minimum offer price rule (MOPR)

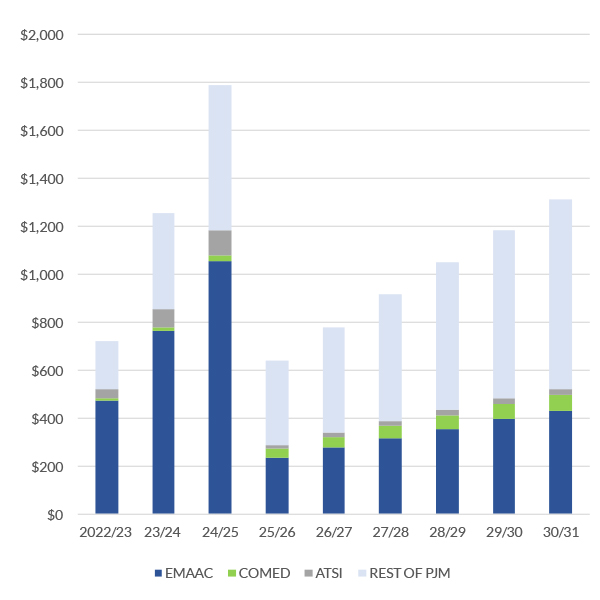

The expanded MOPR will cost PJM ratepayers almost $9.7 billion over nine years if FERC adopts revised floor prices allowing most nuclear plants to clear.

More than two dozen companies and coalitions filed responses to PJM’s compliance filing to FERC's order expanding its MOPR.

PJM officials have revised some of their proposed rules for applying the MOPR to state default service procurements in response to stakeholder feedback.

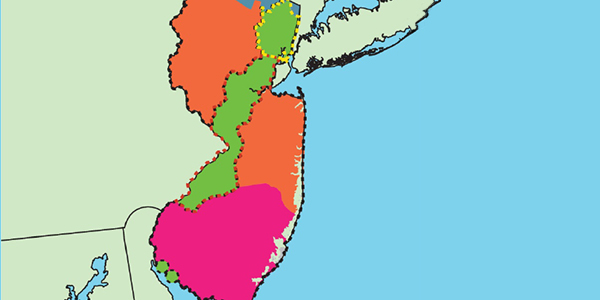

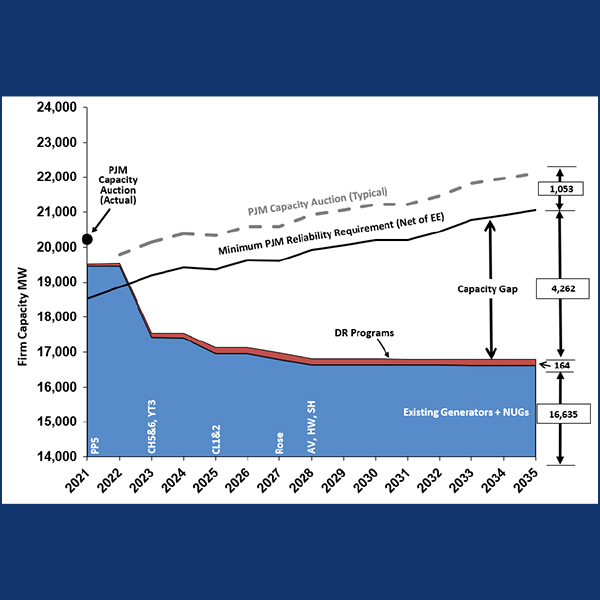

PJM’s Monitor released a report concluding that New Jersey ratepayers would likely see costs increase if the state left the RTO’s capacity market.

Exelon said its Illinois nuclear plants are “up against a clock,” with the legislature unable to meet to consider withdrawing from PJM’s capacity market.

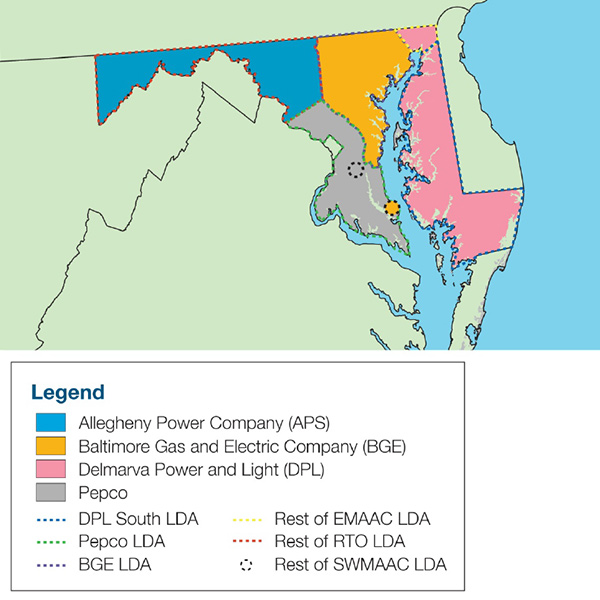

Dominion told Virginia regulators it is undecided about whether to pursue an FRR or remain in the PJM capacity market, where new self-supply resources would be subject to the MOPR.

PJM and its Monitor shared with stakeholders their proposals for responding to FERC’s directive that state default service auctions be subject to the MOPR.

PSEG CEO Ralph Izzo said it would be “logical” for New Jersey to abandon the PJM capacity market by adopting the fixed resource requirement option.

PJM shared its initial response to FERC’s April 16 rehearing orders on the MOPR, which required the RTO to make an additional compliance filing by June 1.

PJM’s Monitor defended a conclusion that ratepayers are likely to see cost increases in jurisdictions that exit the capacity market and adopt the FRR option.

Want more? Advanced Search