Market Monitor

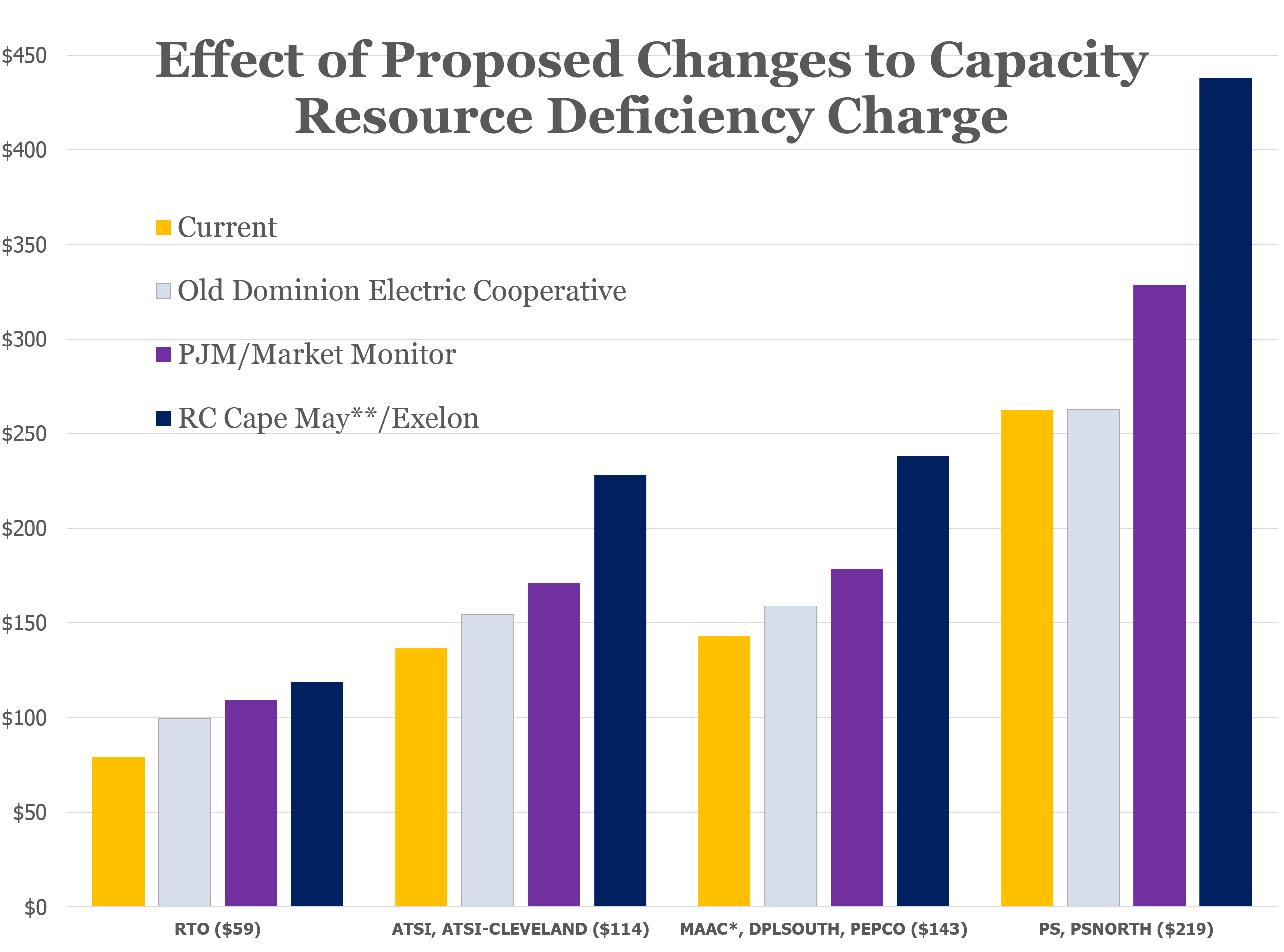

Regulators, consumer advocates and the Market Monitor last week urged the Federal Energy Regulatory Commission not to change a crucial rule for PJM’s upcoming capacity auction, warning that it would allow generators to exercise market power.

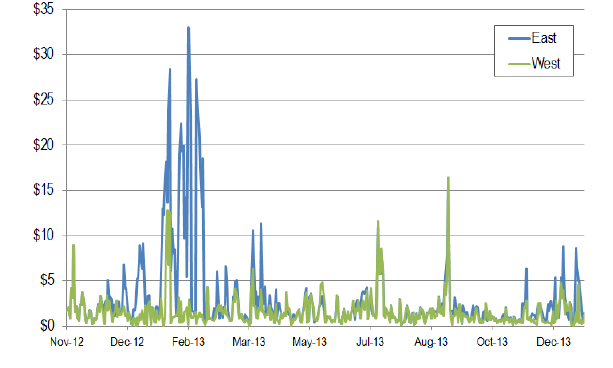

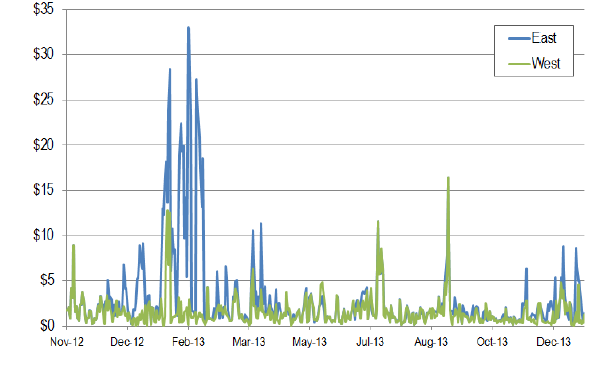

The winter’s high prices for gas and power have busted budgets and left state regulators and consumer advocates scrambling for answers. FERC says it has seen no evidence of market manipulation.

