Base Residual Auction (BRA)

PJM members deadlocked last week on changes to capacity market parameters with none of five proposals winning a supermajority.

Our summary of the issues scheduled for votes at the PJM MRC and MC on 08/21/14. Each item is listed by agenda number, description and projected time of discussion, followed by a summary of the issue and links to prior coverage.

PJM capacity prices would increase sharply but reliability would not be threatened if a recent federal court ruling eliminated demand response from wholesale markets, the Market Monitor said.

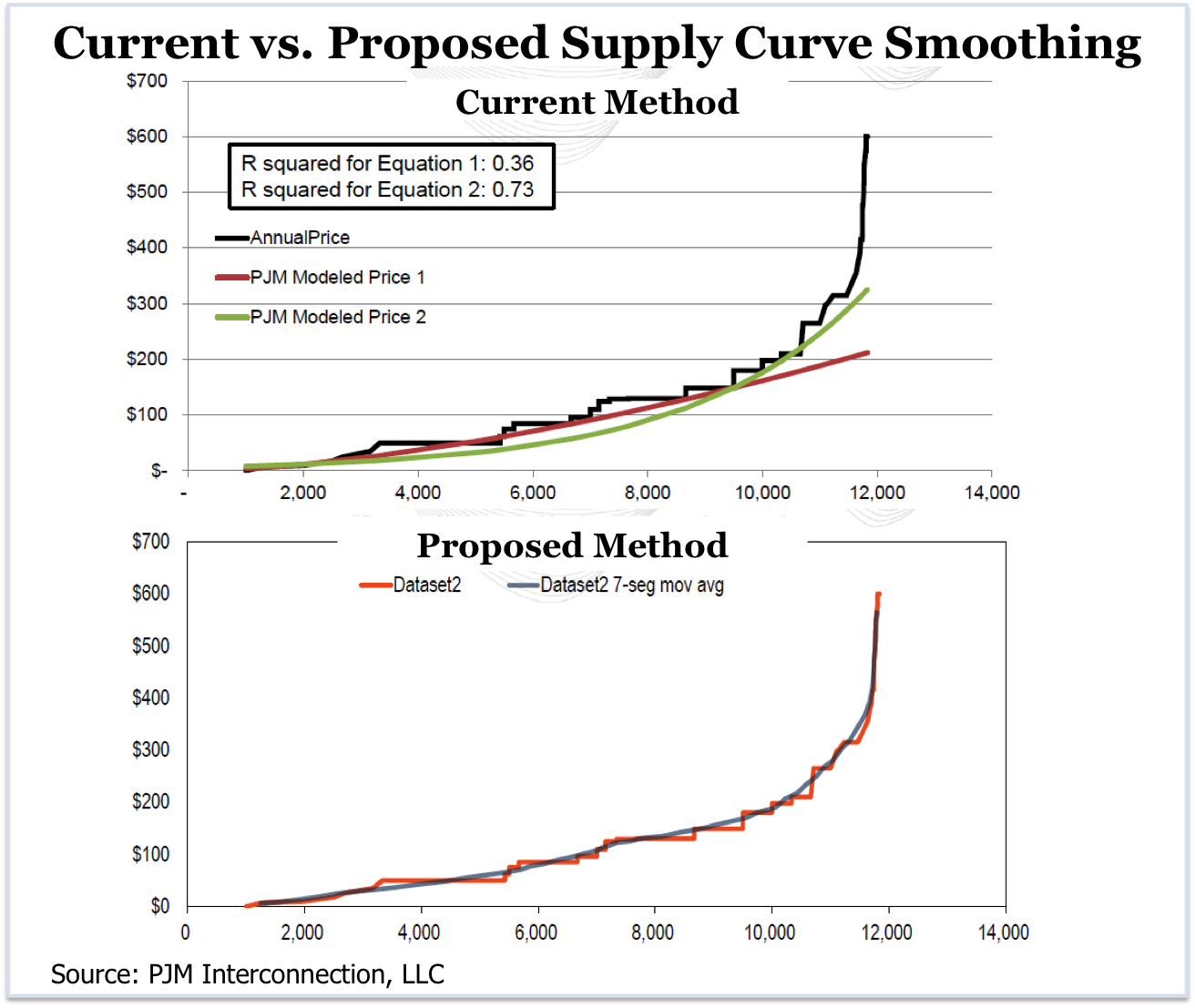

Load representatives concerned by reports of generators’ bidding strategies in May’s PJM capacity auction reacted by threatening to block an initiative by Exelon Corp. to provide more informative supply curves.

