Potomac Economics

New York energy markets performed competitively in the second quarter, according to the NYISO Market Monitoring Unit’s State of the Market report.

Rising natural gas prices will likely mean an end to ERCOT’s all-time low energy prices, according to the Independent Market Monitor.

The ERCOT energy-only market may not be broken, but stakeholders will discuss some fine-tuning at a PUCT workshop this week.

The MISO Market Monitor still sees room for significant improvement after giving the RTO’s markets a passing grade.

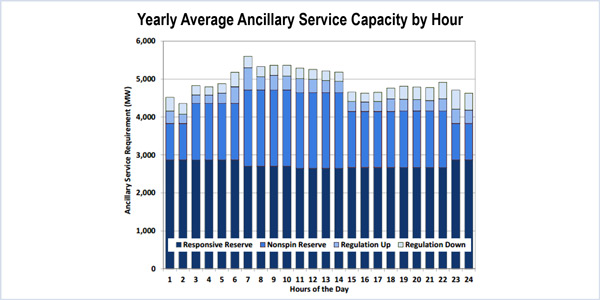

Potomac Economics’ David Patton told ERCOT’s Board of Directors that there’s still room to optimize energy and ancillary services.

ERCOT’s wholesale market performed “competitively” in 2016, the ISO’s Independent Market Monitor said in its annual State of the Market report.

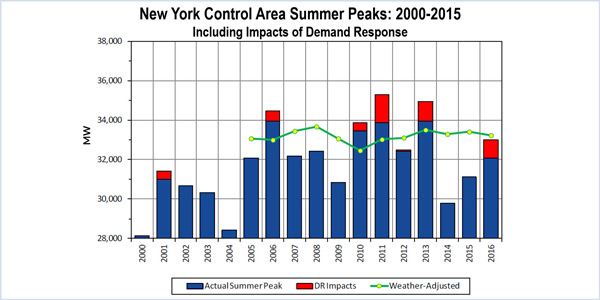

The NYISO Management Committee discussed the upcoming summer, an annual review of the Market Monitoring Unit and Tariff changes.

Natural gas price spreads between Western and Eastern New York in 2016 led to NYC generation being “more economic than in recent years,” NYISO's MMU said.

MISO Independent Market Monitor (IMM) David Patton presented a draft of his quarterly report; expressing concerns over high outage rates in MISO South.

A forward capacity market may have worked for PJM and ISO-NE, but it isn’t the solution for NYISO, the Market Monitor told IPPNY’s fall conference.

Want more? Advanced Search