market manipulation

Maxim Power wants to FERC drop two other allegations or combine them with the original complaint.

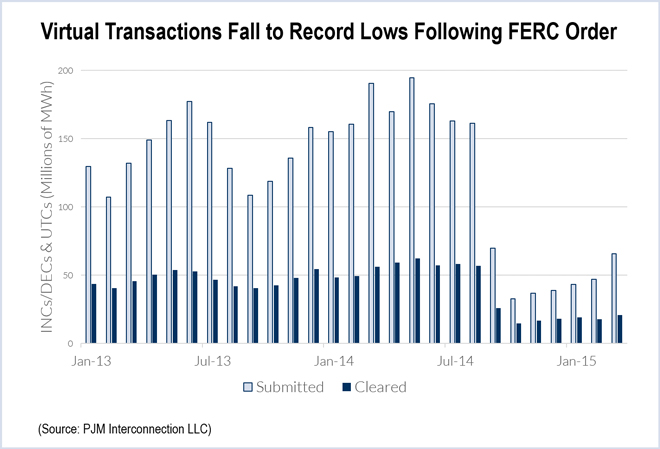

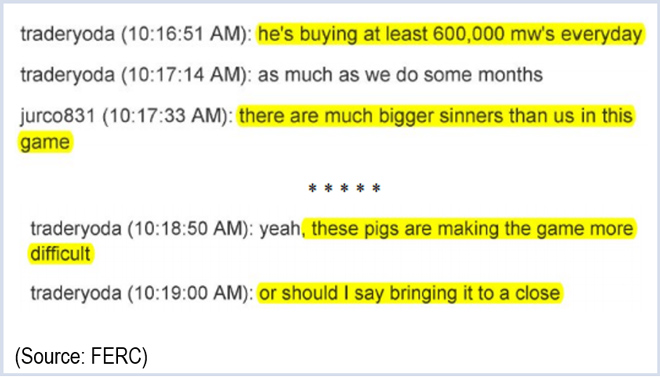

FERC ordered City Power Marketing to pay $15 million in penalties and repay almost $1.3 million in profits for making riskless up-to-congestion trades in PJM to cash in on line-loss rebates.

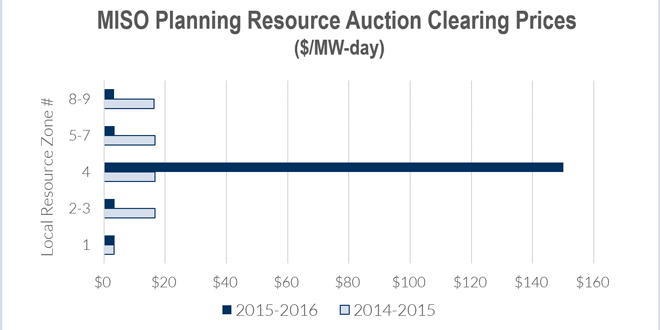

MISO and its Market Monitor have joined Dynegy in denying allegations of improper conduct in the RTO’s Planning Resource Auction last April, which resulted in a nine-fold price increase in Zone 4.

PJM's Market Monitor told FERC that proposals by the RTO and a marketer to change the FTR forfeiture rule would weaken protections against market manipulation.

Grid operators have asked CFTC to remove language from a draft order that they say could undermine the broad exemptions the commission granted them in 2013.

PJM Market Monitor Joe Bowring had a lively debate with one of the consultants for Powhatan Energy over the “duty” of market participants to self-police against market manipulation.

FERC fined Maxim Power $5 million and employee Kyle Mitton was fined $50,000 for overcharging ISO-NE.

A Florida power trader under investigation for market manipulation over up-to-congestion trades says that an “unfair” investigation by FERC has ruined his business.

Maxim Power, accused of market manipulation in New England, has asked FERC to terminate the case.

Attorneys for Powhatan Energy Fund and Kevin Gates accused FERC's Office of Enforcement of withholding information that could exonerate their clients in a high-profile market manipulation case.

Want more? Advanced Search