PJM Interconnection LLC (PJM)

A group of demand response providers in PJM proposed adding two hours to the availability window that binds when the resource can be deployed by the RTO.

FERC accepted PJM’s request to delay the 2025/26 Base Residual Auction from June 12 to July 17 to give stakeholders time to understand new capacity auction rules.

PJM proposed changes to how it measures and verifies the capacity contribution of energy efficiency resources, drawing concerns the RTO is moving too fast to implement changes ahead of the next capacity auction.

ISO-NE, MISO, PJM and SPP released a report calling for improvements to the coordination of the electric and natural gas systems.

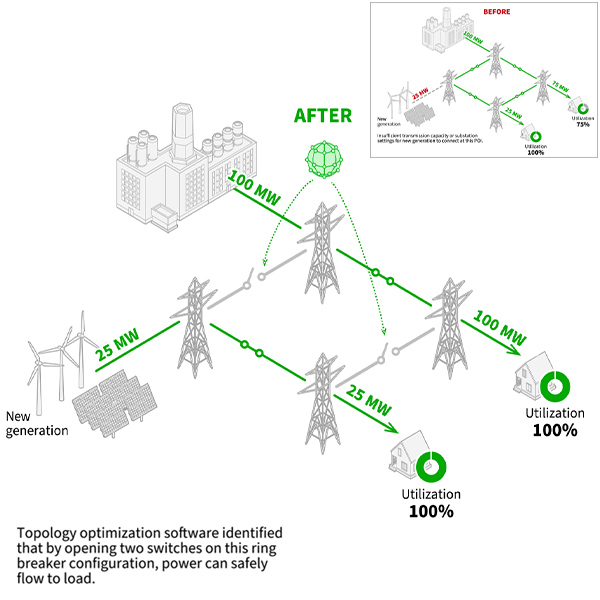

An RMI study about grid-enhancing technologies on the PJM grid found they could save consumers hundreds of millions of dollars a year and speed renewable development.

FERC approved four rate incentives to Mid-Atlantic Offshore Development to serve offshore wind in New Jersey under the State Agreement Approach with PJM.

PJM submitted a waiver request asking FERC to delay the 2025/26 Base Residual Auction by 35 days, which would bump the commencement to July 17.

The PJM Markets and Reliability Committee has four items on its consent agenda for its regularly scheduled meeting.

With more than 300,000 buildings, the U.S. government is the nation’s largest energy consumer and “a steady customer prepared to make long-term investments,” GSA Administrator Robin Carnahan said.

A bevy of consumer, clean energy and environmental advocates have joined state regulators in appealing to MISO and PJM to undertake more comprehensive interregional transmission planning.

Want more? Advanced Search