New England Power Pool (NEPOOL)

ISO-NE told stakeholders that Analysis Group’s modeling approach for a future capacity market construct is consistent with both an FCEM and ICCM.

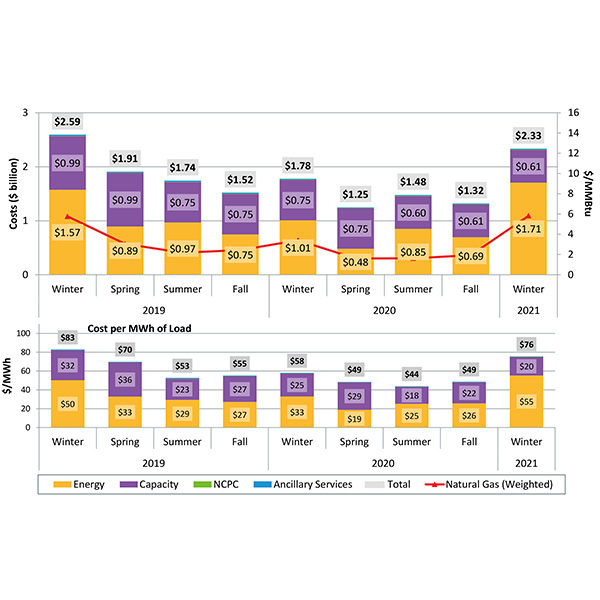

ISO-NE’s winter wholesale market costs totaled $2.33 billion, a 31% increase from the previous winter driven by higher energy costs.

ISO-NE briefed the NEPOOL Participants Committee on a project to address the removal of the minimum offer price rule from the capacity market.

The NEPOOL Participants Committee continued working groups on “Pathways to the Future Grid” as ISO-NE and stakeholders reviewed decarbonization strategies.

ISO-NE told the NEPOOL Markets Committee that the RTO would seek an extension of the compliance deadline for FERC Order 2222 until February 2022.

ISO-NE and NEPOOL jointly filed updated offer review trigger price values with FERC under their “jump ball” provision.

The NEPOOL Markets and Reliability committees produced a consensus framework document and assumptions for Phase 1 of the Future Grid Reliability Study.

ISO-NE officials briefed the NEPOOL Participants Committee on nominations to the RTO’s Board of Directors and operations during last winter.

State energy officials in New England held an online technical forum to discuss equity and environmental justice issues.

NEPOOL's Participants Committee acted on modified proposals for ORTPs used for Forward Capacity Market parameters in the 2025/26 capacity commitment period.

Want more? Advanced Search