California Independent System Operator (CAISO)

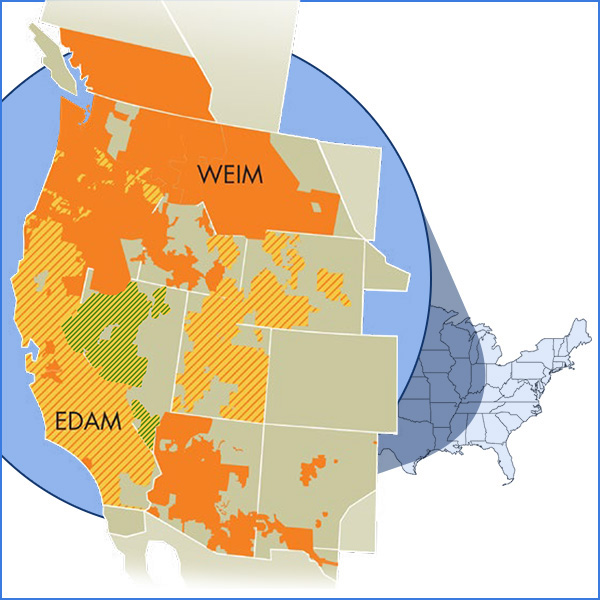

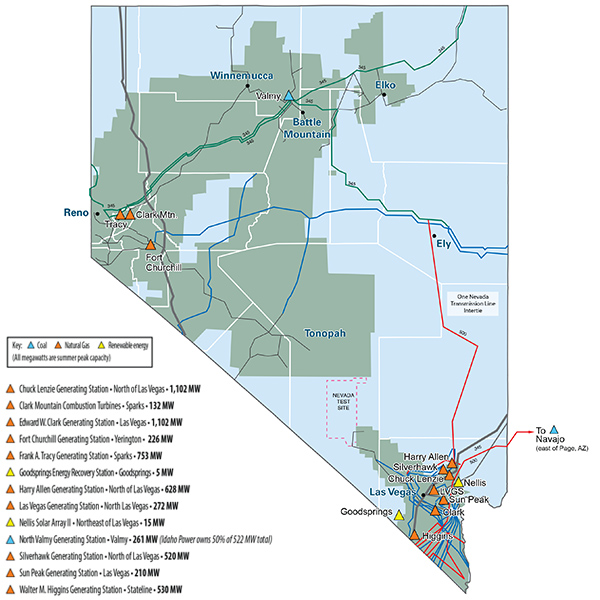

The growing footprint of CAISO’s Extended Day-Ahead Market was a critical factor in NV Energy’s decision to join it rather than the competing Markets+ offering from SPP, the utility said in a regulatory filing.

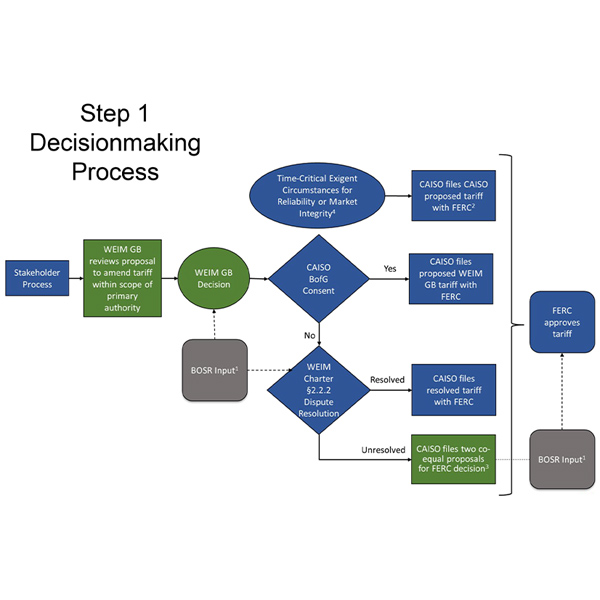

Backers of the West-Wide Governance Pathways Initiative will move quickly on a proposal to alter the governance of CAISO’s Western EIM and EDAM after voting to approve the plan.

