planning futures

MISO is on its way to installing a fourth, 20-year future to inform transmission planning in case supply chains remain unsteady.

Calls to consider a dissolved or weakened Inflation Reduction Act alongside appeals for stronger MISO South planning epitomized the tough situation and unsteady political climate MISO finds itself in as it tries to establish transmission planning expectations.

MISO expects the revamp of its transmission planning futures will be done by November and will yield an extra scenario dedicated to slow-moving generation construction.

Board members have directed MISO to seek guidance on the role of the Independent Market Monitor in transmission planning following a year of IMM David Patton criticizing MISO’s nearly $22-billion long-range transmission portfolio.

MISO further embraced the industry’s move to chance-based transmission planning by hosting a Probabilistic Planning Symposium at its headquarters.

MISO will take a breather from its long-range transmission planning over 2025 to retool the 20-year future scenarios that are the foundation of the transmission portfolios.

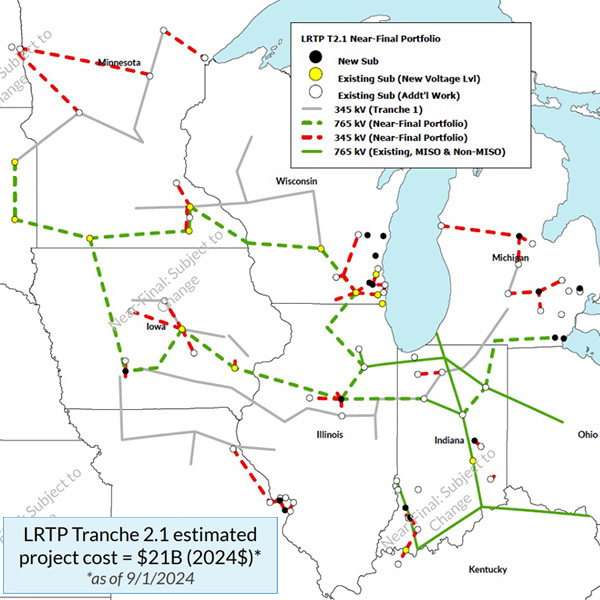

MISO said its second, mostly 765-kV long-range transmission plan will provide the Midwest region with at least a 1.9:1 benefit-cost ratio, a metric that was greeted with skepticism by Independent Market Monitor David Patton.

MISO’s $25 billion, mostly 765-kV long-range transmission package for the Midwest region is nearing finalization, while the Independent Market Monitor continues to doubt the necessity of the projects.

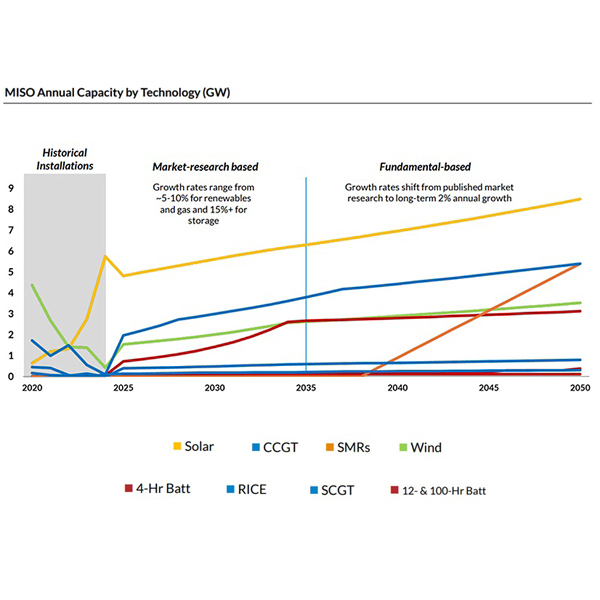

Doubts continue to swirl around which version of MISO’s future fleet mix is appropriate for long-range transmission planning — the Independent Market Monitor’s or the RTO’s itself.

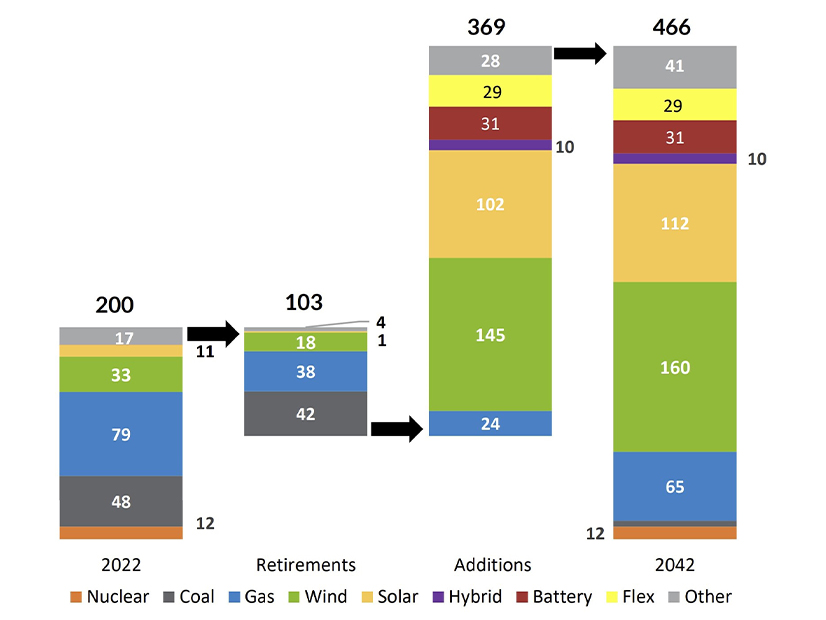

MISO laid out why it needs a 2nd LRTP portfolio, saying it will connect hundreds of gigawatts of new resources in the next 20 years to avoid reliability crises.

Want more? Advanced Search