price formation

The U.S. Energy Department’s study acknowledges its limited authority over wholesale markets, leaving it to FERC and RTOs to act on its recommendations.

ERCOT stakeholders jammed the Public Utility Commission of Texas' (PUCT's) hearing room for the first of several discussions on price-formation issues.

The ERCOT energy-only market may not be broken, but stakeholders will discuss some fine-tuning at a PUCT workshop this week.

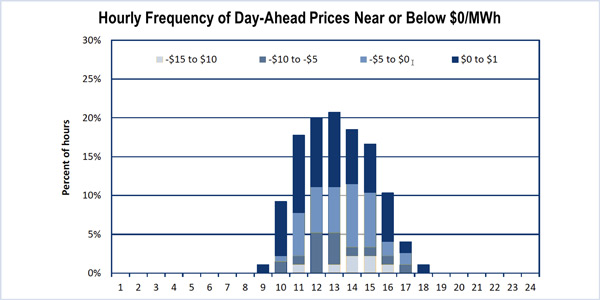

Negative day-ahead prices surged in CAISO during the first quarter stemming from surpluses of solar and hydroelectric output.

The MISO Market Monitor still sees room for significant improvement after giving the RTO’s markets a passing grade.

The plethora of dispatch data PJM provides is only useful if the grid operator also explains what it means, stakeholders told RTO staff at a special MIC.

Stakeholders questioned PJM's method for clearing units in its day-ahead auction at a special session of the Markets Implementation Committee.

PJM should explain its daily operating decisions in more detail so market participants can better understand price formation and how markets are formed.

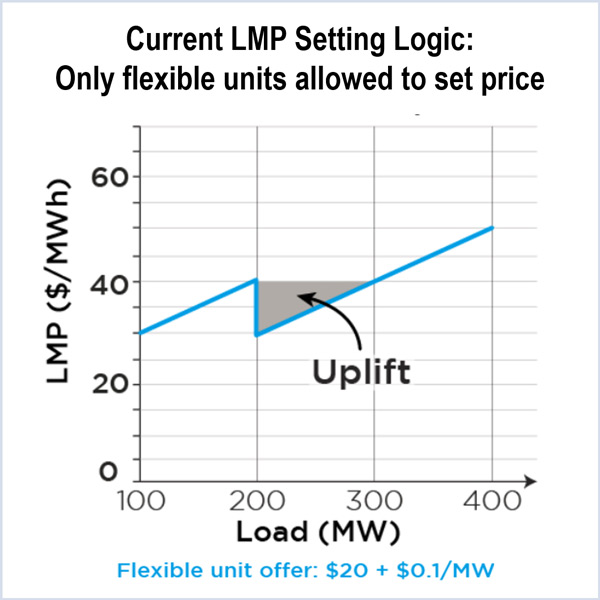

RTOs and ISOs would be required to incorporate fast-start resources into energy and ancillary services pricing under proposed rules approved by FERC.

RTOs will be required to align their settlement and dispatch intervals under new price formation rules approved by FERC.

Want more? Advanced Search