Revolution Wind

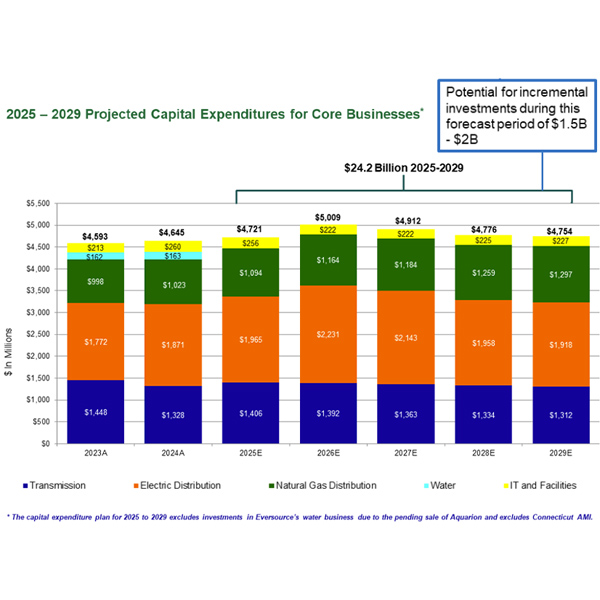

Eversource Energy executives announced during the company’s year-end earnings call its plan to increase investments in its “core electric and natural gas operations” by $1.9 billion in 2025-2028.

Three companies closely involved in offshore wind power development offered a glum assessment of the sector’s prospects in the U.S.

Ørsted CEO Mads Nipper has been replaced by Deputy CEO Rasmus Errboe.

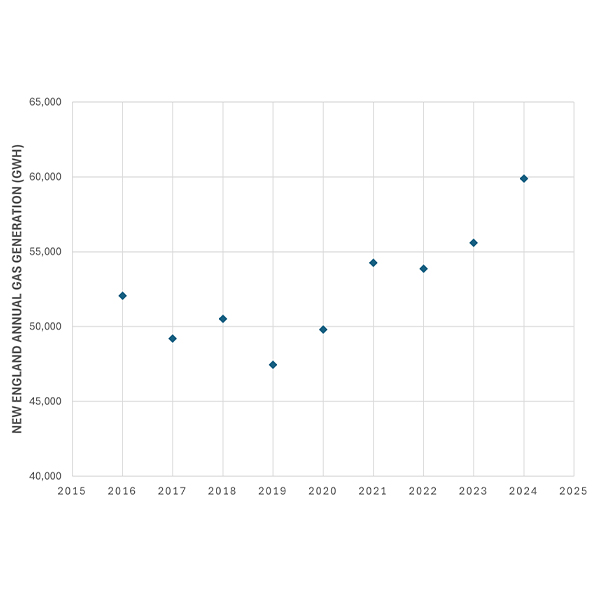

As overall power production ticked up in New England in 2024, natural gas generation reached its highest annual total in the region’s history, accounting for over 55% of all generation and 51% of net energy for load, according to new data from ISO-NE.

Government affairs experts previewing New England’s 2025 legislative sessions outlined some key policy overlaps and notable differences among states during a webinar held by the Northeast Energy and Commerce Association.

Cost increases, delays and diminished value of assets contributed to Ørsted's latest setback — which was announced before President Trump targeted offshore wind in an executive order.

Eversource Energy’s exit from the offshore wind business drove a $118 million loss in the third quarter of 2024, offsetting increased revenue from its electric and gas distribution business relative to 2023, the company told investors.

A one-in-a-thousand problem with a key foundation component is the latest setback in U.S. waters for Ørsted and is blamed for its latest nine-digit cost impairment.

Eversource Energy has formally ended its costly foray into offshore wind development, finalizing the sale of its last two offshore assets and predicting a half-billion-dollar loss as a result.

Activists, ISO-NE officials, and state representatives from across New England convened in New London, Conn., to discuss the benefits of offshore wind to the region’s power system.

Want more? Advanced Search