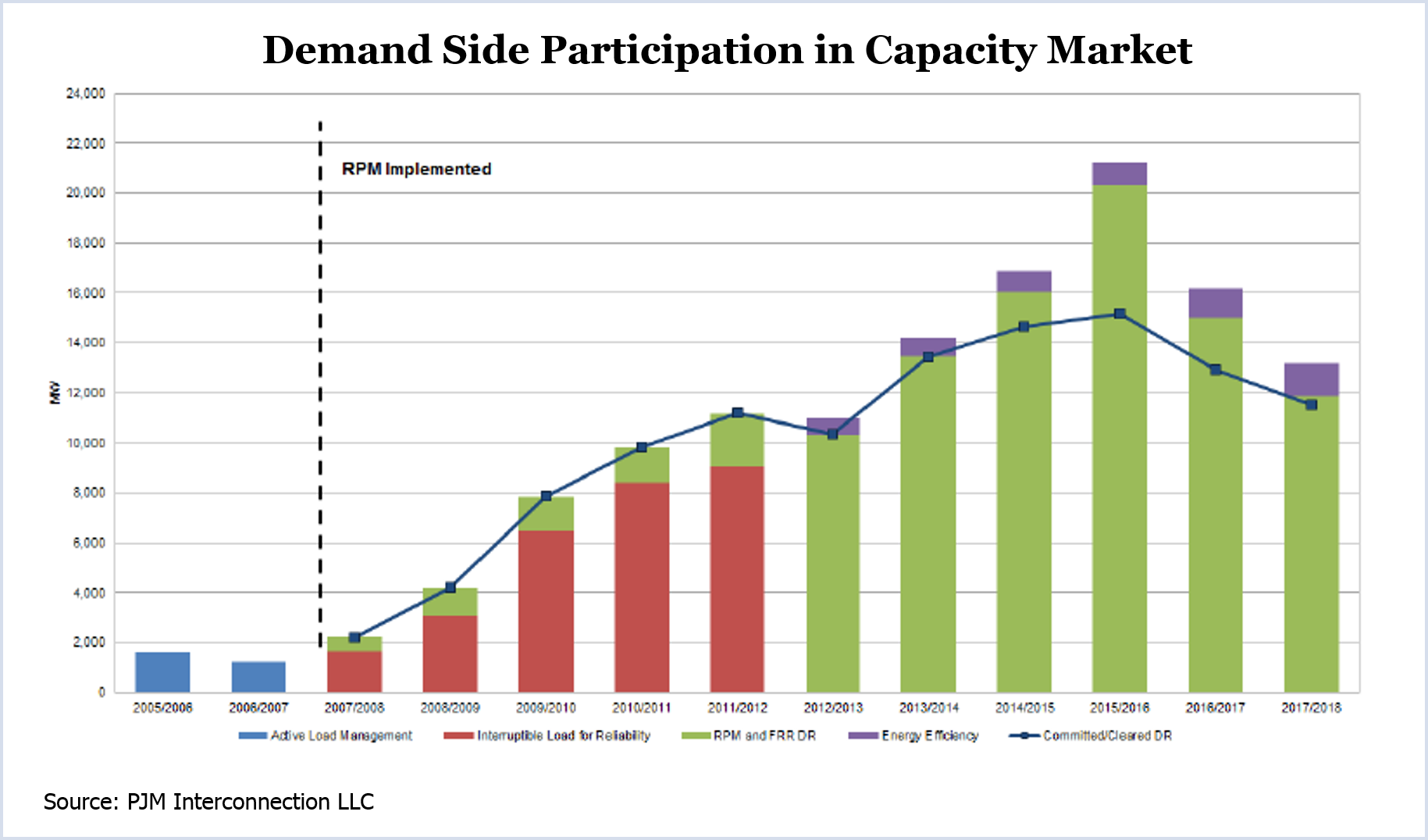

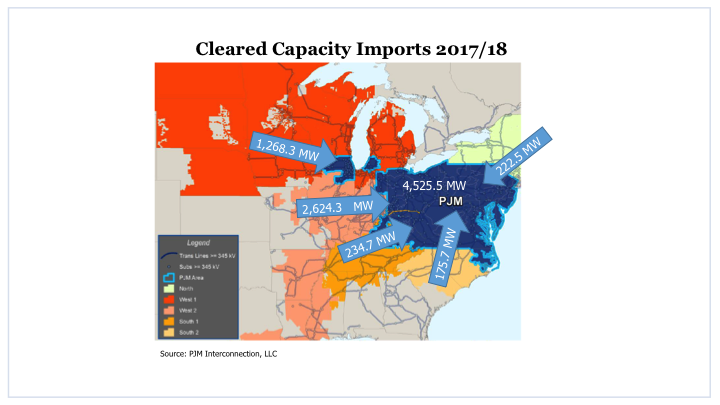

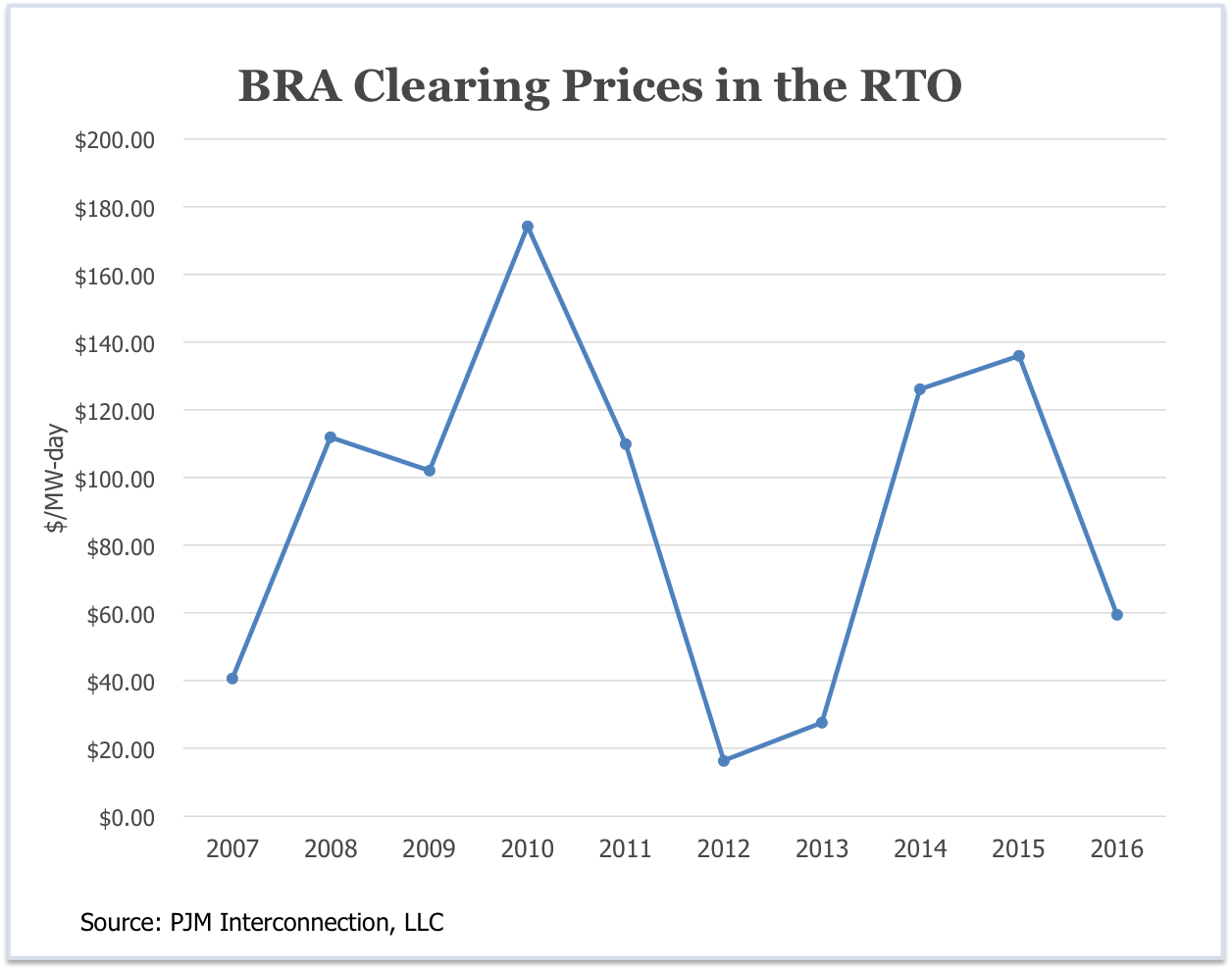

