deeper Western market because of its conflicting responsibilities as BA within that market, a group of entities that support SPP’s Markets+ argue in their latest “issue alert.”

Markets+ proponents argue that the SPP framework allows more flexibility for integrating greenhouse gas emission reduction programs across various states than CAISO’s EDAM.

Proponents of SPP’s Markets+ contend in their latest “issue alert” that the framework provides a much more equitable solution to tackling market seams than under CAISO’s EDAM.

Enhanced protections against uncompetitive market behavior are among several tools to ensure fair and accurate pricing under a Markets+ framework, according to the latest "issue alert" from entities that back its development.

The Bonneville Power Administration will delay its Western day-ahead market choice beyond a scheduled Aug. 29 announcement date and likely will extend the decision-making process into 2025, according to multiple sources.

The integration of Markets+ with the Western Resource Adequacy Program would be among a handful of key reliability benefits of SPP’s Western day-ahead offering, according to an “issue alert” published by 10 entities that backed development of the market.

Want more? Advanced Search