Midcontinent Independent System Operator (MISO)

ERCOT, MISO, PJM and SPP filed a joint brief in the appeal of EPA’s power plant rule seeking more flexibility on compliance, arguing it is needed to ensure reliability.

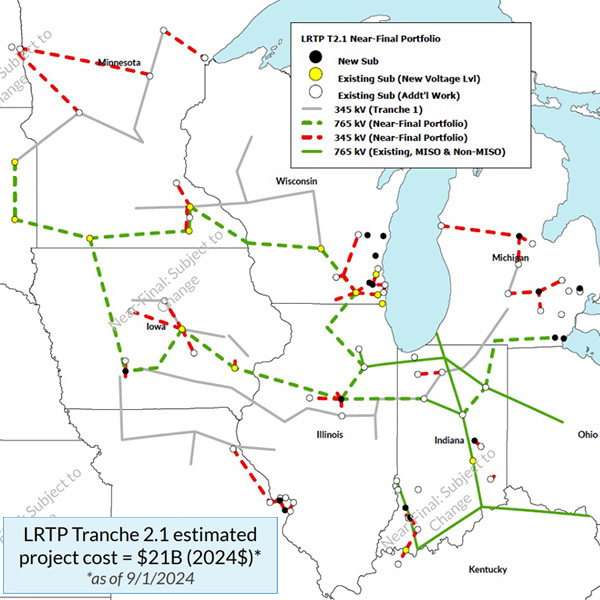

MISO said its second, mostly 765-kV long-range transmission plan will provide the Midwest region with at least a 1.9:1 benefit-cost ratio, a metric that was greeted with skepticism by Independent Market Monitor David Patton.

MISO and its transmission owners defended their practice of allowing TOs to self-fund network upgrades necessary to bring generation online before developers get the chance to finance them.

MISO’s new day-ahead market clearing engine should move into standalone production near the end of September following a delay in testing, RTO executives said.

FERC dismissed separate complaints from MISO and Montana-Dakota Utilities Co. over a MISO-SPP flowgate chronically stressed by a North Dakota cryptocurrency mining operation.

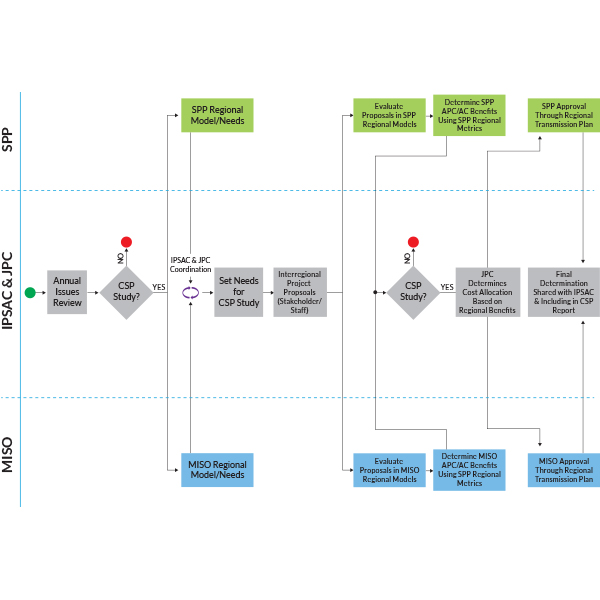

After five fruitless attempts to agree on joint transmission projects across their seams, MISO and SPP will use what they call a “blended joint model” in parallel with existing SPP and MISO regional models.

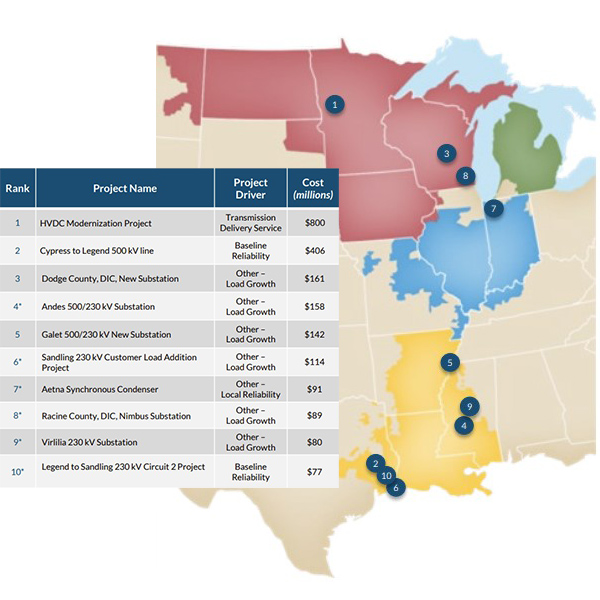

MISO’s 2024 transmission planning cycle is shaping up to include 459 new projects totaling $6.7 billion.

MISO is adamant that it should limit project proposals in future queue cycles to 50% of annual peak load to moderate its 300-GW, oversaturated queue.

MISO is conducting a check-in with stakeholders to gauge whether its market design guiding principles are still valid in a changing industry.

MISO set its 122-GW summertime peak on the unofficial last week of summer, with widespread heat necessitating back-to-back maximum generation warnings.

Want more? Advanced Search