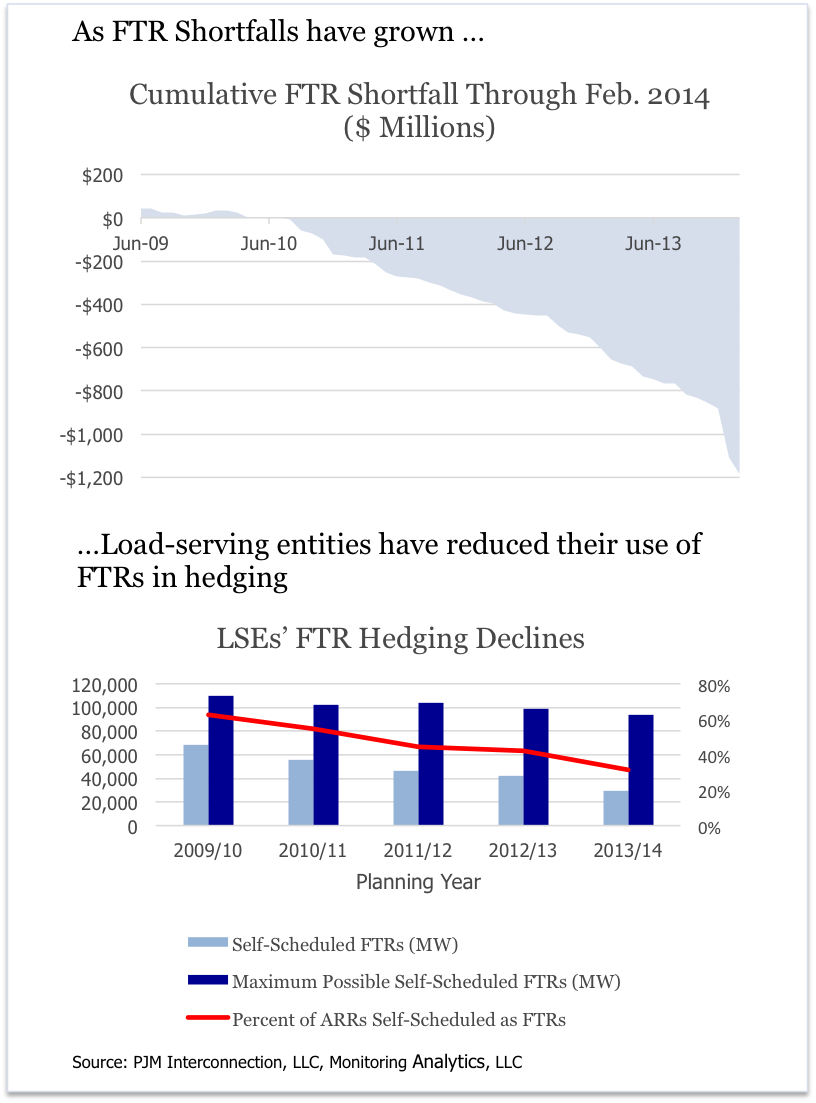

FTR traders asked PJM and the Market Monitor to take action to address funding shortfalls, receiving sympathy but no commitments.

In its State of the Market report for 2013, the Market Monitor listed several high-priority tasks for the coming year.

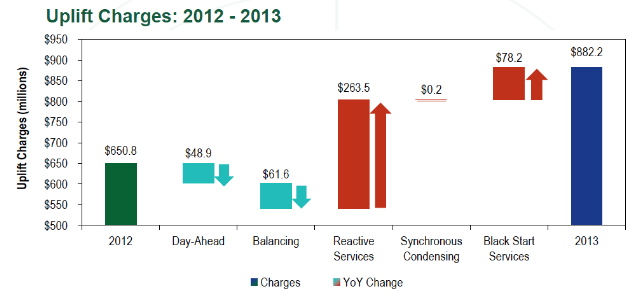

Financial marketers are pleased with PJM’s proposal to change the way uplift charges are assessed on virtual trades but aren’t convinced by a PJM analysis that the RTO says justifies extending the charges to up-to congestion trades (UTCs).

PJM wants to change the way virtual trades pay for uplift, replacing the current unpredictable charges with a flat per megawatt fee and assessing them for the first time on up-to congestion trades (UTCs).

High-cost gas-fired generators will be able to set PJM market clearing prices above $1,000/MWh for the remainder of the winter, the Federal Energy Regulatory Commission ruled.

PJM’s Market Monitor told FERC hat rule changes approved by PJM stakeholders to increase the flexibility of demand response are insufficient and that the commission should impose a must-offer requirement similar to that for generation resources.

PJM's Market Monitor would like to tell stakeholders the identifies of the handful of generators that received $350 million in uplift charges last year. But PJM officials said they are prevented from disclosing the names.

Stakeholders backed PJM’s proposal to eliminate speculation in capacity auctions, selecting it over four alternatives in a vote announced yesterday.

Want more? Advanced Search