investment tax credit (ITC)

Attendees at Yes Energy's annual summit, EMPOWER 25, discussed the Trump administration, pending ERCOT market changes, the future of wind power generation and uses for artificial intelligence, among other topics.

New Jersey has launched a stakeholder input campaign for its community solar program as the state prepares to solicit interest for 250 MW of capacity next year after two nearly fully subscribed allocations in the program’s first 12 months.

Keith Martin, a specialist in tax and renewable energy policy, said a Republican-led Congress would likely look to "cannibalize" parts of the Inflation Reduction Act.

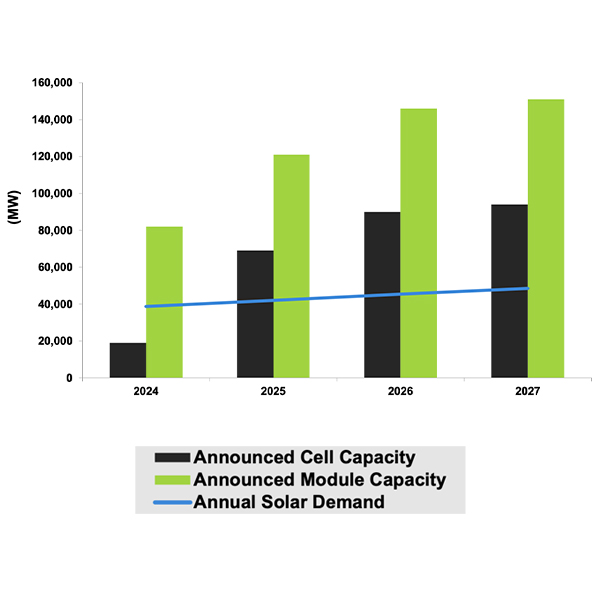

The U.S.' incentives for domestic solar component manufacturing are insufficient, even with the Inflation Reduction Act, the report argues.

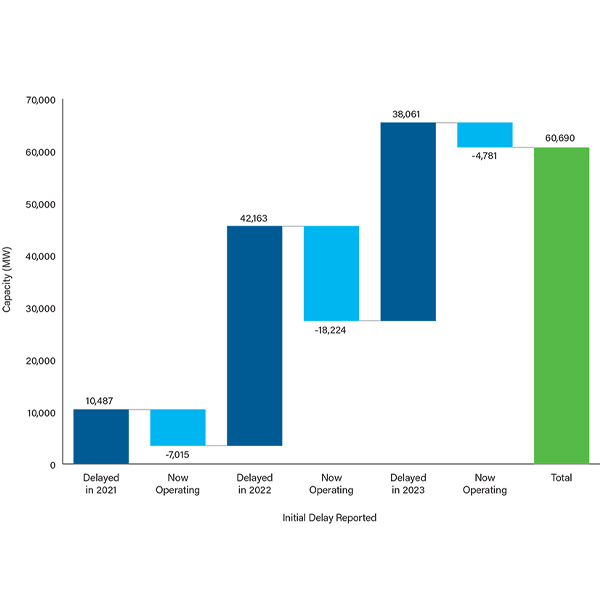

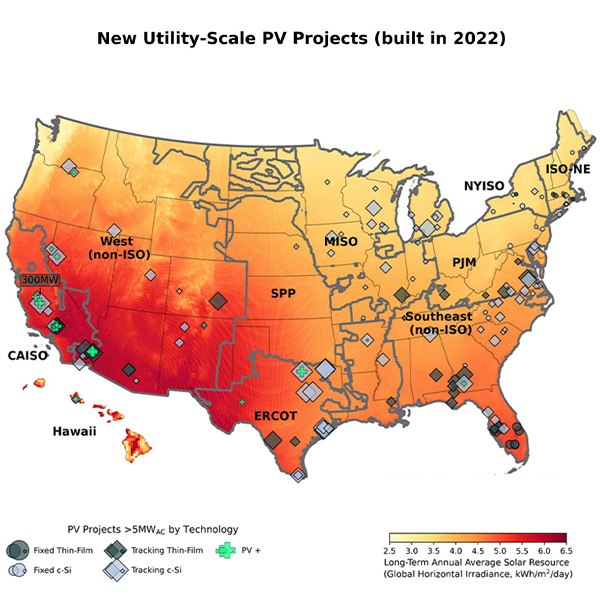

The U.S. could nearly quadruple solar capacity in the next 10 years, according to a SEIA report, while a ACP report shows that delays on clean energy projects have put more than 60 GW of clean power capacity on hold.

Delaying the solicitation “is crucial to encourage the most cost-effective bids for the benefit of Massachusetts ratepayers,” the Department of Energy Resources wrote.

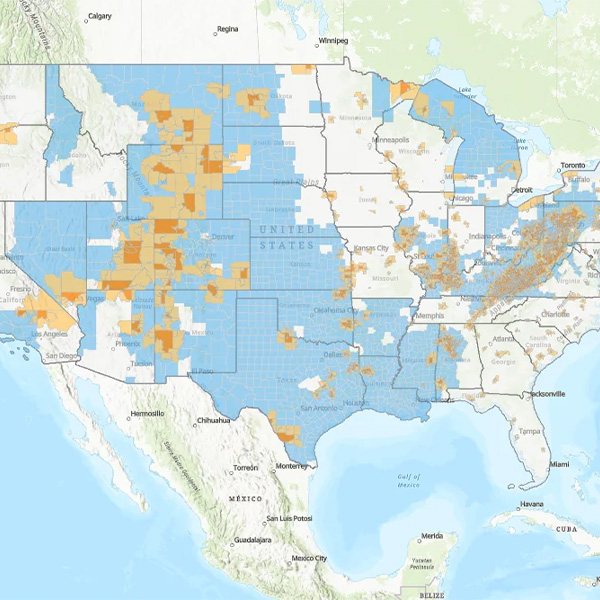

The Treasury Department released guidelines for the Inflation Reduction Act’s investment tax credits for clean energy projects.

After a down year, the Berkeley Lab sees new utility-scale solar capacity increasing more than fourfold by the mid-2030s to over 50 GW per year.

One year on, implementation of the IRA has not been smooth or easy, and four out of 10 registered voters say they know nothing about the law.

Millions in new funding and bonus tax credits are heading to new clean energy projects in communities impacted by the closure of fossil fuel-based industries.

Want more? Advanced Search