California wildfires

The California PUC authorized costs for a new safety program as part of San Diego Gas & Electric and Southern California Gas' general rate case.

The California PUC opened a formal examination into PG&E’s Chapter 11 reorganization plan, as bondholders trying to take over the utility upped the ante.

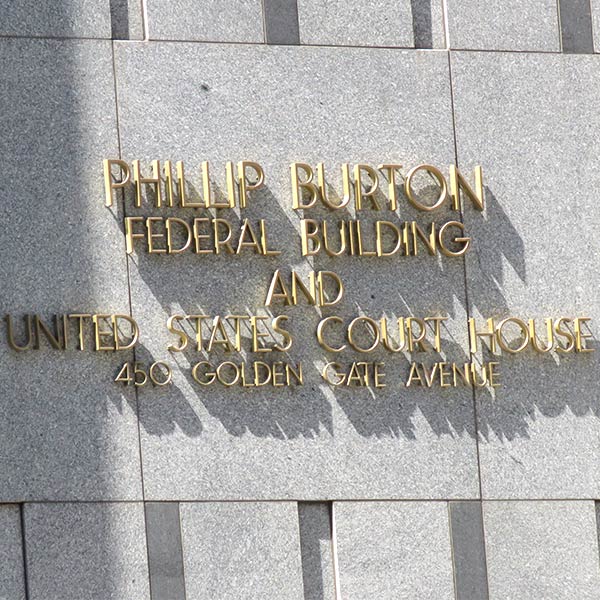

Lawyers in the Pacific Gas and Electric bankruptcy case argued for hours over competing reorganization plans and how much the utility owes victims.

The judge overseeing the PG&E (NYSE:PCG) bankruptcy will consider 2 reorganization plans: one from the company and one by bondholders and wildfire victims.

PG&E [NYSE:PCG] announced it had reached an $11B settlement agreement with nearly all the insurers trying to recoup their payments to victims of wildfires.

PG&E Corp. [NYSCE:PCG] filed a reorganization plan in U.S. Bankruptcy Court that includes $16.9 billion to pay for wildfire claims.

PG&E Corp. said it was postponing a controversial effort to secure up to $20 billion in bonds from the state to pay for wildfires sparked by its equipment.

The judge overseeing PG&E's bankruptcy relinquished a major part of the case to another federal judge while a third part is heading to state court.

PG&E is hoping the California legislature will approve a bill providing up to $20 billion in bonds to help the company pay its debts to wildfire victims.

The judge overseeing PG&E’s bankruptcy ruled against bondholders and insurers that wanted to offer their own reorganization plans for the embattled utility.

Want more? Advanced Search