minimum offer price rule (MOPR)

Anger over a recent dramatic rate hike and fears of energy shortfalls because of a predicted future rise in demand have prompted New Jersey to look anew at whether the state should consider pulling out of PJM.

The 3rd U.S. Circuit Court of Appeals upheld FERC's 2021 approval of PJM's tightened minimum offer price rule, which removed a requirement that resources receiving state subsidies be mitigated to their cost-based offer.

A range of clean energy stakeholders outlined questions and concerns about the potential changes in ISO-NE's FCA 19.

Ohio lawmakers are raising concerns about how the costs from Illinois’ Climate and Equitable Jobs Act will impact their state's ratepayers.

FERC denied a request to impose a capacity price floor on subsidized resources in NYISO, reiterating its support for narrower buyer-side mitigation rules.

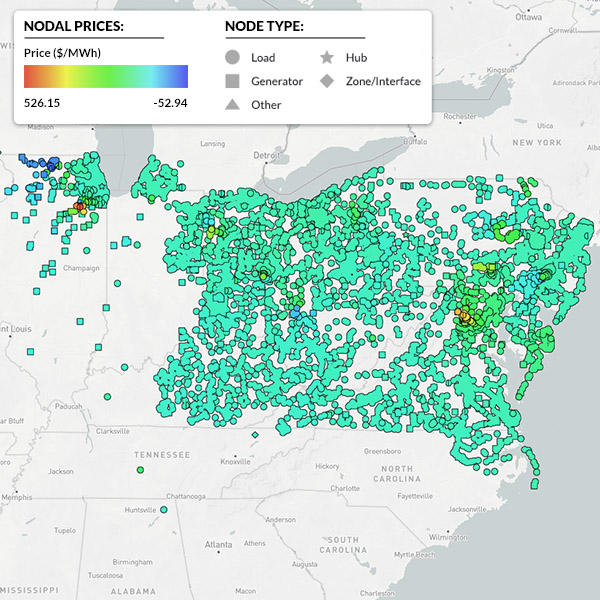

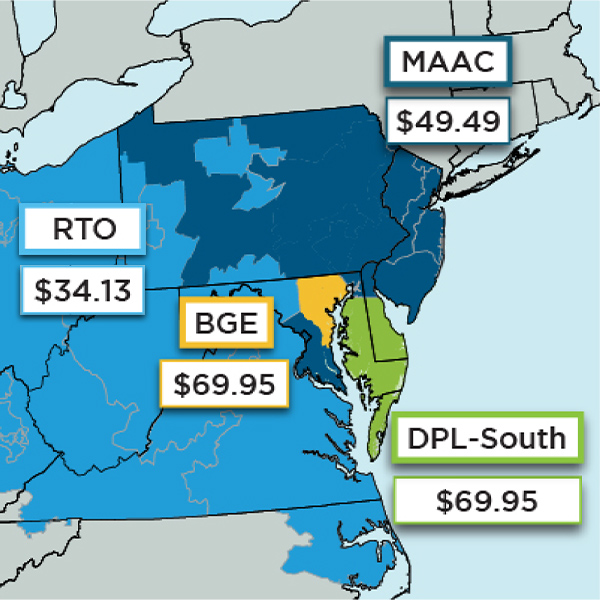

Capacity prices dropped by one-third to almost one-half in PJM’s auction for 2023/24, likely depressed by the end of the MOPR and a tougher price cap.

ISO-NE is leaning toward a marginal approach to resource capacity accreditation, but there's a year of stakeholder discussions ahead.

Fletcher6, CC BY-SA 3.0, via Wikimedia Commons

FERC reluctantly accepted ISO-NE’s plan to remove its minimum offer price rule after a two-year transition period.

Legal challenges to the PJM MOPR do not just concern the RTO and its capacity market; they could set a precedent for how courts review tie votes at FERC.

Massachusetts broke from NESCOE's stance on the elimination of ISO-NE's MOPR, saying the rule should be disposed of as soon as possible, without any delay.

Want more? Advanced Search