seams

CAISO and SPP have made “significant progress” on adapting existing tools to tackle seams between the two entities’ respective day-ahead markets, according to a CAISO representative.

As the Bonneville Power Administration prepares to join Markets+, the agency hopes to complete the initial program governance setup and define its commercial model for market participation in early 2026.

A new FERC report adds to the growing body of work showing the complexity of confronting the seams issues likely to arise between the West’s two day-ahead markets when compared with challenges at the borders between RTOs and ISOs in the Eastern U.S.

SPP stakeholders resoundingly rejected a proposed tariff change to integrate large loads, pushing back against what some say is a rushed process outside of the normal stakeholder structure.

After about 15 years, MISO appears ready to say goodbye to its stakeholder-run Seams Management Working Group.

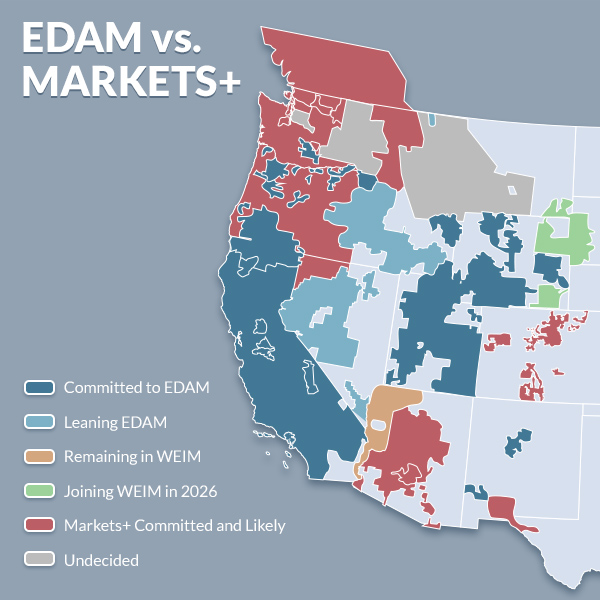

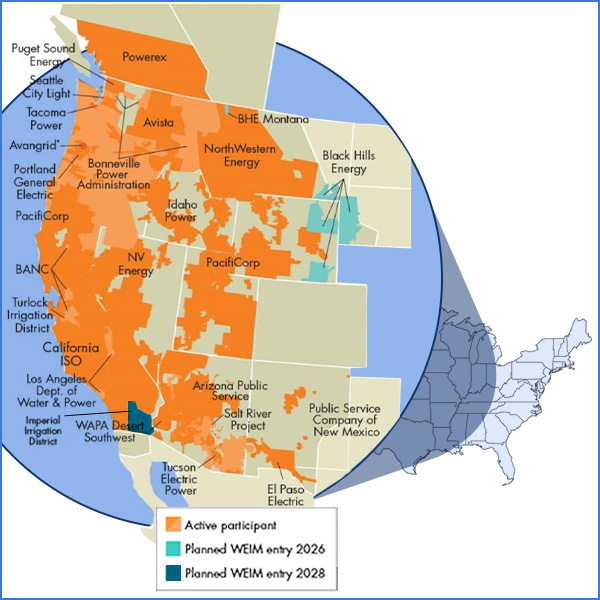

The formation of two competing day-ahead markets will create seams across the West, but at least one utility representative is more worried about seams resulting from the fracture of CAISO’s real-time Western Energy Imbalance Market.

MISO generation developers pushed back on MISO’s cost allocation of the $1.65 billion Joint Targeted Interconnection Queue, reportedly saying MISO’s late-stage alterations have eroded the value of the seams planning.

Though BPA removed any uncertainty by selecting SPP’s Markets+ over CAISO’s EDAM, the debate over whether BPA made the right choice likely will heat up as the West confronts a split into two major markets.

Bonneville's final record of decision will come as little surprise to those who’ve been following market developments in the West.

MISO is seeking judicial review of two FERC decisions preventing the RTO from recouping costs or revising a joint procedure with SPP over a shared North Dakota transmission line that has become congested by a new cryptocurrency mining facility.

Want more? Advanced Search