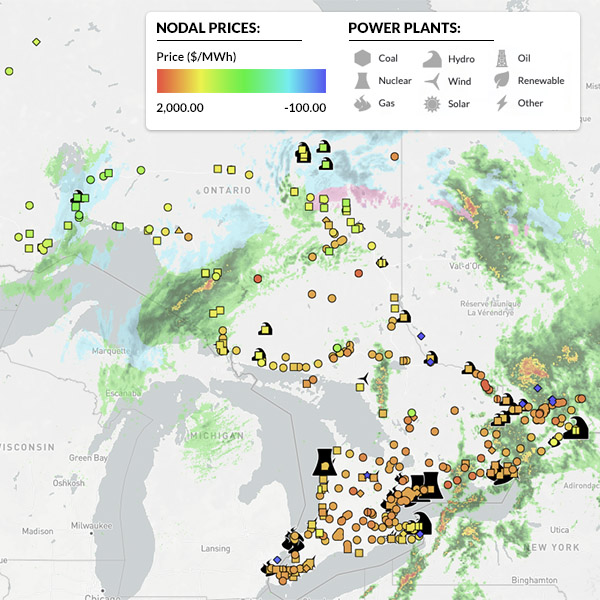

locational marginal pricing (LMP)

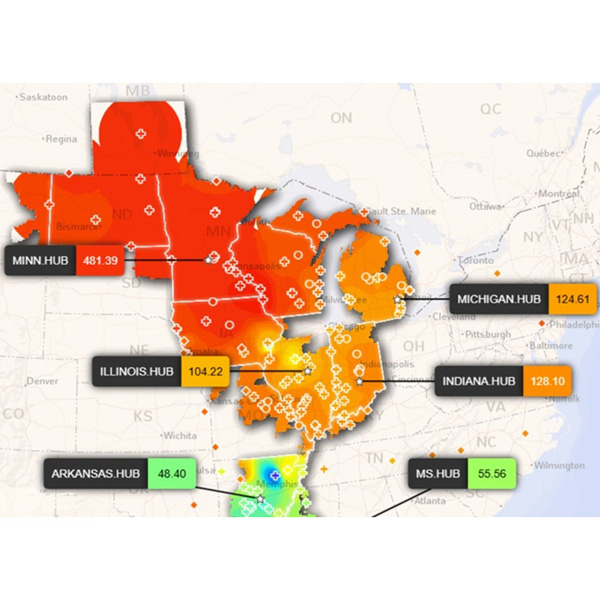

MISO declared a maximum generation emergency for its Midwest region just after midnight on Jan. 24 as the northern portions of the footprint rode out double-digit negative temperatures.

Year-over-year prices rose in MISO to serve a typical September peak.

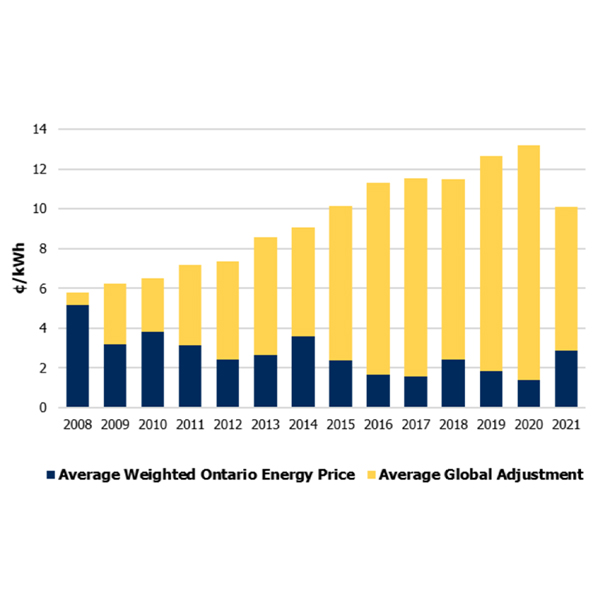

The move was a big step for IESO, and one of the biggest tweaks to its market design in years.