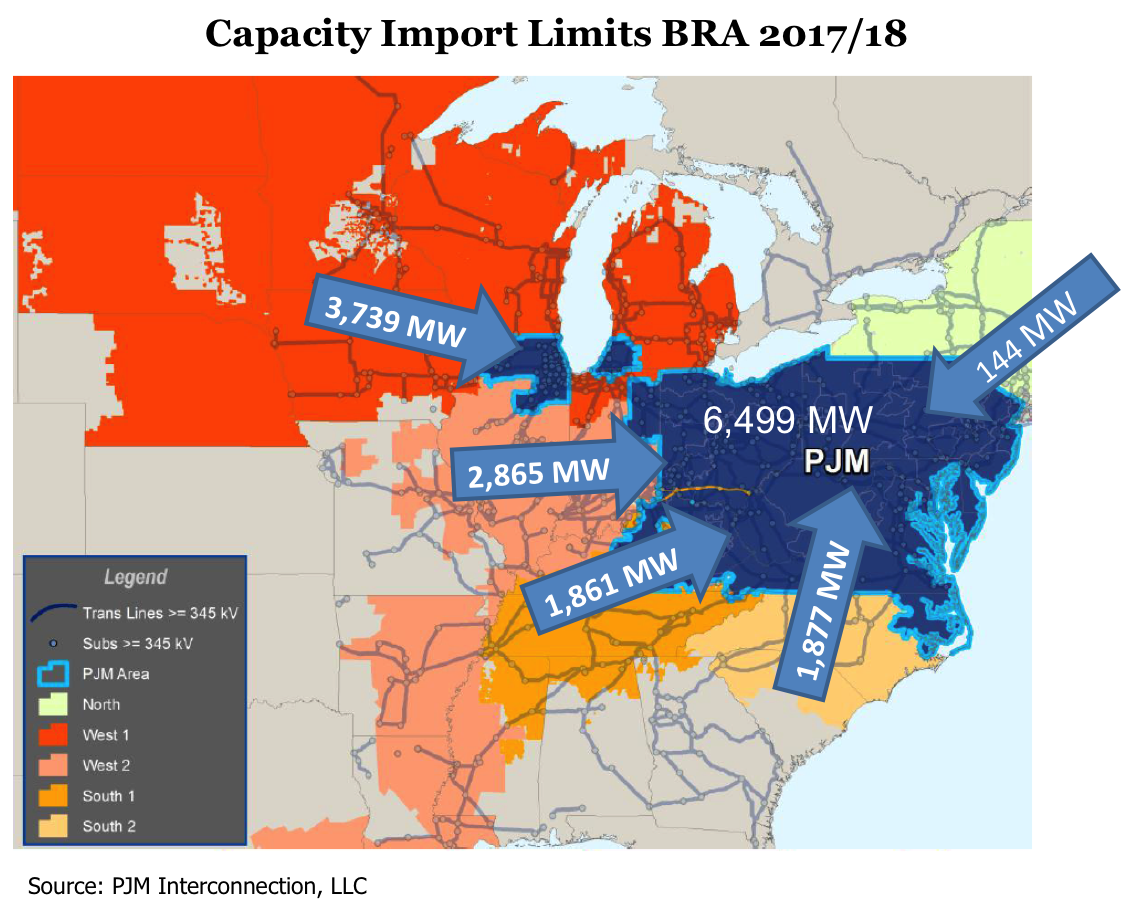

PJM rule changes since last year’s auction resulted in reductions in cleared generation imports and demand response. The mix of DR that cleared also changed, with more annual resources and less summer-only.

