NEPOOL Markets Committee

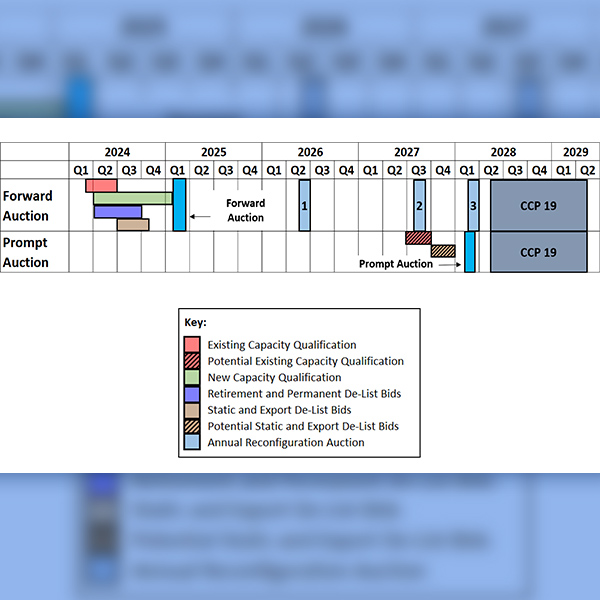

ISO-NE told the NEPOOL Markets Committee that it is proposing a major redesign to its capacity market, moving from a three-years-ahead schedule to a prompt and seasonal design.

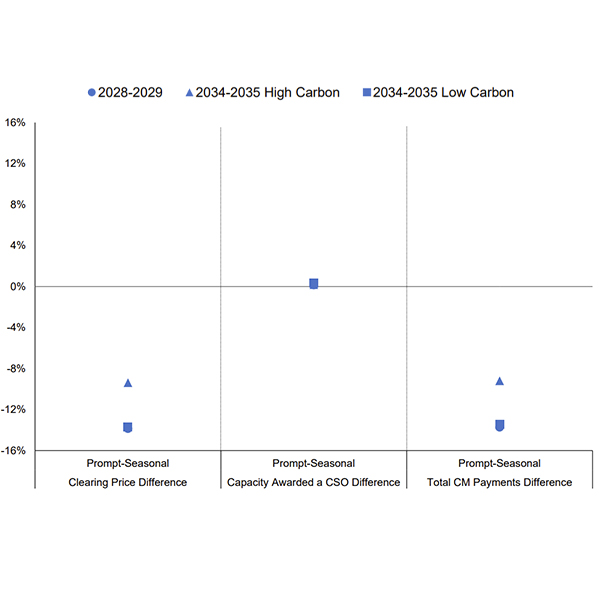

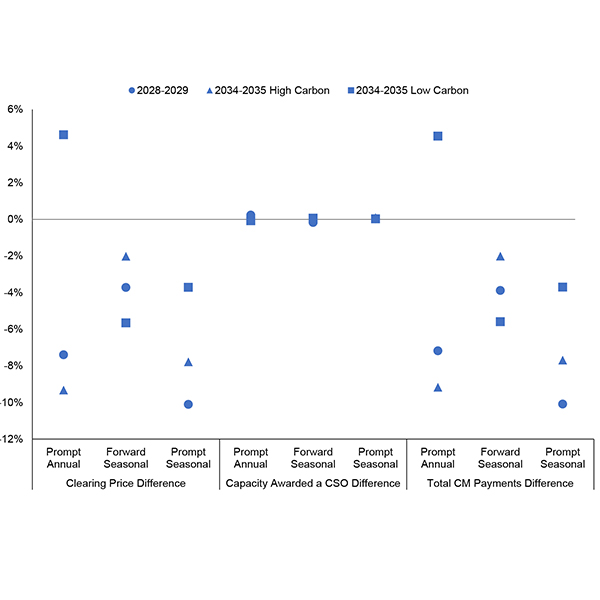

Analysis Group presented its final report on converting ISO-NE's Forward Capacity Market to a prompt, seasonal construct.

Analysis Group outlined the methodology of its study of major changes to the structure of ISO-NE’s Forward Capacity Market (FCM) at the NEPOOL Markets Committee meeting.

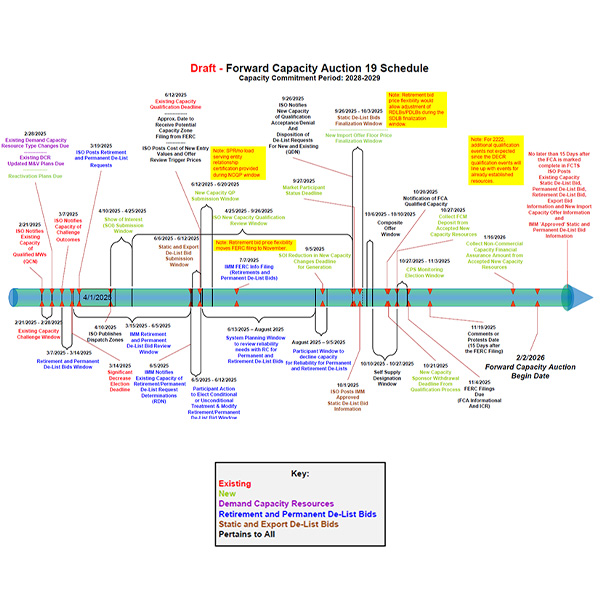

Some clean energy stakeholders have expressed concerns about the impacts that delaying ISO-NE's FCA 19 would have on new resources looking to secure capacity rights in the auction.

A range of clean energy stakeholders outlined questions and concerns about the potential changes in ISO-NE's FCA 19.

ISO-NE presented stakeholders the pros and cons of moving to a prompt and seasonal capacity market.

NEPOOL's Markets Committee approved changes to the Inventoried Energy Program intended to get the winter reliability program in line with global energy markets.

ISO-NE is narrowing down its options as it moves forward with revamping its process for resource capacity accreditation.

NRDC argued that ISO-NE’s preferred method of measuring marginal reliability impact risks under-valuing some components of clean energy resources.

ISO-NE is leaning toward a marginal approach to resource capacity accreditation, but there's a year of stakeholder discussions ahead.

Want more? Advanced Search