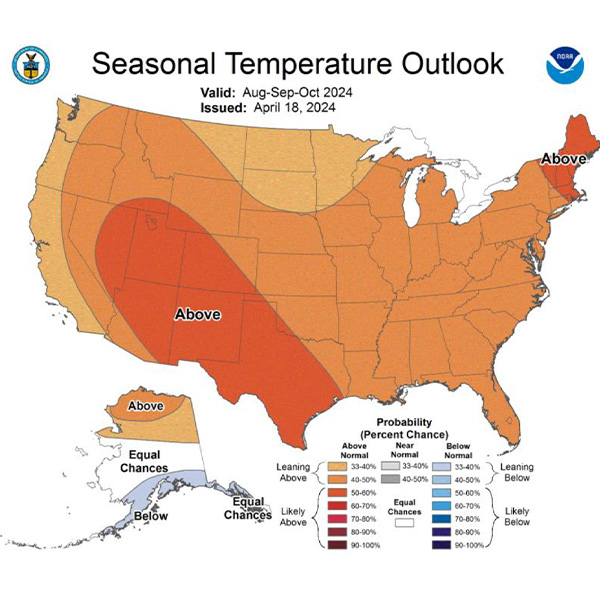

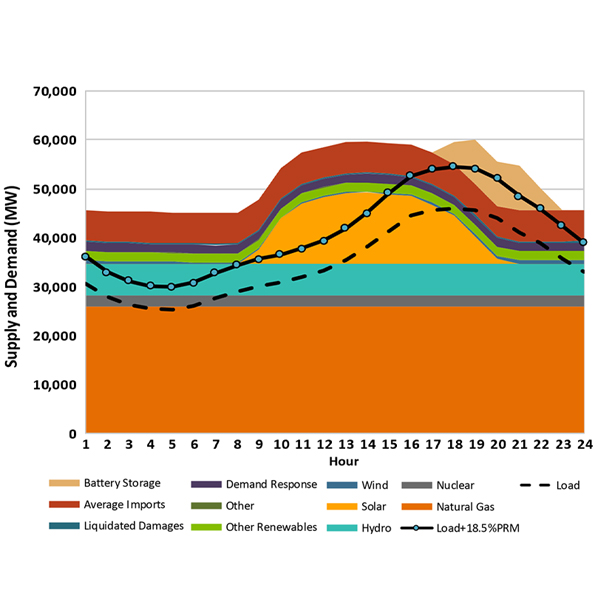

State energy officials are “cautiously optimistic” about maintaining grid reliability during the upcoming summer, with California poised to benefit from above-normal snowpack and precipitation coupled with the probability of mild conditions in its coastal regions.

NV Energy plans to make its intention to join the CAISO EDAM public on May 31 when it files an integrated resource plan with the Public Utilities Commission of Nevada.

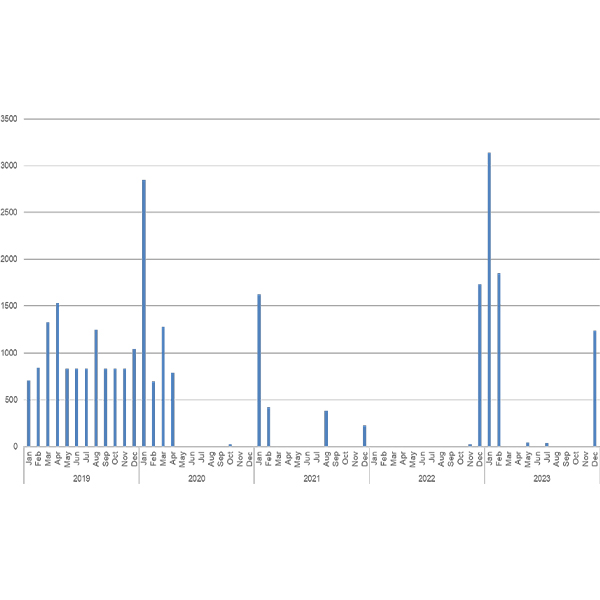

CAISO’s Board of Governors and WEIM Governing Body unanimously voted to approve an expedited proposal to increase the ISO’s soft offer cap from $1,000/MWh to $2,000.

This summer should bring high temperatures and electricity demand but flat power prices as cheaper fuel offsets heavy load, according to a FERC assessment.

CAISO is proposing to raise the soft offer cap in its market from $1,000/MWh to $2,000 to accommodate the bidding needs of battery storage and hydro resources in time for operations this summer.

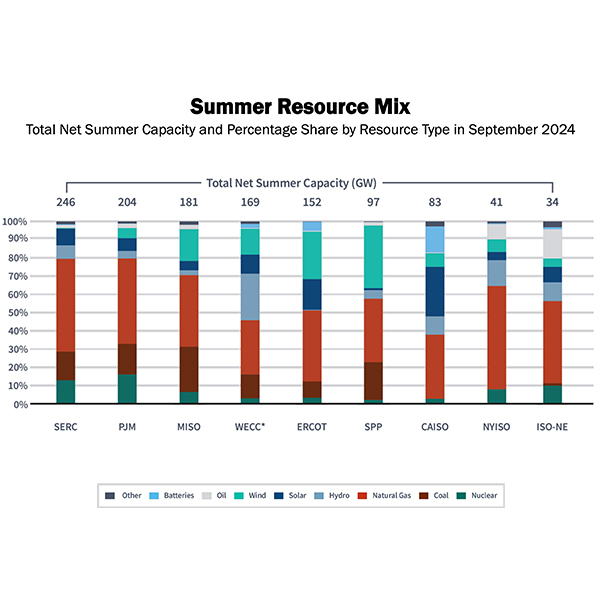

CAISO officials are optimistic about the grid’s performance this summer, as the system has added 4.5 GW of nameplate capacity since September with another 4.5 GW on the way.

Lack of visibility into the contract and availability status of the fleet is causing “inefficiencies” in CAISO’s capacity procurement mechanism process, staff and stakeholders said.

SPP says its stakeholder-driven culture is key to Markets+' success in the Western Interconnection.

Want more? Advanced Search