El Paso Electric (EPE)

El Paso Electric again is seeking regulatory approval for its New Mexico renewable energy plan after resolving tariff-related cost uncertainty of a solar-plus-storage procurement proposed in the plan.

Arizona utilities are seeking U.S. Department of Energy funding to help plan for additional nuclear power facilities in the state.

California-based Turlock Irrigation District has agreed to join CAISO’s Extended Day-Ahead Market in 2027.

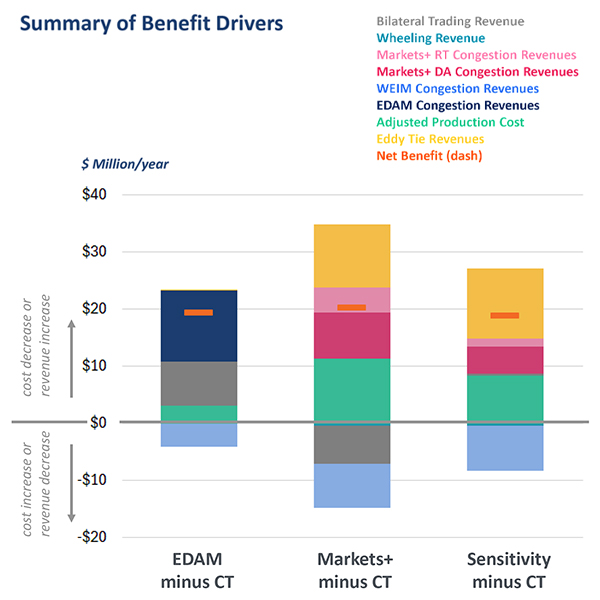

Puget Sound Energy said it is joining Markets+, marking another win for SPP shortly after the Bonneville Power Administration issued its final market policy in favor of the day-ahead market.

A New Mexico Public Regulation Commission workshop aimed to restore trust between the commission and El Paso Electric after the utility’s surprise announcement in January that it planned to join SPP’s Markets+.

BPA will be on the hook for nearly $27 million in funding for the next phase of SPP’s Markets+ — and potentially more depending on the market’s final footprint, according to a document SPP filed with FERC.

Financial backers of Phase 2 of SPP’s Markets+ have until Feb. 14 to submit executed funding agreements, the RTO said.

Want more? Advanced Search