Energy and Environmental Economics (E3)

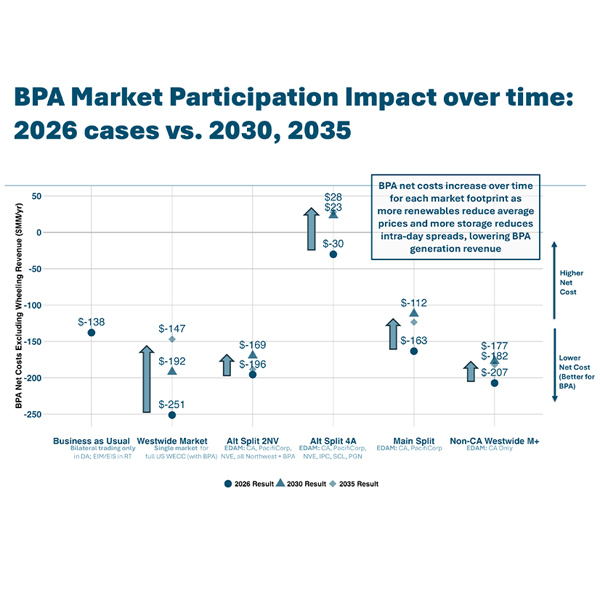

BPA’s insistence on favoring joining SPP’s Markets+ over CAISO’s Extended Day Ahead Market is “alarming” and could lead to $221 million in economic advantages going up in smoke, Seattle City Light argued.

BPA should be allowed to decide on a day-ahead market without outside federal interference, a group of Northwest publicly owned utilities that favor SPP’s Markets+ told DOE in a letter.

BPA's biggest risks in joining SPP’s Markets+ come down to footprint size and the limited transmission connectivity between the Northwest and Southwest entities most inclined to join the market, agency executives said.

A polite discussion at a BPA day-ahead market participation workshop ended on a testy note as critics of the staff leaning in favor of SPP’s Markets+ urged the agency to rethink its position and consider once again delaying a market decision.

New findings from a much-anticipated study have “not shifted” BPA's staff recommendation that the agency choose SPP’s Markets+ over CAISO’s — despite results showing greater economic benefits from EDAM.

Activists, ISO-NE officials, and state representatives from across New England convened in New London, Conn., to discuss the benefits of offshore wind to the region’s power system.

Panelists at a forum convened by the Massachusetts Executive Office of Federal and Regional Energy Affairs said advanced transmission technologies will be essential to limiting transmission costs.

Ten East Coast states signed a memorandum of understanding to set up a framework to coordinate interregional transmission planning and development.

The six New England states have submitted two applications for federal funding for transmission projects aimed at improving grid reliability and enabling the interconnection of clean energy resources.

A key factor in the CAISO EDAM advantage is the benefits the utility would lose by leaving the Western Energy Imbalance Market, a Brattle Group consultant said.

Want more? Advanced Search