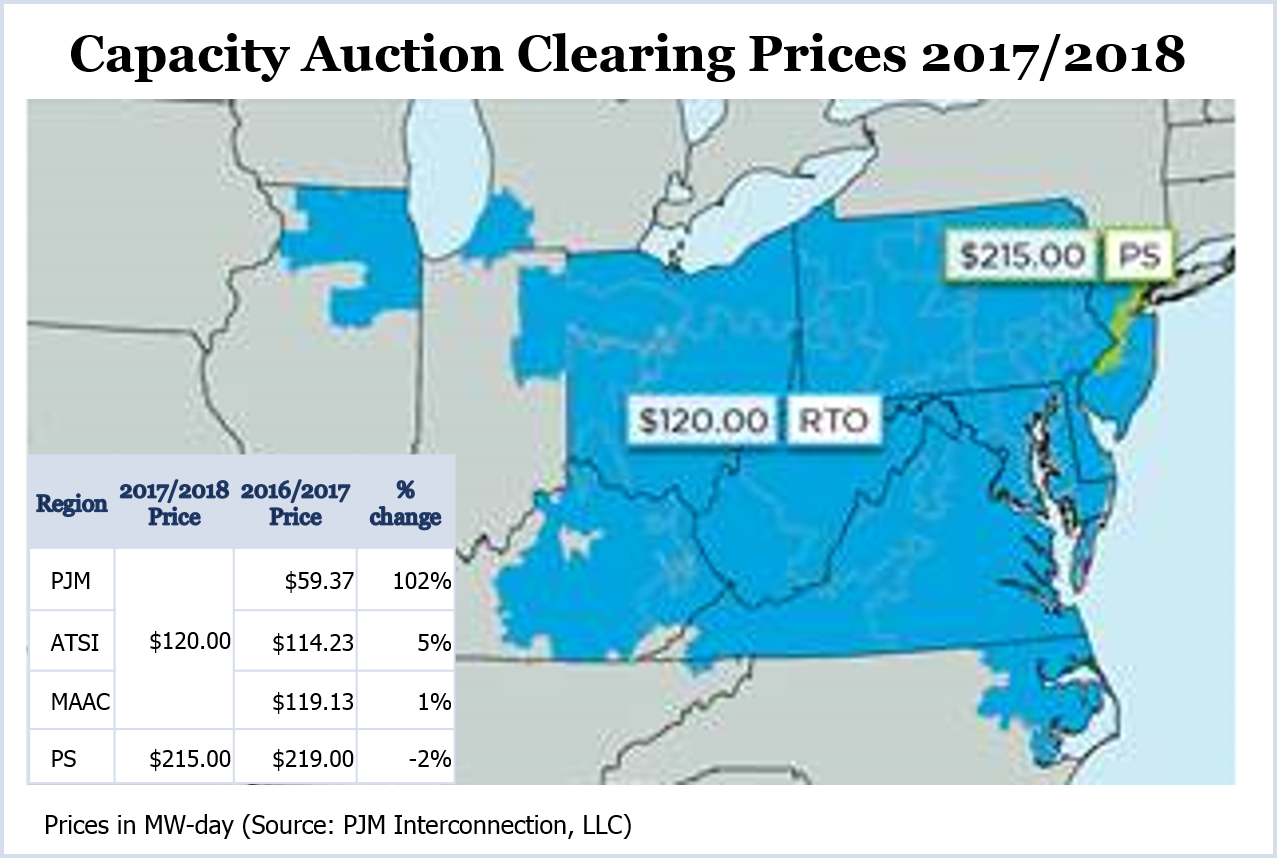

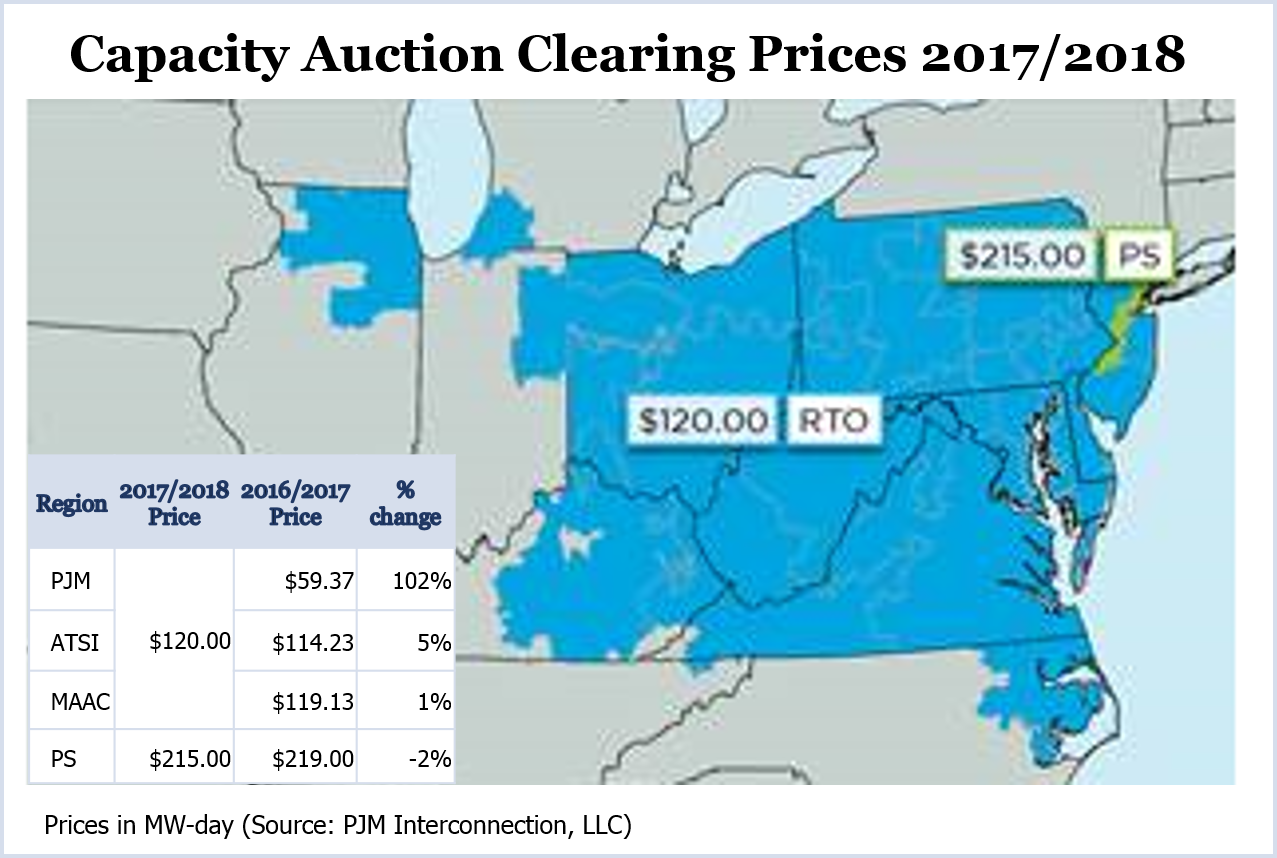

The 2017/2018 capacity auction cleared at $120/MW-day in most of PJM as restrictions on demand response and imports doubled prices in Virginia, West Virginia, North Carolina and much of Ohio. Prices were essentially flat in the East.

The 2017/2018 capacity auction cleared at $120/MW-day in most of PJM as restrictions on demand response and imports doubled prices in Virginia, West Virginia, North Carolina and much of Ohio. Prices were essentially flat in the East.

