Joe Bowring

Md. PSC staff said Exelon should increase its proposed credit to customers as a condition of approval of the company's merger with Pepco, while the OPC said the commission should reject the deal.

PJM IMM Joe Bowring said the RTO should exclude generators from participating in drafting cost development guidelines that determine their compensation.

A cost-benefit analysis released by PJM and the IMM says the RTO's proposed Capacity Performance product would cost ratepayers as much as $6 billion over the next four years.

PJM’s Oct. 7 revisions to its Capacity Performance proposal appear to have won over Independent Market Monitor Joe Bowring.

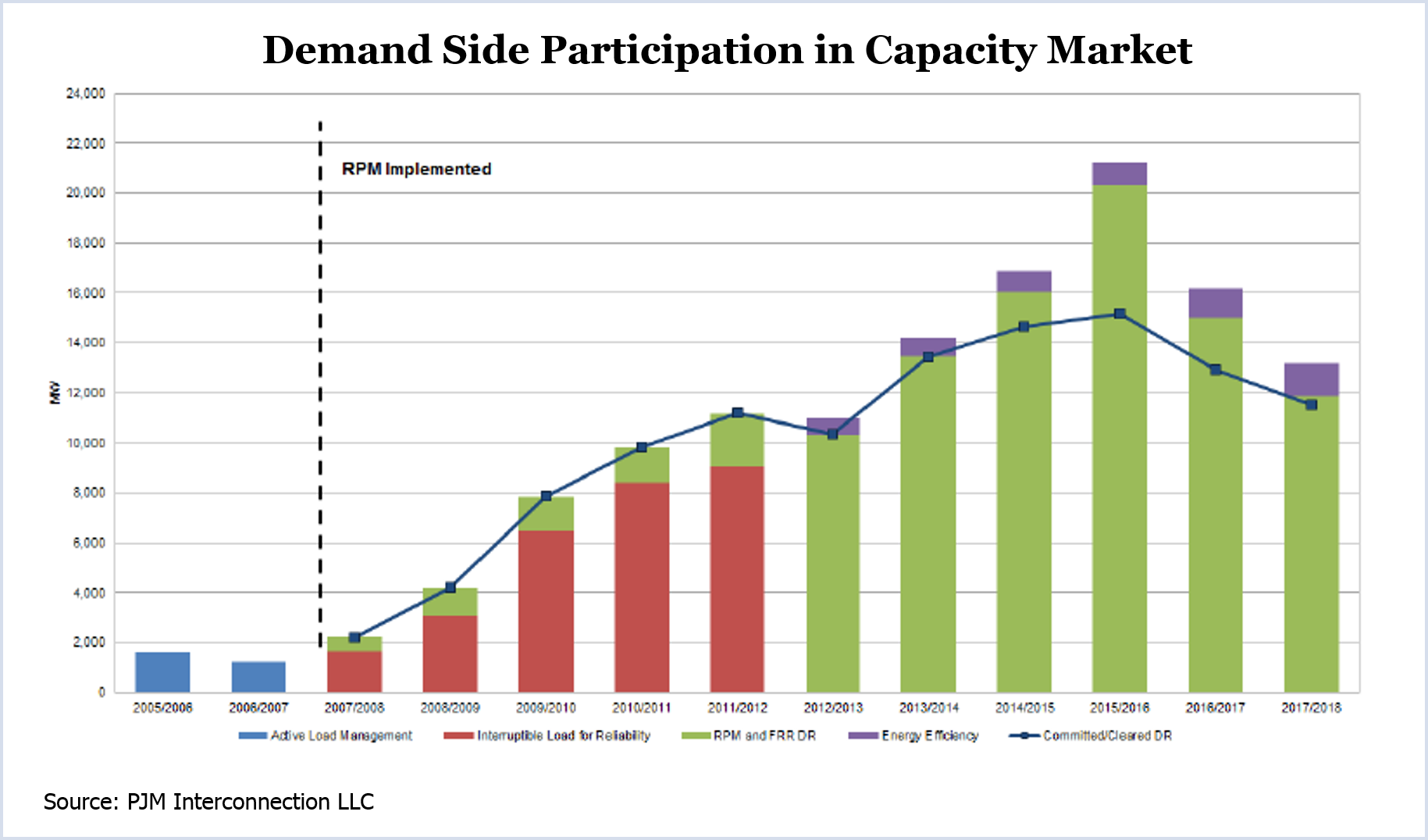

PJM capacity prices would increase sharply but reliability would not be threatened if a recent federal court ruling eliminated demand response from wholesale markets, the Market Monitor said.

