State of the Market report

COVID-19 and record hurricane and wildfire seasons made 2020 “a unique and at times challenging year,” FERC said in its State of the Markets report.

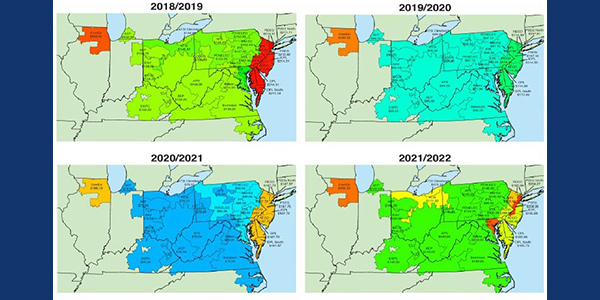

PJM’s Monitor sounded alarms about market power in the energy and capacity markets and said it may intervene in the RTO’s next capacity auction.

PJM's Monitor urged the RTO not to rush into making changes to its capacity market before the approved design is given a chance to succeed.

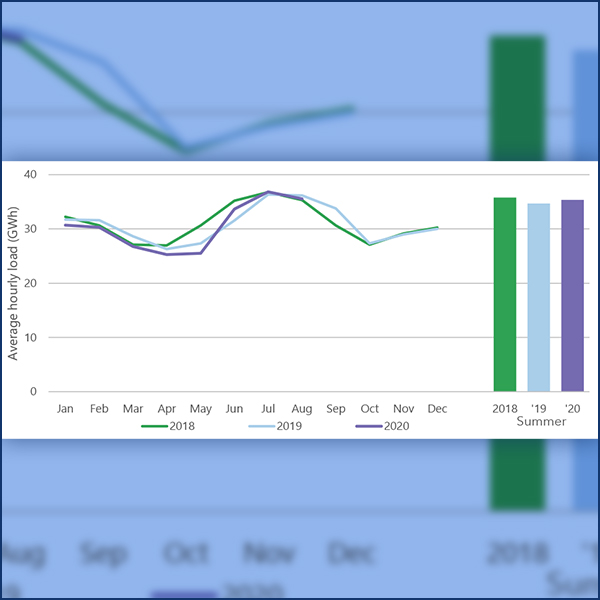

This summer’s average hourly load in the SPP footprint was 2% higher than the year before, according to the MMU’s quarterly report.

MISO agrees with nearly all the new recommendations its Monitor issued this year, though executing the ideas may take some time.

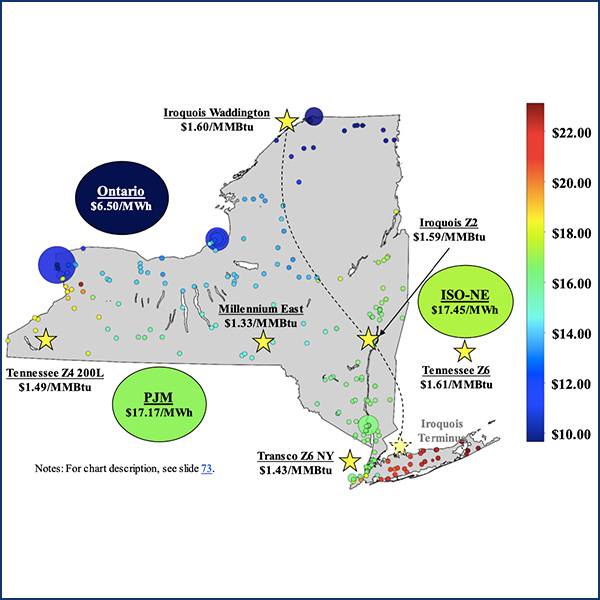

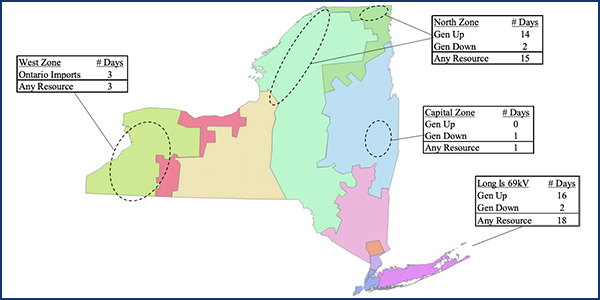

NYISO energy markets performed competitively in the second quarter, with the pandemic leading to the lowest load and average fuel prices in more than a decade.

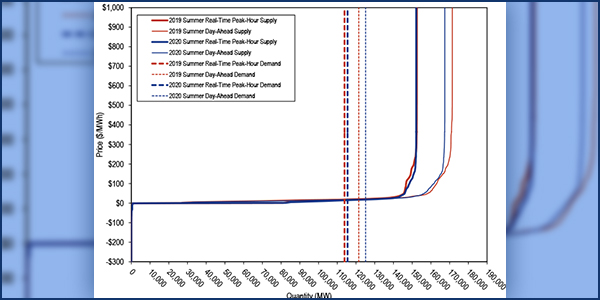

PJM energy prices were lower in the first half of 2020 than any first six-month period since the creation of the RTO’s markets in 1999.

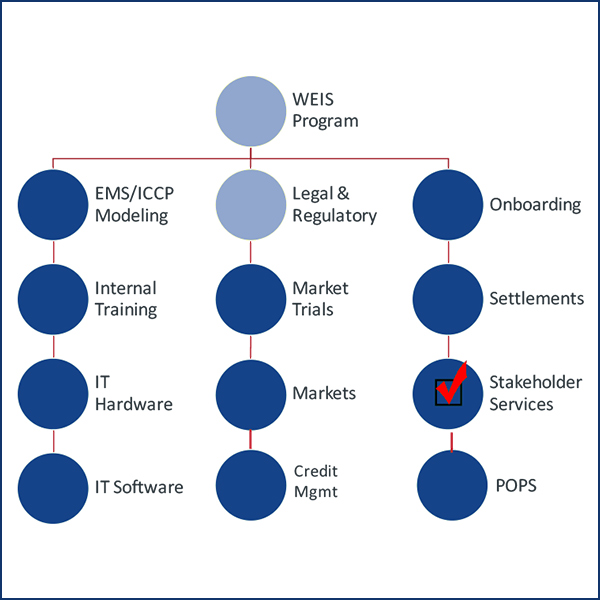

SPP's Western Energy Imbalance Service market is at risk of falling behind schedule because it is still waiting on FERC approval of the standalone Tariff.

PJM has responded to the Market Monitor’s annual State of the Market Report, highlighting five different areas of focus out of hundreds of recommendations.

NYISO energy prices sank to 11-year lows during the first quarter, ranging from $15 to $35/MWh, according to the MMU’s State of the Market report.

Want more? Advanced Search