fixed resource requirement (FRR)

The New Jersey BPU voted unanimously to accept the final version of a staff report recommending the state continue in PJM’s capacity market — for now.

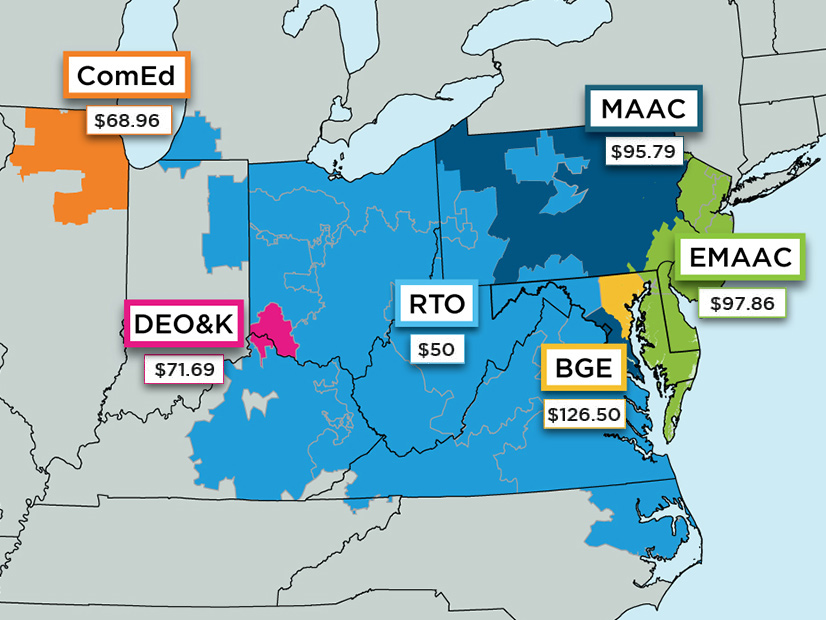

Capacity prices in most of PJM dropped by nearly two-thirds for 2022/23, with EMAAC and SWMAAC recording their lowest prices ever.

PJM ratepayers will likely see capacity prices drop as a result of Dominion’s decision to exit the market, according to a report by the RTO’s Monitor.

PJM defended its handling of Dominion Energy’s decision to opt out of the May 19 capacity auction, asking FERC to reject a complaint by LS Power.

LS Power asked FERC to block Dominion from opting out of PJM’s capacity auction, saying the RTO violated its rules by accepting the utility’s FRR election.

Dominion has abandoned PJM’s capacity market over concerns the minimum offer price rule will undermine its ability to meet Virginia’s renewable targets.

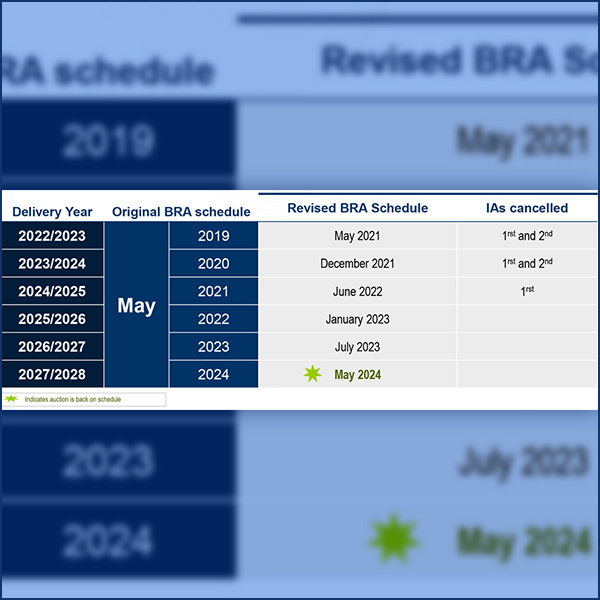

PJM will hold the 2022/23 Base Residual Auction in May after being delayed since 2019 over FERC’s expansion of the minimum offer price rule.

FERC approved most of PJM’s compliance filing on its expanded MOPR while reversing its position on state-directed default service auctions.

NYISO and PJM officials discussed the future of their capacity markets as more renewables come online during GTM’s annual Power and Renewables Summit.

The New Jersey BPU held a technical conference to consider whether it should remain in PJM’s capacity market or go on its own through the FRR alternative.

Want more? Advanced Search