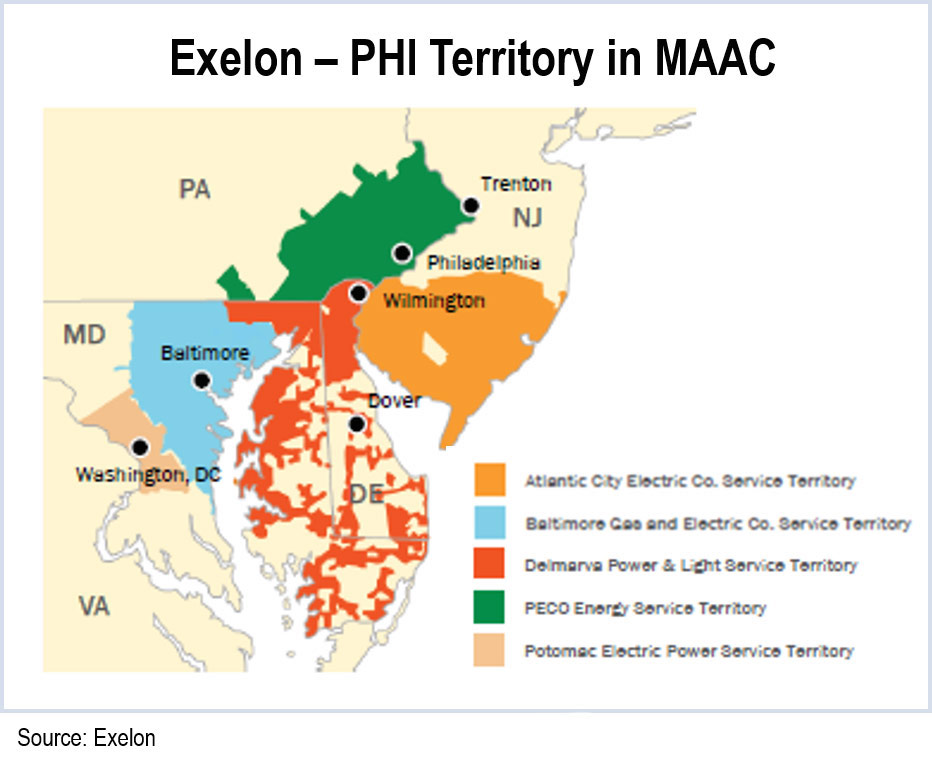

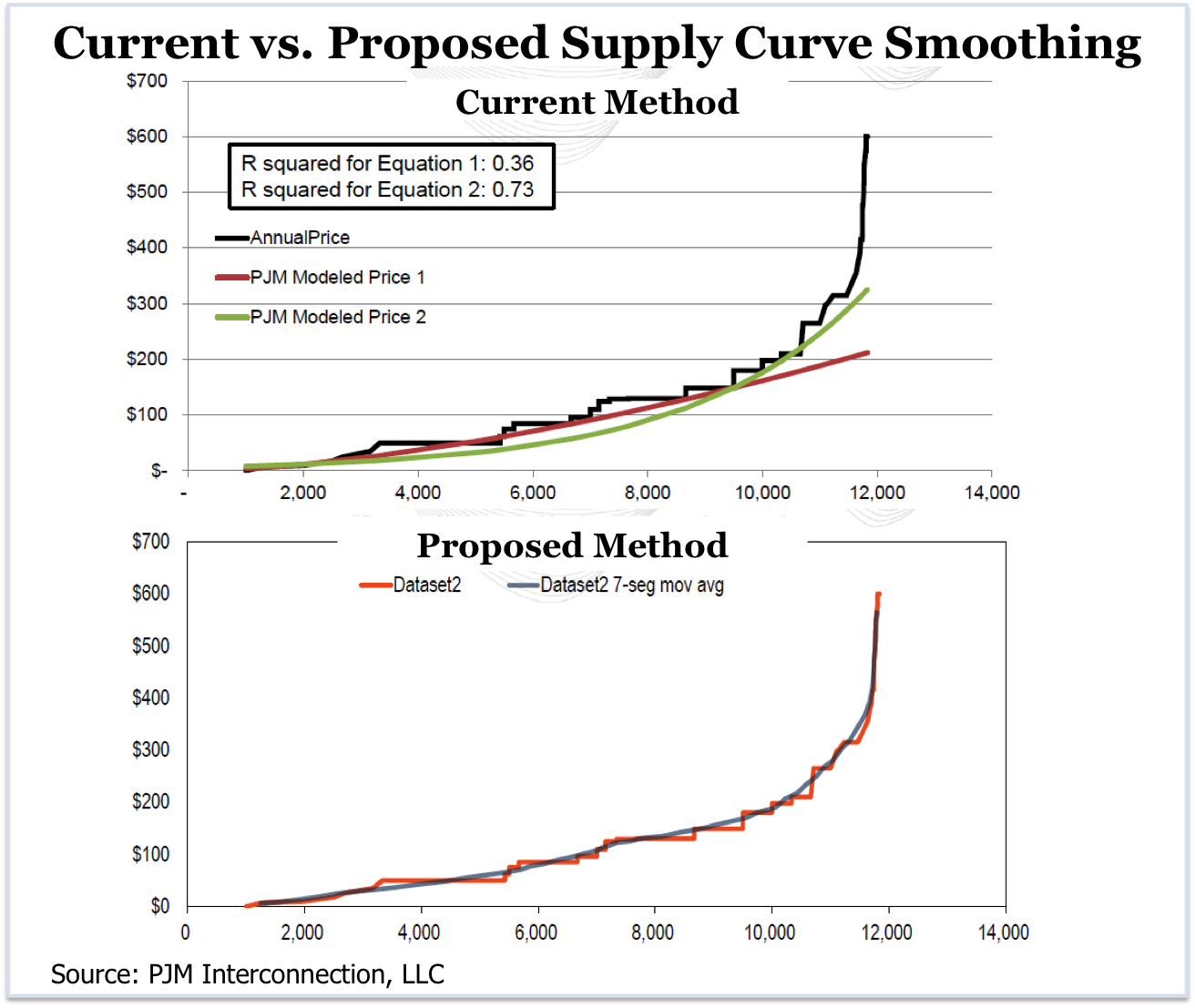

Load representatives concerned by reports of generators’ bidding strategies in May’s PJM capacity auction reacted by threatening to block an initiative by Exelon Corp. to provide more informative supply curves.

PJM and the IMM have reached agreement on a way to reduce the number of Frequently Mitigated Units eligible for “adders” but their proposal faces heavy opposition from generation owners.

In its State of the Market report for 2013, the Market Monitor listed several high-priority tasks for the coming year.