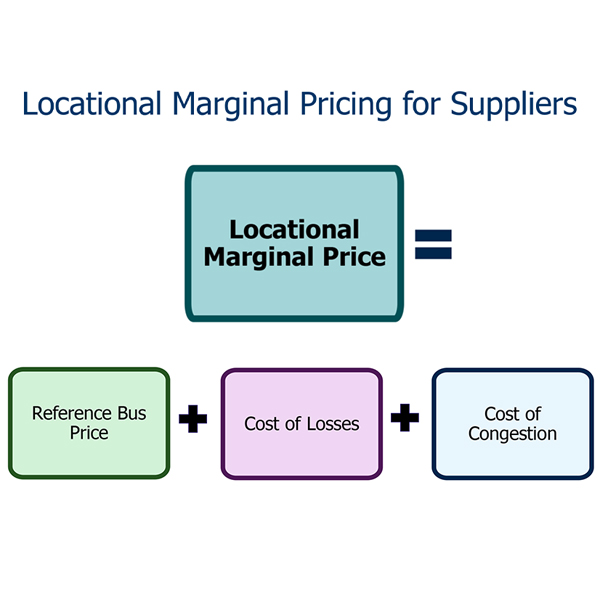

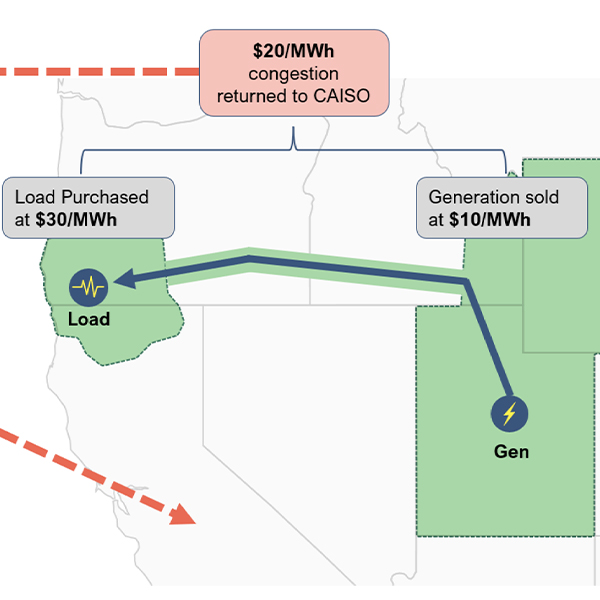

IESO is scheduled to launch its new nodal market May 1, a change it says will save Ontario $700 million over the next decade through reduced out-of-market payments and increased efficiency.

Yes Energy's Emily Merchant provides answers to some frequently asked questions about IESO's new nodal market.

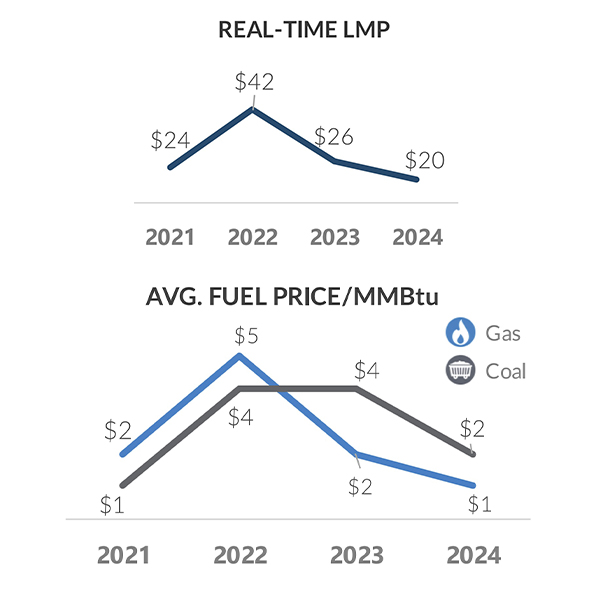

MISO’s real-time energy prices in February 2025 nearly doubled from a year earlier as the footprint saw higher load and gas prices.

The new paper from Powerex is likely to reignite the debate between supporters of CAISO’s Extended Day-Ahead Market and SPP’s Markets+ just as the competition between the two markets approach critical junctures.

MISO reported relatively lower costs and outages in August while it served its annual peak late in the month.

MISO energy prices plunged on record low natural gas prices in March while the RTO managed a comparatively lower, 68-GW average systemwide load.

February held no operational surprises, MISO reported in a monthly market review.

Want more? Advanced Search