SPP Markets+

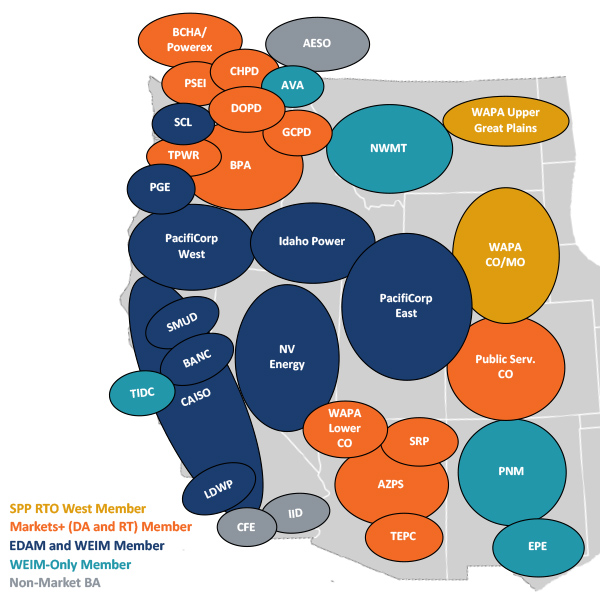

CAISO scored simultaneous victories in heavily contested territory after Portland General Electric and Idaho Power both signaled their intent to join the Extended Day-Ahead Market.

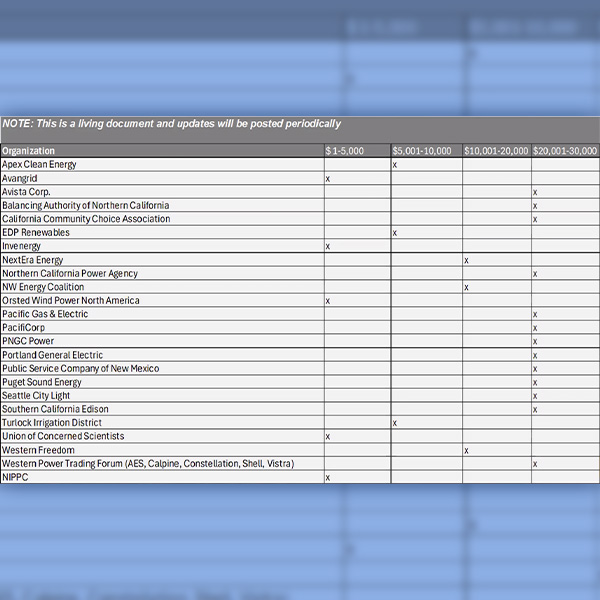

The West-Wide Governance Pathways Initiative has secured commitments of financial support from 24 utilities and other electricity-sector organizations and expects that list to grow.

The Colorado Public Utilities Commission has proposed rules that would govern how it will review applications from utilities wishing to join the various regional markets being developed in the Western Interconnection.

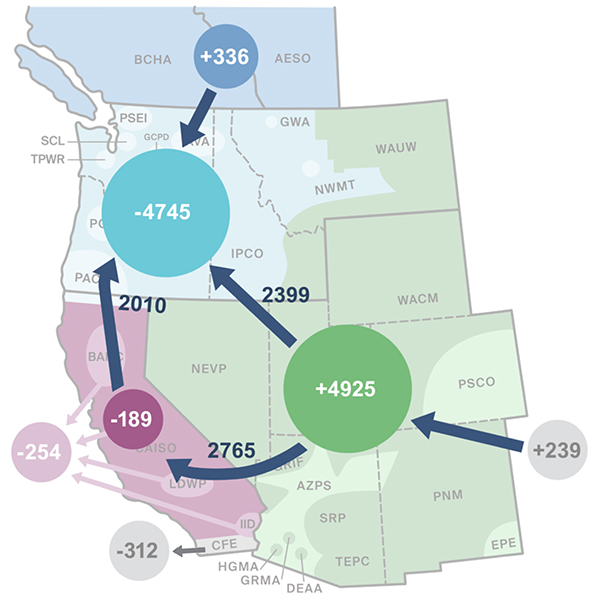

A new report from electricity marketer Powerex adds to the expanding debate around what transpired on the Western grid during a January cold snap that saw the Northwest forced to import large volumes of power.

The 80-page report represents the latest volley in an ongoing skirmish among Western electricity sector stakeholders over what exactly occurred on the regional grid during the Jan. 12-16 deep freeze.

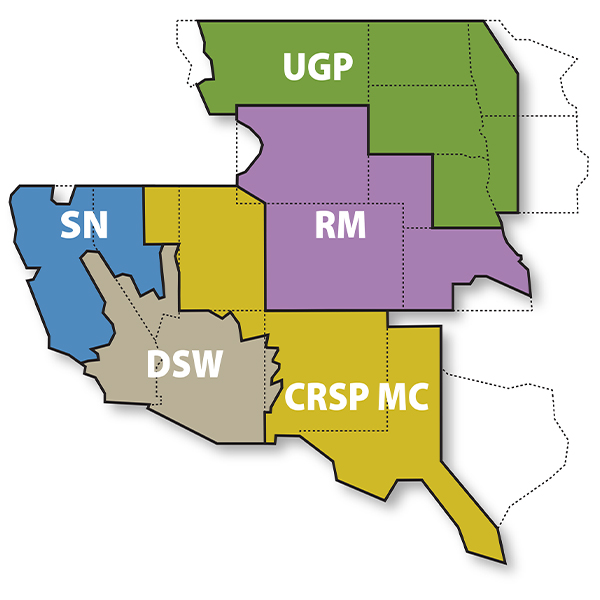

WAPA's Desert Southwest Region pulled out of the second phase of developing SPP's Western day-ahead market after determining it would see few benefits from participating in either Markets+ or EDAM.

NV Energy is aiming to bring a proposal to Nevada regulators by the end of the year for joining a day-ahead market, but what process regulators will use to evaluate that request is still very much up in the air.

NV Energy would gain significantly more economic benefits from participating in CAISO’s EDAM than SPP’s Markets+, new analysis from the Brattle Group shows.

Independent SPP directors overseeing Markets+’s development in the Western Interconnection have lent their approval to the market’s draft tariff, the culmination of several months of drafting and refinement.

NV Energy and several stakeholder groups have weighed in on how Nevada regulators should evaluate a request from the utility to join a day-ahead market or RTO.

Want more? Advanced Search