investment tax credit (ITC)

President Biden rolled out a new framework for a whittled-down budget reconciliation package that includes $555 billion in clean energy funding.

Developers still face challenges to finance offshore wind projects, but lenders are eager to get involved, speakers told the ACPA's OSW conference.

American Clean Power Association will absorb fellow trade group U.S. Energy Storage Association at the beginning of the new year, the groups announced.

Citing the coronavirus pandemic, the IRS extended the time that wind and solar developers have to complete their projects and qualify for tax credits.

Legislators see long-term, full-value tax credits as one tool among many that are needed to expand renewables at the requisite pace and scale.

The U.S. could save $35 billion by 2031 by immediately eliminating fossil fuel tax preferences, according to a line item in President Biden’s 2022 budget.

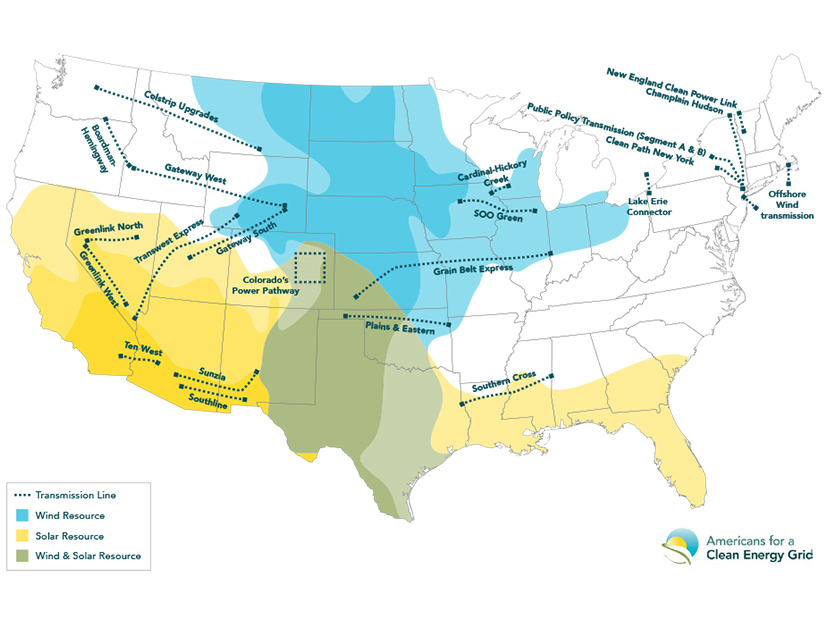

Speakers on an ARPA-E Innovation Summit panel agreed that the transition to renewable energy will require an interconnected nationwide grid.

The Biden administration’s climate goals and a new investment tax credit has U.S. offshore wind developers and prospective lenders bullish about the future.

At a hearing before the House Select Committee on the Climate Crisis, speakers discussed modernizing the grid & the steps necessary to decarbonize the U.S.

The energy industry needs a federal investment tax credit specifically for transmission, according to a report by the American Council on Renewable Energy.

Want more? Advanced Search