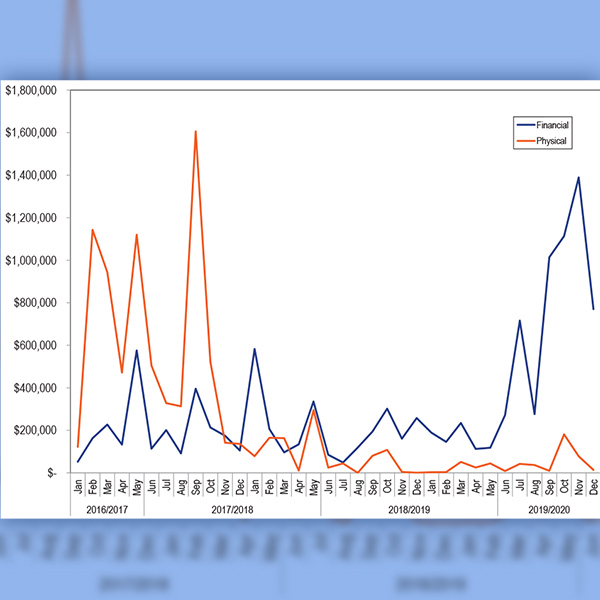

financial transmission rights (FTRs)

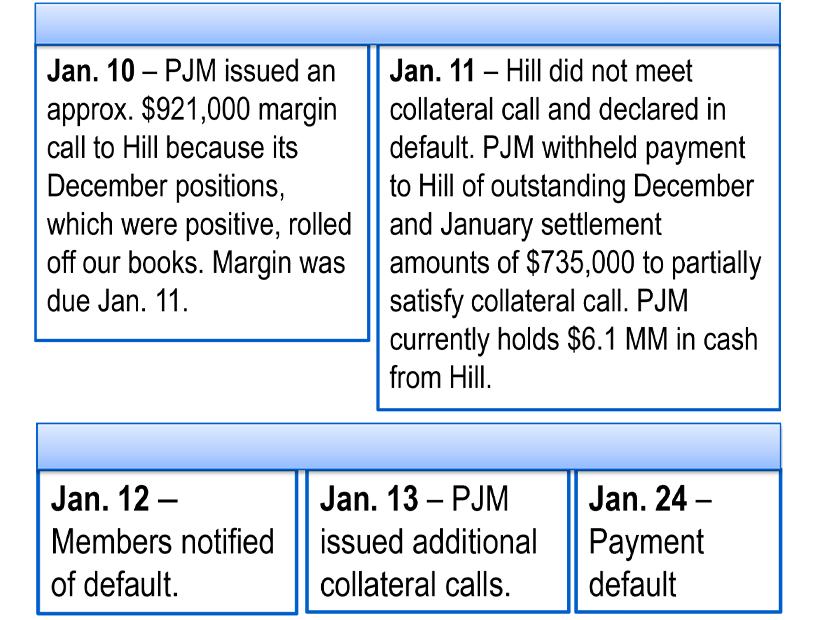

The principals of GreenHat Energy will pay PJM $1.4 million to settle claims over the company’s FTR market default, which cost members nearly $180 million.

The PJM MRC will vote on rules governing the inclusion of variable environmental charges in cost-based offers and four sets of capacity auction parameters.

FERC denied PJM’s rehearing request of its rejected FTR credit requirement calculation, but it said it would address the RTO’s arguments in a future order.

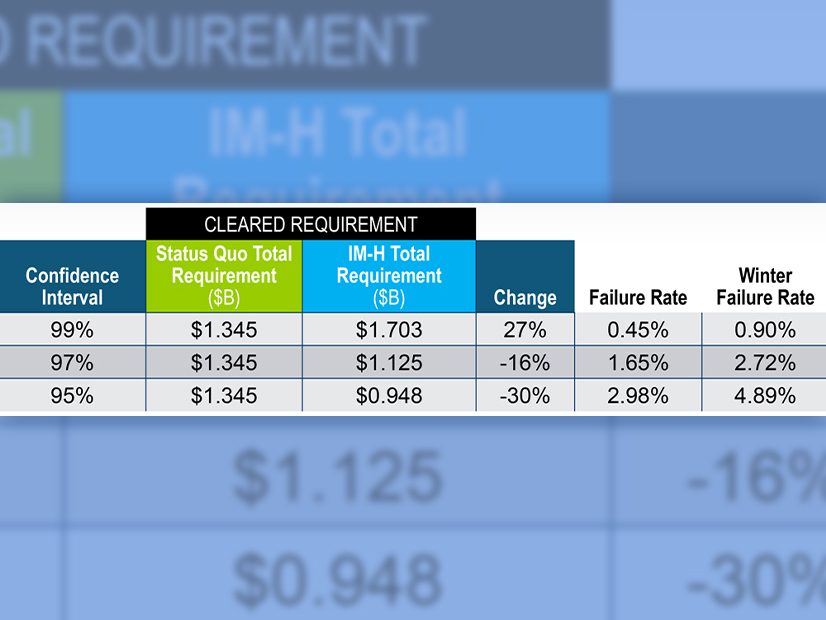

PJM asked FERC to rehear a decision that rejected the RTO’s plan to modify its financial transmission rights credit requirement calculation.

Stakeholders urged PJM to hold its ground on collateral requirements for FTR traders, saying it should offer more support for a proposal that FERC rejected.

FERC rejected PJM’s proposal to modify the FTR rights credit requirement and opened a show-cause proceeding to examine the existing requirement.

FERC accepted PJM’s new FTR forfeiture rule without ordering refunds of bills under the previous regime the RTO implemented without commission approval.

PJM is requesting input from stakeholders on a course of action after a member defaulted on its portfolio in the financial transmission rights market.

FERC determined that GreenHat Energy and its owners violated the Federal Power Act by “engaging in a manipulative scheme” in PJM’s FTR market.

A joint PJM-stakeholder proposal to address the RTO’s auction revenue rights and financial transmission rights won endorsement at the MRC meeting.

Want more? Advanced Search