Planning Resource Auction (PRA)

Voltus filed a complaint with FERC against MISO, alleging the RTO’s “11th-hour” changes in testing and contract proof requirements ahead of the spring capacity auctions will harm demand response resources and affect rates.

MISO revealed it will crack down on demand response testing requirements ahead of its spring capacity auction, while some stakeholders argued the stepped-up measures amount to a change that requires FERC approval.

Voltus filed a complaint at FERC over MISO's interpretation of a recent rule change that led the grid operator to stop accepting replacements for customers who sign up to provide demand response but retire.

FERC ordered Ketchup Caddy and its owner to pay $27 million in penalties for dishonestly offering demand response services in MISO’s capacity market from 2019 to 2021.

Load-serving entities that decide against participating in MISO’s capacity auction must secure anywhere from 1.5% to 4.2% beyond their reserve margin requirements in the 2025/26 planning year.

Nearly a decade on, the saga over Dynegy’s manipulation of MISO’s capacity market continues, with FERC denying the company’s asks for procedural changes that might have softened repercussions in the case.

The Sierra Club, Natural Resources Defense Council and the Sustainable FERC Project are seeking a rehearing of MISO’s sloped demand curve in its capacity auction.

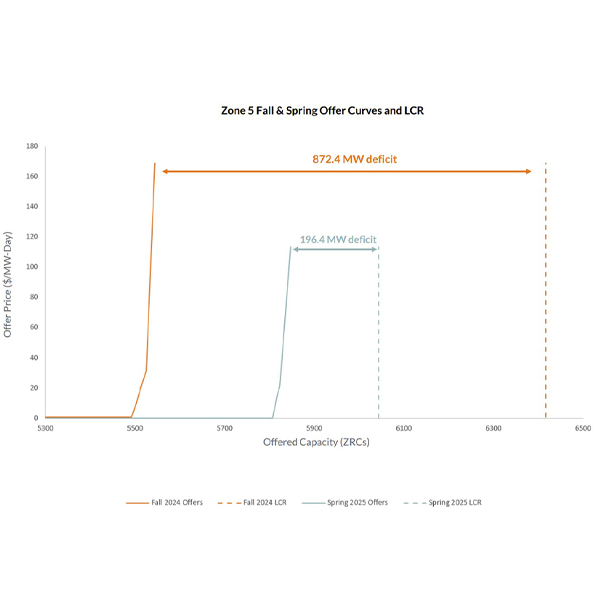

As it gears up to run its first auctions using sloped demand curves, MISO said prices and procurement would have risen had it used them in this year’s auctions.

After two requests for more information and nine months, FERC has greenlit MISO’s plan to exchange its current, vertical curve for sloped demand curves in its seasonal capacity auctions.

Nearly a decade after the MISO capacity auction in which Dynegy was found to have manipulated clearing prices, FERC has directed hearing and settlement procedures in the case.

Want more? Advanced Search