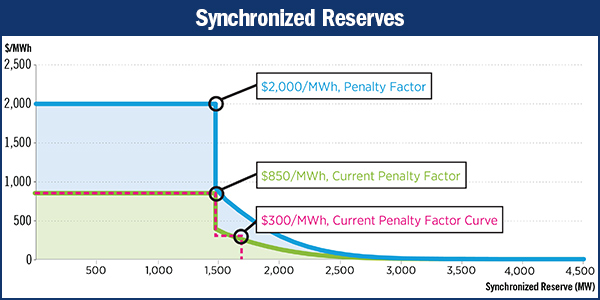

synchronized reserves

A summary of the issues scheduled to be brought to a vote at the PJM Markets and Reliability Committee and Members Committee meetings on Dec. 15, 2021.

Stakeholders at last week’s Operating Committee meeting endorsed a PJM proposal seeking to improve deployment of synchronized reserves during a spin event.

PJM stakeholders will vote next month on two different proposals seeking to improve the deployment of synchronized reserves during a spin event.

PJM stakeholders unanimously endorsed an issue charge that seeks to improve the deployment of synchronized reserves during a spin event.

PJM is looking to improve the deployment of synchronized reserves during a spin event, but some stakeholders questioned the timing of the issue.

FERC approved PJM’s proposed energy price formation revisions, agreeing with the RTO that its reserve market was not functioning as intended.

PJM dropped its plan to clarify pseudo-tie eligibility after stakeholders argued some of the revisions conflicted with pending litigation.

PJM’s Monitor said recently approved maintenance adders to the synchronized reserve calculation allow resources to increase offers above competitive levels.

The PJM Board of Managers agreed to submit staff’s revised energy price formation proposal for FERC approval, CEO Andy Ott said.

PJM stakeholders appeared resigned to a unilateral FERC filing by the Board of Managers revising the RTO’s proposed price formation rules.

Want more? Advanced Search