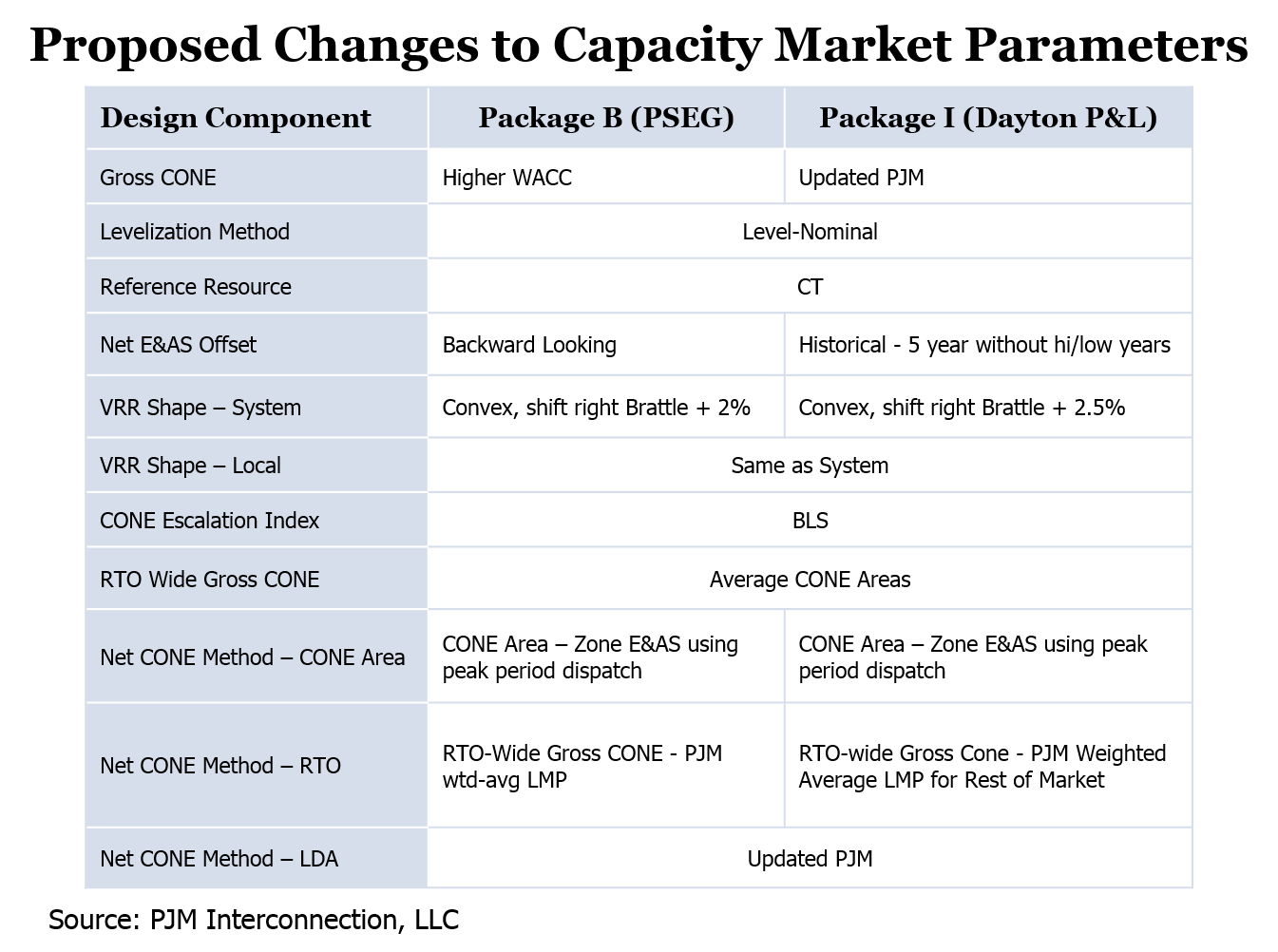

PJM proposed changing the demand curve to be used in the 2015 Base Residual Auction, while recommending the RTO continue using a combustion turbine as the model for determining the Cost of New Entry (CONE).

PJM yesterday opened the 2017/2018 Capacity Auction amid modest hopes among generators that the RTO’s rule changes will cause a rebound in prices.

In a win for PJM generation owners, FERC approved a rule change that will reduce capacity imports and likely increase clearing prices.

Want more? Advanced Search