fixed resource requirement (FRR)

Exelon (NASDAQ: EXC) will close 2 Illinois nuclear plants that face hundreds of millions of dollars of revenue shortfalls.

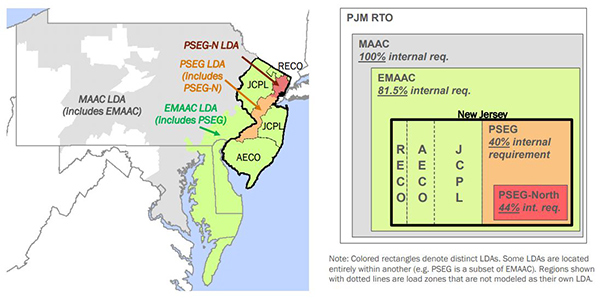

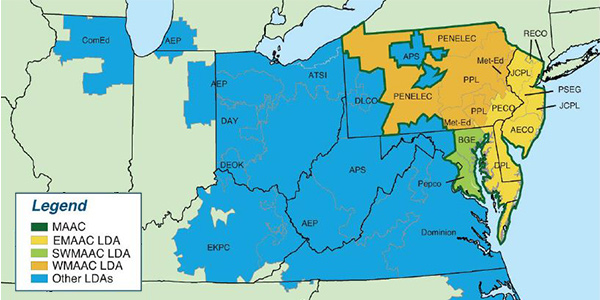

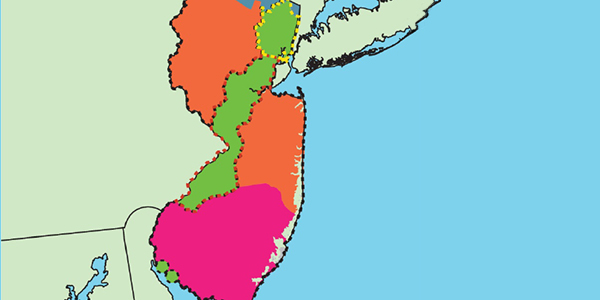

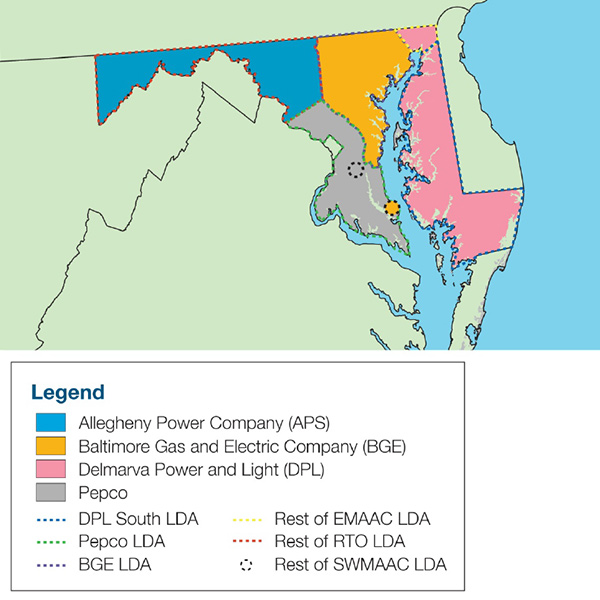

The New Jersey BPU received dozens of comments on how it should respond to PJM's expanded MOPR. State regulators initiated the investigation to determine if staying in the capacity market will increase consumer costs or impede the state's goals of 100% clean energy sources by 2050.

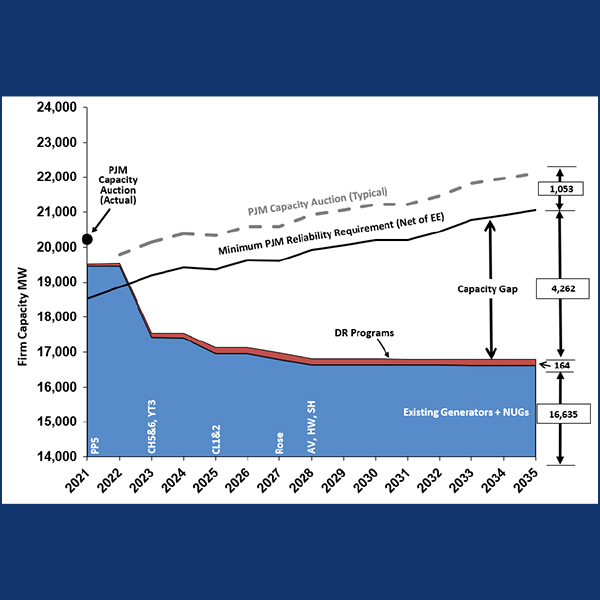

Analyses that predict increased costs for regions that exit PJM’s capacity market should be redone to presume maximizing imports to counter local market power.

More than two dozen companies and coalitions filed responses to PJM’s compliance filing to FERC's order expanding its MOPR.

PJM’s Monitor released a report concluding that New Jersey ratepayers would likely see costs increase if the state left the RTO’s capacity market.

Exelon said its Illinois nuclear plants are “up against a clock,” with the legislature unable to meet to consider withdrawing from PJM’s capacity market.

Dominion told Virginia regulators it is undecided about whether to pursue an FRR or remain in the PJM capacity market, where new self-supply resources would be subject to the MOPR.

PSEG CEO Ralph Izzo said it would be “logical” for New Jersey to abandon the PJM capacity market by adopting the fixed resource requirement option.

PJM’s Monitor defended a conclusion that ratepayers are likely to see cost increases in jurisdictions that exit the capacity market and adopt the FRR option.

FERC clarified voluntary renewable energy credits and participation in RGGI will not subject capacity resources to PJM’s expanded minimum offer price rule.

Want more? Advanced Search