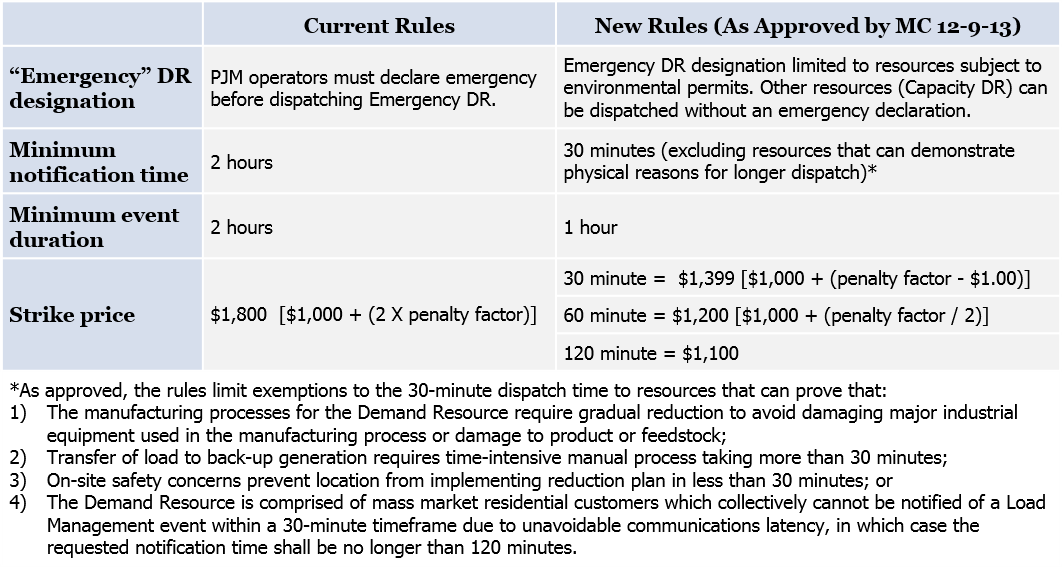

PJM’s plan to implement new demand response rules in time for the May capacity auction are in doubt following a FERC order requiring the RTO to provide more information to support its proposal.

Financial marketers are pleased with PJM’s proposal to change the way uplift charges are assessed on virtual trades but aren’t convinced by a PJM analysis that the RTO says justifies extending the charges to up-to congestion trades (UTCs).

Want more? Advanced Search