market seller offer cap (MSOC)

PJM's Adam Keech told the Market Implementation Committee the RTO plans to file governing document revisions with FERC to expand the requirement that resources must offer into the capacity market to also apply to all resources holding capacity interconnection rights.

PJM has decided not to refile several components of its proposed capacity market redesign that was rejected by FERC in February.

FERC has rejected a PJM proposal to rework the role of performance penalties in its capacity market and how the associated risks can be reflected in seller offers.

The court reaffirmed FERC's order eliminating the default offer cap, denying generators' claims that the changes to PJM's market seller offer cap deprived them of the ability to set their own rates.

PJM's MIC deferred a vote on adopting a problem statement and issue charge to discuss combined cycle modeling in the market clearing engine.

PJM's Independent Market Monitor has proposed a plan to eliminate performance assessment intervals and related penalties from the RTO’s capacity market.

The MRC discussed the market seller offer cap and capacity performance quantifiable risk at the behest of stakeholders concerned about current constructs.

Generators faced skeptical questioning from D.C. Circuit judges in their bid to overturn PJM’s capacity offer cap rules.

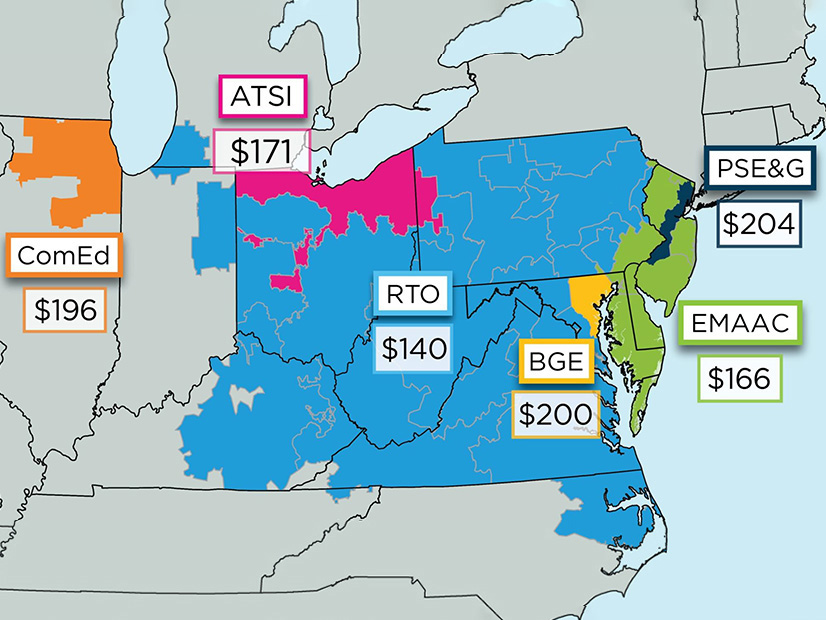

The 2023/24 Base Residual Auction held by PJM in June yielded competitive results, the RTO’s IMM announced in a report released last month.

PJM's MRC rejected two proposals intended to allow market sellers to represent a greater degree of the risk they take on when entering the capacity market.

Want more? Advanced Search