ISO New England (ISO-NE)

ISO-NE presented its proposed 2022 operating and capital budgets to the NEPOOL Participants Committee.

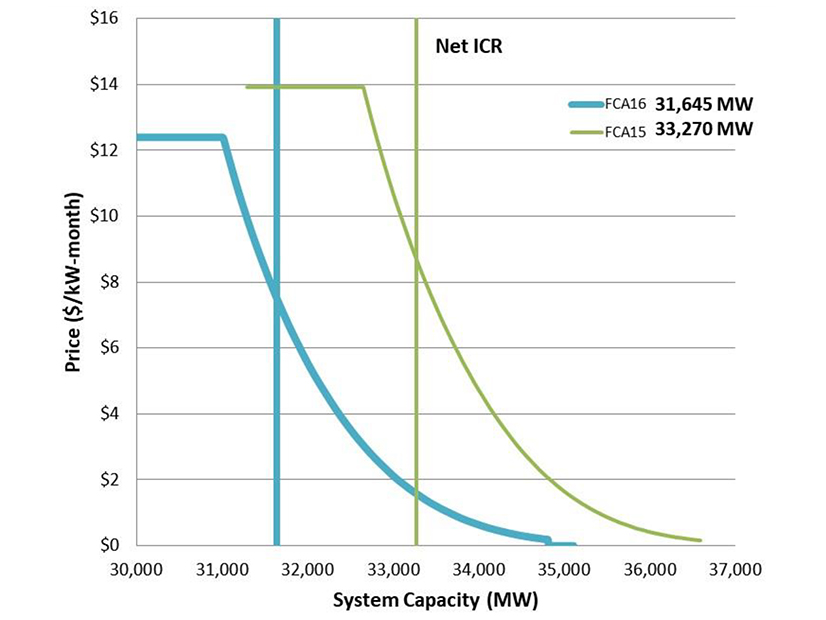

ISO-NE proposed an installed capacity requirement of 32,568 MW for FCA 16, a 1,585-MW decrease from FCA 15, at the NEPOOL Reliability Committee meeting.

Plus Power filed a petition last week with the Massachusetts Energy Facility Siting Board for approval to build the Cranberry Point Energy Storage project.

Bidgee, CC BY-SA 3.0, via Wikimedia Commons

NewGrid's CEO says the company's software could move 40% more power on the ISO-NE grid.

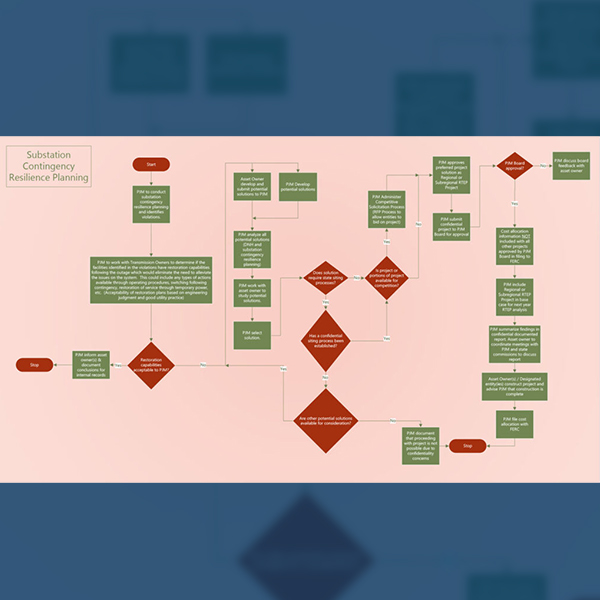

United Illuminating told the ISO-NE Planning Advisory Committee that it is moving ahead with a floodwall protection system at a Connecticut substation.

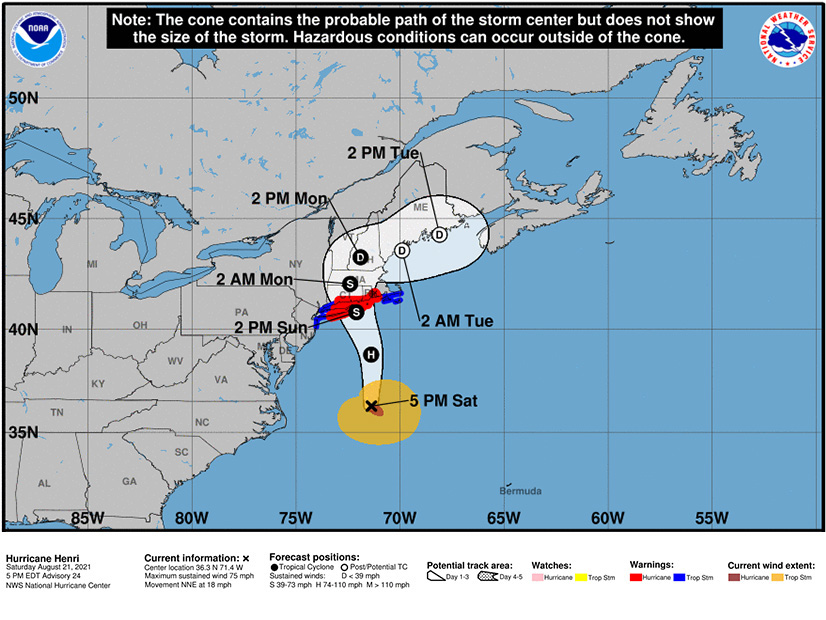

Tropical Storm Henri made landfall in southern New England, causing power outages in Connecticut, Rhode Island and Massachusetts.

Stakeholders discussed ISO-NE’s revised proposal for FERC Order 2222 compliance and removal of the MOPR at NEPOOL's three-day summer meeting.

PJM stakeholders unanimously endorsed the 2021 reserve requirement study but requested more modeling on the impacts of extreme weather conditions.

Semiconductor manufacturer GlobalFoundries wants to procure its own electricity from ISO-NE and be exempt from the Vermont's renewable energy standard.

Panelists at a recent NECA webinar discussed the highs and lows of working to refine offer review trigger prices for offshore wind and storage resources.

Want more? Advanced Search