NV Energy

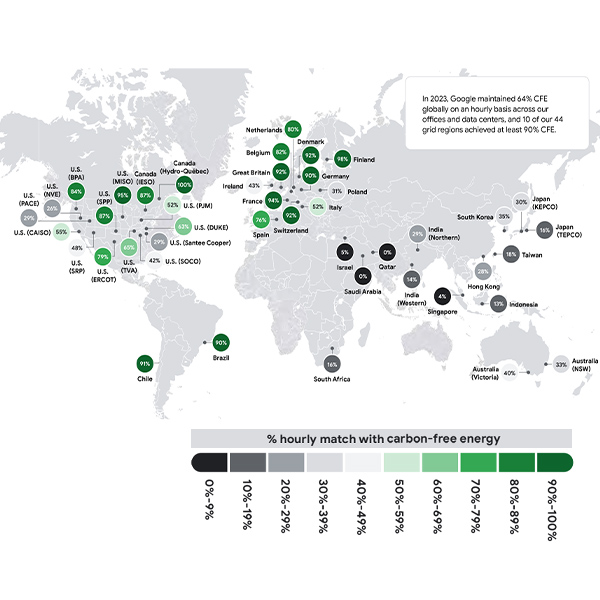

Google's 2023 emissions totaled the equivalent of 14.3 million tons of carbon dioxide, a 48% increase over 2019. It expects further increases before dropping to its emission reduction target of net zero by 2030.

CAISO declared its first transmission emergency of the summer as a fast-spreading Northern California fire forced PG&E to de-energize transmission lines near one of the state’s key hydroelectric facilities.

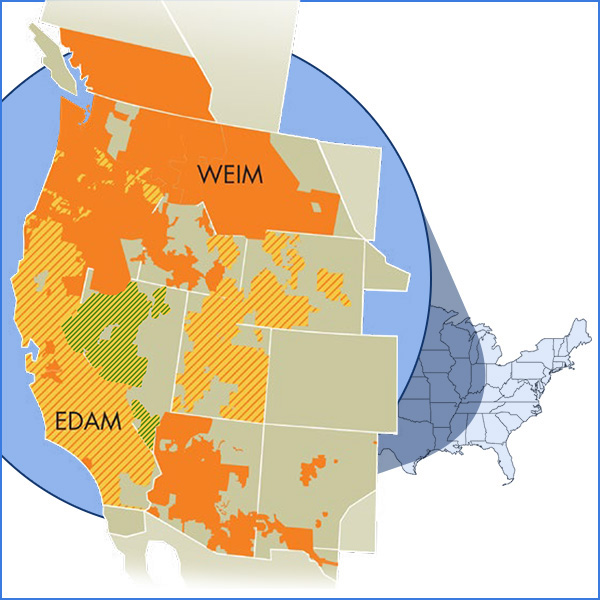

As NV Energy moves forward with plans to join CAISO’s Extended Day-Ahead Market, Nevada regulators have laid out a framework for how the company can seek approval for EDAM participation.

FERC approved CAISO tariff revisions that will allow transmission owners to recover transmission revenue shortfalls attributed to transitioning their assets into the Extended Day-Ahead Market.

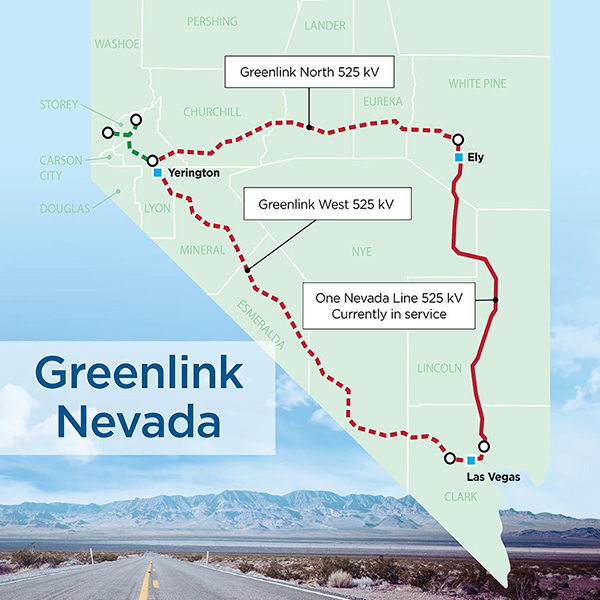

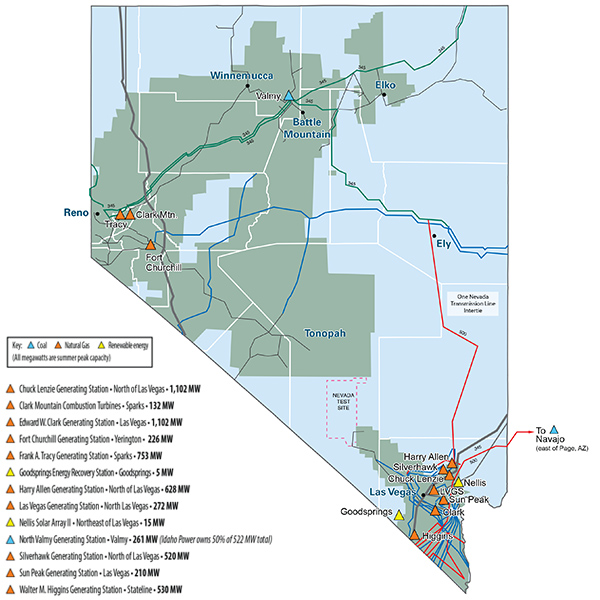

Rising costs of materials and labor and an increased use of H-frame structures as an environmental mitigation have contributed to a $1.755 billion increase in the projected cost of NV Energy’s Greenlink transmission projects.

The growing footprint of CAISO’s Extended Day-Ahead Market was a critical factor in NV Energy’s decision to join it rather than the competing Markets+ offering from SPP, the utility said in a regulatory filing.

NV Energy intends to join CAISO’s Extended Day-Ahead Market, an official with the utility said, notching a major win for the ISO in its competition with SPP’s Markets+ day-ahead offering in the West.

NV Energy plans to make its intention to join the CAISO EDAM public on May 31 when it files an integrated resource plan with the Public Utilities Commission of Nevada.

An NV Energy executive provided the strongest public indication yet as to why the utility is poised to choose the ISO's Extended Day-Ahead Market over SPP’s Markets+.

FERC granted Nevada Power an exemption simplifying the NV Energy subsidiary’s filing of its triennial updated market power analysis.

Want more? Advanced Search