day-ahead market (DAM)

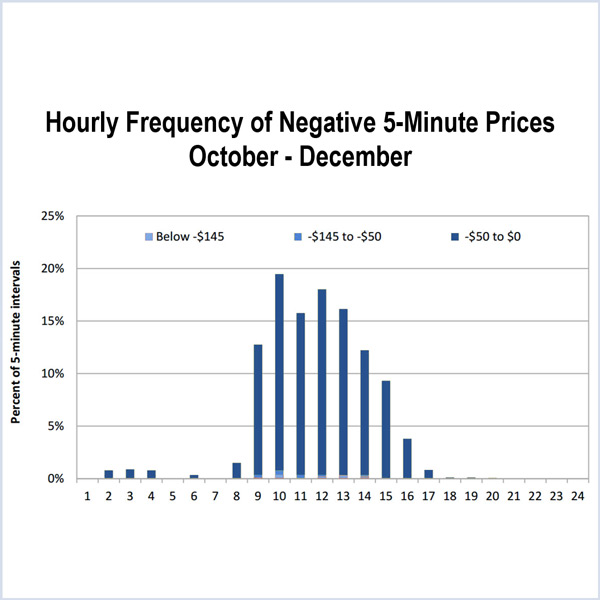

The CAISO real-time market experienced an uptick in volatility during Q4 of 2016, as five-minute prices spiked to well above day-ahead and 15-minute levels.

The MISO Market Subcommittee met on March 9th and discussed improving emergency pricing and cost recovery for manual redispatch.

In a settlement approved by FERC's Office of Enforcement, GDF SUEZ will will pay almost $82 million to PJM to settle market manipulation charges.

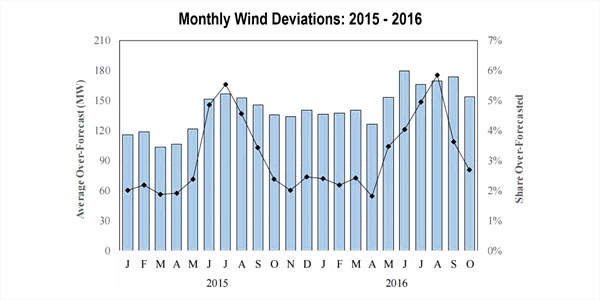

Some wind power generators appear to be deliberately over-forecasting their output to inflate their revenues, according to MISO IMM David Patton.

Below is a summary of the issues scheduled to be brought to a vote at the Markets and Reliability and Members committees Thursday. Each item is listed by agenda number, description and projected time of discussion, followed by a summary of the issue and links to prior coverage in RTO Insider.

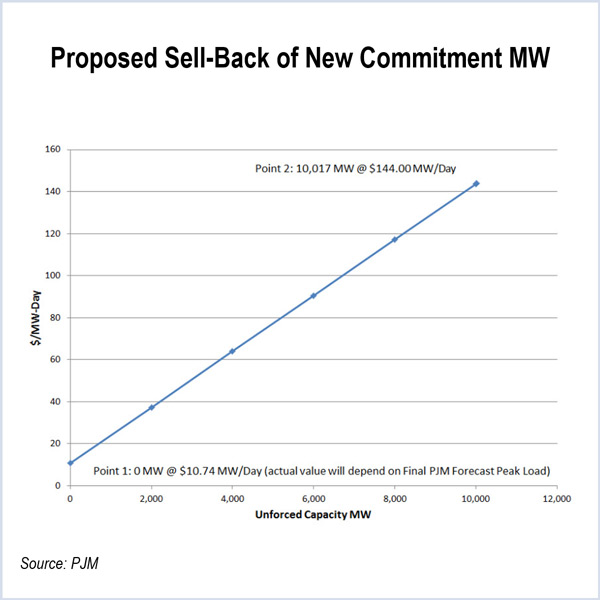

PJM is trying to usurp the IMM’s authority to regulate fuel-cost policies and consequently increasing market participants’ ability to exercise market power, the Monitor argued in a protest.

PJM will try again next month to gain stakeholder approval for codifying several generator operating parameters after a Market Implementation Committee discussion led to last-minute changes.

The PJM Market Implementation Committee discussed the earlier day-ahead offer deadline and the new way to measure emergency DR.

A summary of measures approved and issues discussed by the PJM Markets and Reliability and Members committees on March 31, 2016.

The MISO day-ahead market schedule may continue to use EST instead of EPT even as the RTO alters scheduling deadlines to comply with updated gas nomination cycles.

Want more? Advanced Search