Oncor

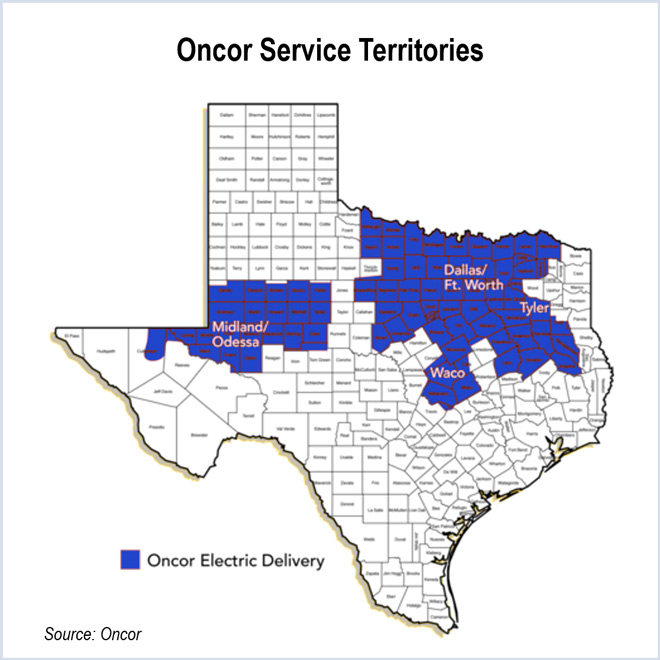

NextEra Energy has won FERC approval to acquire Oncor, but is still facing questions from the PUCT and calls for more protections from stakeholders.

The PUCT approved a preliminary order outlining numerous issues NextEra Energy and Oncor must address, while also approving AEP's consolidation.

Energy Future Holdings' attempt to emerge from bankruptcy may be hampered by a ruling that it must pay hundreds of millions of dollars to bondholders.

The Public Utility Commission of Texas (PUCT) scheduled hearing dates on the NextEra - Oncor merger while punting on various other matters.

Having finally chased down Oncor, NextEra Energy (NYSE:NEE) has embarked on a charm offensive to ensure it successfully completes its acquisition.

Energy Future Holdings reached a milestone in its Chapter 11 reorganization, completing its tax-free spinoff of Luminant and TXU Energy into TCEH Corp.

NextEra Energy (NYSE:NEE) sought to assure the PUCT that they won’t be constrained in their review of the company’s agreement to purchase Oncor.

The NextEra Energy (NYSE:NEE) bid to acquire Oncor may have to navigate some choppy waters with the Public Utilities Commission of Texas (PUCT).

The U.S. Bankruptcy Court for the District of Delaware has approved a reorganization plan that will take the Energy Future Holdings competitive businesses out of Chapter 11.

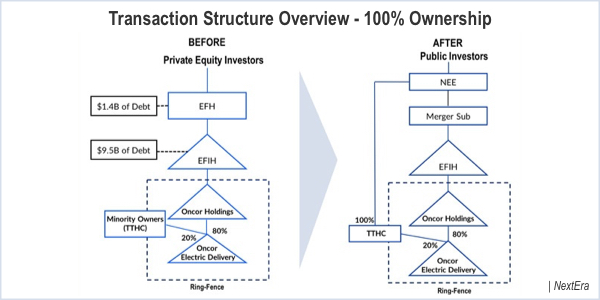

NextEra has agreed to buy Energy Future Holdings’ Oncor assets in a deal that values the Texas transmission and delivery subsidiary at $18.4 billion.

Want more? Advanced Search