Production Tax Credit (PTC)

Citing the coronavirus pandemic, the IRS extended the time that wind and solar developers have to complete their projects and qualify for tax credits.

Legislators see long-term, full-value tax credits as one tool among many that are needed to expand renewables at the requisite pace and scale.

The U.S. could save $35 billion by 2031 by immediately eliminating fossil fuel tax preferences, according to a line item in President Biden’s 2022 budget.

A panel of industry stakeholders concluded ACORE’s Policy Forum with a discussion on infrastructure and the policies that might shape the future grid.

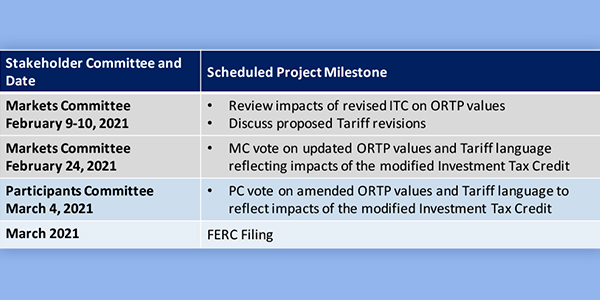

The NEPOOL Markets Committee reviewed proposals by ISO-NE and stakeholders to change the offer review trigger prices for renewables.

Renewables, energy efficiency and carbon capture all won tax break extensions in the massive stimulus and budget bill approved by Congress.

AWEA hosted a web-accessible three-day event to discuss the state of the renewable energy industries amid the pandemic and the expanded PJM MOPR.

The wind and solar industries were disappointed that Congress’ $2 trillion stimulus bill did not include extensions of production and investment tax credits.

WEC Energy Group reported year-end net income of $1.13 billion ($3.58/share), up from $1.06 billion ($3.34/share) in 2018.

AWEA welcomed nearly 8,000 attendees to its annual exhibition held May 20-23 at the George R. Brown Convention Center in Houston.

Want more? Advanced Search