Midcontinent Independent System Operator (MISO)

MISO said unless stakeholders can come up with an alternative it hasn’t explored, it will have to renew its sole system support resource — Manitowoc Public Utilities’ Lakefront 9 coal unit — for another year.

MISO Independent Market Monitor David Patton has made a final stand against the RTO’s $21.8 billion long-range transmission plan, while members are advising the MISO Board of Directors that the IMM's opinions on transmission shouldn't hold water.

MISO and the Tennessee Valley Authority hope to implement an emergency energy purchase framework by Christmas Eve.

The Organization of MISO States and Organization of PJM States Inc. have sent a second letter to MISO and PJM emphasizing the need for vigorous interregional transmission planning.

State regulators, MISO and members remain anxious over the fragile state of resource adequacy, how much load growth to expect and a potential new resource adequacy standard.

FERC authorized MISO’s move to a capacity accreditation method that blends probabilistic availability with historical unit performance.

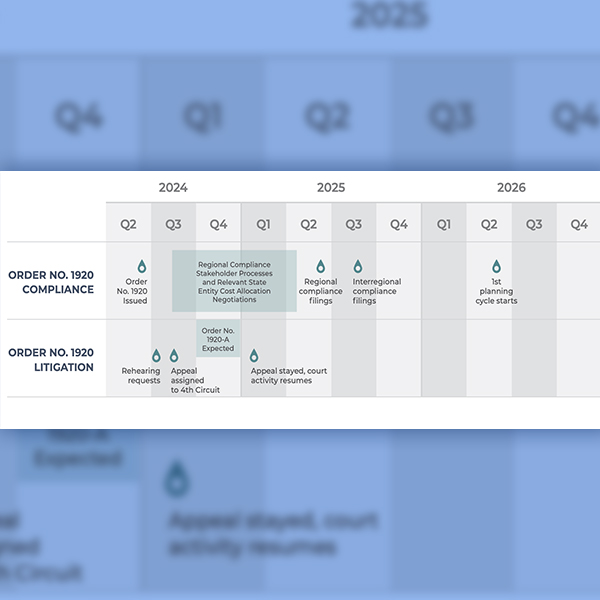

Americans for a Clean Energy Grid released an update to its transmission planning report card. It includes recent policy changes from transmission planning regions, including Order 1920 compliance efforts.

As he prepares to exit MISO, President and longtime employee Clair Moeller delivered parting advice, telling industry players to remember the human aspect in energy.

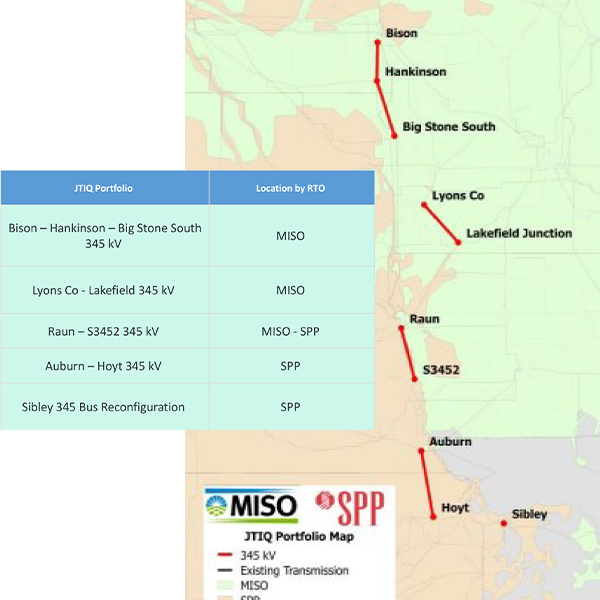

SPP and MISO are coordinating responses to their FERC filings to facilitate their Joint Transmission Interconnection Queue process and cost-allocation methodology.

MISO announced it will move forward on annual interconnection queue cap based on 50% of peak load for the year in question, this time removing exemptions for projects that regulators deem essential.

Want more? Advanced Search