Powerex Corp.

As the Trump administration forged last-minute agreements with Canada and Mexico to postpone steep new tariffs, the energy industry fretted about potential fallout for cross-border supply chains and wholesale electricity markets.

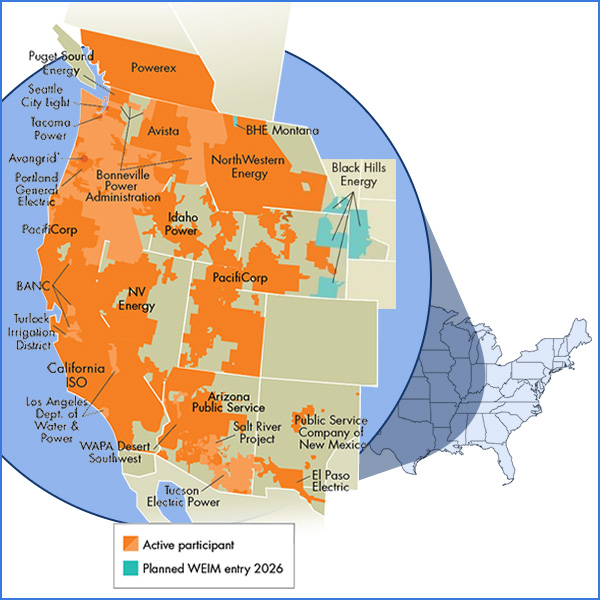

CAISO's Western Energy Imbalance Market provided participants $374.25 million in benefits during the fourth quarter of 2024, down about 4% from the same period a year earlier, according to an ISO report.

BPA would have to strike several types of agreements, many of which are complex and could take years to implement, to tackle seams that could arise if BPA joins a day-ahead market, agency staff said during a workshop.

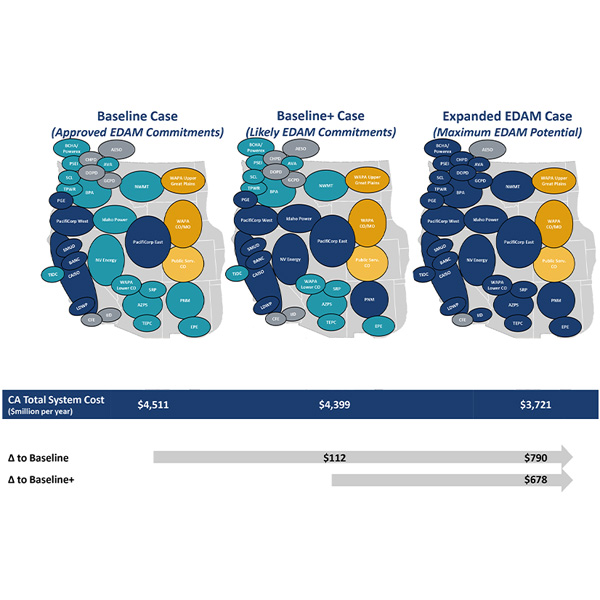

California ratepayers would save millions more in a CAISO Extended Day-Ahead Market encompassing nearly all the West than in one that includes only those utilities likely to join the market, according to a new Brattle Group study.

Markets+ notched another in a string of successes when the Chelan County Public Utility District in Washington said it will pay its $1 million to $2 million share of funding for the market’s Phase 2 implementation stage.

Powerex says it will fund the next phase of SPP’s Markets+ and “re-affirmed” its commitment to joining the Western real-time and day-ahead offering.

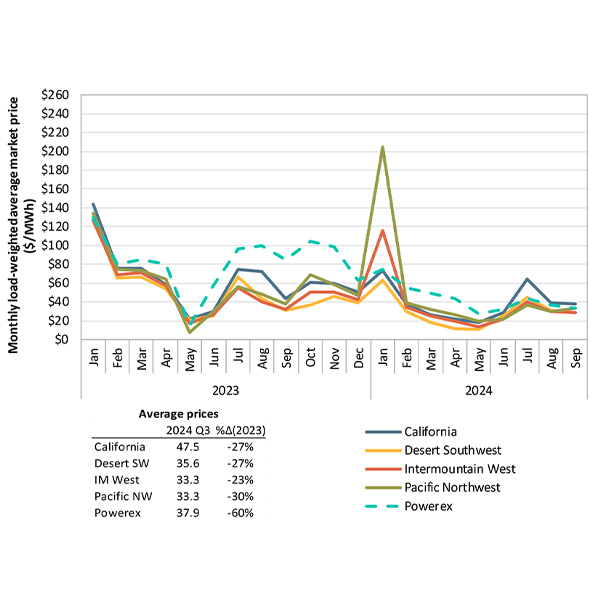

Prices in CAISO’s WEIM fell sharply in the third quarter of 2024 compared with a year earlier as declining gas costs outweighed the impact of increased summer loads, the DMM found.

Establishing a fast-start pricing mechanism in CAISO and the WEIM is complex and brings few benefits compared to other potential market enhancements, the ISO's Department of Market Monitoring said.

The Los Angeles Board of Water and Power Commissioners gave the go-ahead for LADWP to join CAISO’s EDAM, in a move expected to increase the utility’s annual net revenue by almost $40 million.

The joint announcement by APS, SRP, TEP and UniSource Energy marks a significant win for SPP after a string of victories for CAISO’s competing Extended Day-Ahead Market.

Want more? Advanced Search