Base Residual Auction (BRA)

Panels during the OPSI Annual Meeting discussed the 2025/26 capacity auction yielding an eightfold jump in prices, as well as possible changes to the subsequent auction.

The second leg of the Independent Market Monitor's analysis on PJM's 2025/26 Base Residual Auction looked at the impact of not counting reliability-must-run resources as capacity, paired with several other factors.

The Market Implementation Committee rejected a PJM issue charge that envisioned adding notice that Base Residual Auction rules are subject to change, with two-thirds of stakeholders opposed.

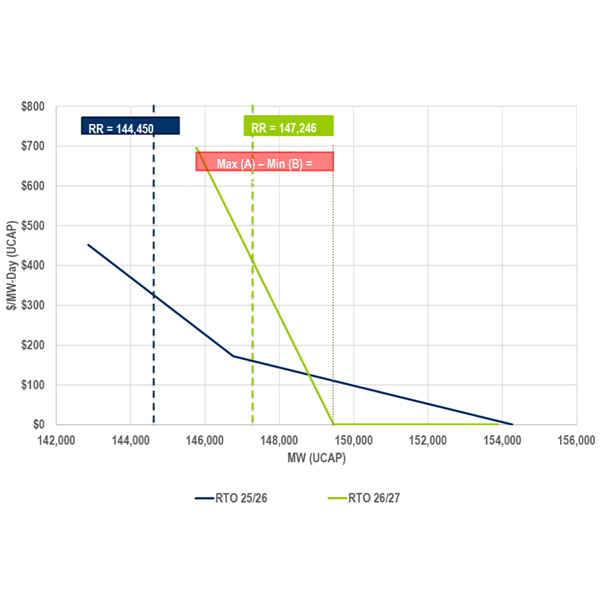

PJM presented how the planning parameters for the 2026/27 Base Residual Auction affected the variable resource rate curve, which intersects with supply and demand to determine auction clearing prices.

Consumers and electric distributors in PJM opposed a proposal to revise two financial parameters used to calculate the cost of new entry input to the 2027/28 Base Residual Auction.

Exelon is focused on meeting rising demand from data centers and manufacturing, company officials said during its second-quarter earnings call.

Generation owners say the increase in PJM capacity prices is the signal they need to invest in new development, while consumer advocates say the backlogged interconnection queue could limit the ability for market participants to react.

PPL reported GAAP earnings of $190 million for the second quarter and executives focused on changing market dynamics in PJM during a teleconference with analysts.

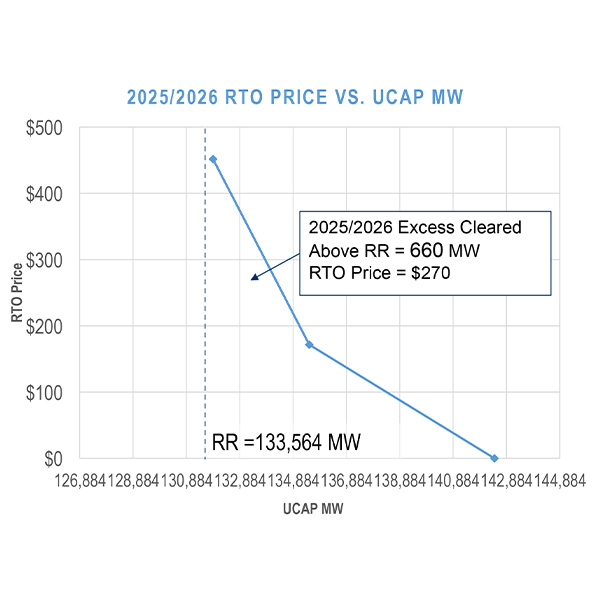

PJM capacity prices increased nearly tenfold in the 2025/26 Base Residual Auction as a trifecta of load growth, generation deactivations and changes to risk modeling shrank reserve margins.

PJM stakeholders presented several proposals to revise how energy efficiency resources are measured and verified to the Market Implementation Committee.

Want more? Advanced Search