PJM Critical Issue Fast Path (CIFP)

FERC approved PJM's proposal to rework several areas of its capacity market centered around aligning how resources’ capacity contributions match up to system risk analysis.

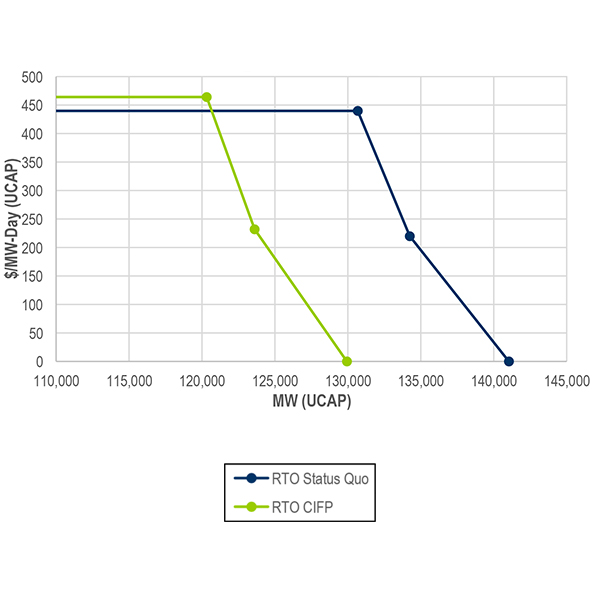

The Market Implementation Committee discussed PJM's analysis of how proposed Critical Issue Fast Path filings before FERC might have impacted the 2024/25 Base Residual Auction results.

PJM and stakeholders spent much of 2023 debating how to position the RTO's markets to be prepared for future severe weather and maintain the balance between retiring fossil generation and renewable development.

PJM’s MIC heard updates on capacity market proposals pending before FERC and began a review of how energy efficiency resources participate in the market.

Generators that plan to come online by the start of the 2025/26 delivery year will have until Dec. 12 to notify PJM of their intent to participate in the Base Residual Auction for that year.

PJM stated that FERC's approval of a six-day extension of the comment period in its CIFP filings would not affect the feasibility of having market changes implemented for the 2025/26 capacity auction slated for June 2024.

The PJM Markets and Reliability Committee rejected a proposal to change the rules for how generators with co-located load may enter into the capacity market during its Oct. 25 meeting.

The OPSI annual meeting debated PJM’s recent capacity market filing and whether the RTO needs to consider changes to its energy and reserve markets.

Comments are due Nov. 3 on PJM’s proposal, which it said would improve reliability and incentivize resource development while controlling costs.

The PJM Market Implementation Committee endorsed the creation of a fifth cost of new entry area for the Commonwealth Edison zone, as well as two proposals aiming to limit the prospective performance impact of implementing multi-schedule modeling in the market clearing engine.

Want more? Advanced Search